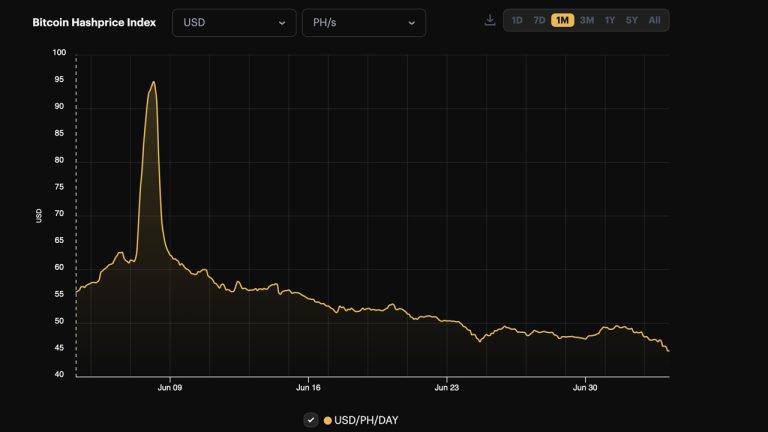

Bitcoin’s hashprice, or the anticipated value of 1 petahash per second (PH/s) of hashing power per day, has plummeted to a historic low. According to Luxor’s hashprice index, at 6 a.m. EDT on July 4, 2024, the price per petahash dropped to $44.842 per PH/s. The dollar value of daily mining revenue per petahash of […]

Bitcoin’s hashprice, or the anticipated value of 1 petahash per second (PH/s) of hashing power per day, has plummeted to a historic low. According to Luxor’s hashprice index, at 6 a.m. EDT on July 4, 2024, the price per petahash dropped to $44.842 per PH/s. The dollar value of daily mining revenue per petahash of […]

“I’ve been working on a new electronic cash system that’s fully peer-to-peer, with no trusted third party,” Satoshi said in an Oct. 31 email in 2008.

Today marks 15 years since the pseudonymous creator of Bitcoin, Satoshi Nakamoto, shared the Bitcoin (BTC) white paper to a mailing list of cryptographers on Oct. 31, 2008 — a date also annually celebrated as Halloween.

“I’ve been working on a new electronic cash system that’s fully peer-to-peer, with no trusted third party,” Satoshi famously said in the opening sentence before linking the document titled: “Bitcoin: A Peer-to-Peer Electronic Cash System.”

The whitepaper proposed a decentralized system that could facilitate peer-to-peer transactions which could solve the “double spending” problem often associated with digital currency.

It proposed to achieve this via a network of nodes to validate and record transactions through a proof-of-work consensus mechanism, launching just two months later on Jan. 3, 2009.

Satoshi’s computer science breakthrough came on the back of other impressive developments in the cryptography and e-money space.

The first reference cited in the Bitcoin whitepaper is Wei Dai’s invention of b-money, an electronic peer-to-peer cash system which never launched but nonetheless played a key role in Satoshi’s plans for Bitcoin.

Like Bitcoin, b-money proposed that participants of the system maintain a database of account balances, which keep track of the ownership of money. Transactions would be initiated and completed by a broadcast message to all participants, which would update the account balances of those involved in a specific transaction.

In many ways, it could be seen as a precursor to the nodes of Bitcoin’s protocol which keep a record of the constantly growing blockchain.

This process is one which requires proof-of-work — a form of cryptographic proof in which one party proves to others that a certain amount of a specific computational effort has been expended.

Satoshi implemented this into Bitcoin, citing Adam Back’s invention of Hashcash in 1997 which incorporated proof-of-work to limit e-mail spam and denial-of-service attacks.

The Cypherpunks and Fathers of #Bitcoin:

— Crypto Leroy (@TheBitLeroy) June 27, 2020

• Hal Finney: Reusable PoW

• Adam Back: Hashcash

• Wei Dai: B-money

• David Chaum: DigiCash

• Nick Szabo: BitGold

• Phil Zimmermann: PGP

• Bram Cohen: BitTorrent

• Tim May: Crypto Anarchist Manifesto

And Satoshi Nakamoto: Bitcoin

Timestamps are another core property of Bitcoin which was successfully implemented by Satoshi.

Bitcoin’s timestamp server works by taking a hash — akin to a unique serial number — of a block of transactions and timestamping it towhen the block is added to Bitcoin’s blockchain.

The hashes cryptographically link one block to the next, ensuring integrity of Bitcoin data. Timestamps also prevent double spending on Bitcoin, making the network tamper-proof and immutable.

Satoshi cited work from Henri Massias, Scott Stornetta, Stuart Haber and Dave Bayer in implementing timestamping into Bitcoin’s protocol.

Meanwhile,Merkle trees were implemented into Bitcoin to verify transaction data through digital signatures. Satoshi cited Ralph Merkle’s work on developing public key cryptosystems.

David Chaum - "DigiCash" 1995

— Crypto Shaman (@CryptoShaman256) September 10, 2022

R.C Merkle - "Protocols for public key cryptosystems" 1980

Adam Back - Hashcash - "A Deniel of Service Counter-Measure" 2002

Nick Szabo - "Bit Gold" 2005

Wei Dai - "b-money" 1998

Satoshi Nakamoto - "Bitcoin: A Peer-to-Peer Electronic Cash System 2008 pic.twitter.com/EjfVsE4pDc

Bitcoin advocate and cyperphunk Jameson Lopp previously told Cointelegraph that credit should be given to the preliminary projects which paved the way for Bitcoin.

However the genius in Satoshi was the puzzling of all these pieces into a fully functional system, said Lopp:

“There's no single piece of the puzzle that I think is more important than the others. Nakamoto's genius was not any of the individual components of Bitcoin, but rather the intricate way in which they fit together to breathe life into the system.”

Bitcoin was at the time, one of the first inventions to use cryptography to successfully separate money from state. Satoshi’s invention enabled users to effectively bypass banks and financial institutions to transact with others, all around the world.

The first real-world transaction paid for in Bitcoin came from Laszlo Hanyecz in May 2010, who bought two pizzas for 10,000 Bitcoin.

Mainstream media highlighted Bitcoin’s increased use by criminals to launder funds, among other things in the early days, but that narrative has continued to change.

Ithas become an increasingly adopted around the globe. It was made legal tender in El Salvador in September 2021.

President Bukele just announced that a new #Bitcoin City will be built in El Salvador.

— Peter Young (@petermiyoung) November 21, 2021

Bitcoin will be legal tender. There will be 0% income, capital gains and property tax.

A 10% VAT will serve as a key source of city revenue.

The city will be financed by a “bitcoin bond”. pic.twitter.com/CvCPvXvPIq

Financial institutions have also recently applied to offer spot Bitcoin exchange-traded funds (ETFs) in the United States, while others have launched their own Bitcoin ETFs in Europe.

Several developments have been implemented to help Bitcoin scale and bring more use cases to the network.

The Lightning network was launched in 2018 to increase Bitcoin’s transaction speed by taking computation off-chain.

Related: BlackRock’s Bitcoin ETF: How it works, its benefits and opportunities

Nonfungible token-like Ordinals were launched on Bitcoin in January, which was made possible by the Taproot soft fork in November 2021.

Bitcoin’s price has also been taken on a wild ride.

Starting out as cheap as a penny in 2009, BTC has endured several bull and bust cycles with its price volatility swinging as large as 88% in some instances.

BTC is currently priced at $34,350, down 50% from its all-time high price of $69,000 on Nov. 10, 2021.

BTC price has started to correct, and with $1.48 billion in Bitcoin options expiring on Jan. 27, traders are watching to see if the price holds above $22,000.

Bitcoin investors' sentiment improved after signals pointing to lower inflationary pressure suggested that the U.S. Federal Reserve could soon move away from its interest rate increase and quantitative tightening. Commonly known as a pivot, the trend change would benefit risk assets such as cryptocurrencies.

On Jan. 22, the China-based peer-to-peer trades of USD Coin (USDC) reached a 3.5% premium versus the United States dollar, indicating moderate FOMO by retail traders. This level is the highest in more than 6 months, suggesting excessive cryptocurrency buying demand has pressured the indicator above fair value.

The all-time high on the 7-day Bitcoin hash rate — an estimate of processing power dedicated to mining — also supported the bullish momentum. The indicator peaked at 276.9 exo-hash per second (EH/s) on Jan. 19, signaling a reversion of the recent weakness caused by miners facing financial difficulties.

Despite the bears' best efforts, Bitcoin has been trading above $20,000 since Jan. 14 — a movement that explains why the $1.48 billion Bitcoin monthly options expiry will vastly benefit bulls despite the recent failure to break the $23,200 resistance.

Bitcoin's latest rally on Jan. 20 caught bears by surprise, as a mere 6% of the put (sell) options for the monthly expiry have been placed above $22,000. Thus, bulls are better positioned even though they set nearly 40% of their call (buy) options at $23,000 or higher.

A broader view using the 1.15 call-to-put ratio shows more bullish bets because the call (buy) open interest stands at $790 million against the $680 million put (sell) options. Nevertheless, most bearish bets will likely become worthless as Bitcoin is up 36% in January.

If Bitcoin's price remains above $22,000 at 8:00 am UTC on Jan. 27, only $38 million worth of these put (sell) options will be available. This difference happens because there is no use in the right to sell Bitcoin at $21,000 or $22,000 if it trades higher on expiry.

Below are the four most likely scenarios based on the current price action. The number of options contracts available on Jan. 27 for call (bull) and put (bear) instruments varies, depending on the expiry price. The imbalance favoring each side constitutes the theoretical profit:

This crude estimate considers the call options used in bullish bets and the put options exclusively in neutral-to-bearish trades. Even so, this oversimplification disregards more complex investment strategies.

Related: Bitcoin due for shake-up vs. gold, stocks as BTC price dips under $22.5K

Bitcoin bears need to push the price below $21,000 on Jan. 27 to greatly reduce their losses. However, Bitcoin bears recently had $335 million worth of liquidated leveraged short futures positions, so they likely have less margin required to exert power in the short term.

Consequently, the most probable scenario for the January monthly BTC options expiry is the $22,000 or higher level, providing a decent win for bulls.

Bitcoin (BTC) price faced fierce resistance at $23,000 after an 11% rally on Jan. 20, but that was enough to cause $335 million in liquidations for short positions using futures contracts. The 36% year-to-date gain to $22,500 caused bears to be ill-prepared for the $1.48 billion monthly options expiry on Jan. 27.

The views, thoughts and opinions expressed here are the authors’ alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

14 years ago on Jan. 3, 2009, Satoshi Nakamoto launched the Bitcoin network and block zero at approximately 1:15 p.m. (ET) on a Saturday afternoon. Satoshi’s technology allows “online payments to be sent directly from one party to another without going through a financial institution.” Since Bitcoin was born it changed the financial system significantly, […]

14 years ago on Jan. 3, 2009, Satoshi Nakamoto launched the Bitcoin network and block zero at approximately 1:15 p.m. (ET) on a Saturday afternoon. Satoshi’s technology allows “online payments to be sent directly from one party to another without going through a financial institution.” Since Bitcoin was born it changed the financial system significantly, […] On Monday, bitcoin mining rig manufacturer Canaan Inc., announced the launch of the company’s latest high-performance bitcoin miners called the A13 series. Canaan has revealed two models in the A13 series, which feature “improved power efficiency over its predecessors,” and the new models produce an estimated 110 to 130 terahash per second (TH/s). Canaan Launches […]

On Monday, bitcoin mining rig manufacturer Canaan Inc., announced the launch of the company’s latest high-performance bitcoin miners called the A13 series. Canaan has revealed two models in the A13 series, which feature “improved power efficiency over its predecessors,” and the new models produce an estimated 110 to 130 terahash per second (TH/s). Canaan Launches […] On Saturday, the cryptocurrency mining platform Nicehash revealed the company has “fully [unlocked] Nvidia’s [Lite Hash Rate]” graphic processing units (GPUs). Nicehash says the firm’s Quickminer mining software is the first protocol that can unlock LHR GPU cards by 100%. Nicehash Says Software Is the First to Fully Crack Nvidia’s Lite Hash Rate Technology According […]

On Saturday, the cryptocurrency mining platform Nicehash revealed the company has “fully [unlocked] Nvidia’s [Lite Hash Rate]” graphic processing units (GPUs). Nicehash says the firm’s Quickminer mining software is the first protocol that can unlock LHR GPU cards by 100%. Nicehash Says Software Is the First to Fully Crack Nvidia’s Lite Hash Rate Technology According […] In mid-May 2021, the American multinational technology company Nvidia Corporation revealed that it added a hashrate limiter to curb the use of cryptocurrency mining with its graphics processing units (GPUs). However, crypto miners now say the move was pointless, and the mining organization Nicehash details that the hashrate limiter scheme introduced by Nvidia “did not […]

In mid-May 2021, the American multinational technology company Nvidia Corporation revealed that it added a hashrate limiter to curb the use of cryptocurrency mining with its graphics processing units (GPUs). However, crypto miners now say the move was pointless, and the mining organization Nicehash details that the hashrate limiter scheme introduced by Nvidia “did not […] 13 years ago today, the anonymous creator of the Bitcoin protocol kickstarted the network by mining the genesis block. Satoshi started the genesis block on Saturday, January 3, 2009, at precisely 1:15 p.m. (EST), and since then more than 700,000 blocks have been mined into existence. Kickstarting the Bitcoin Network Today, bitcoiners and cryptocurrency advocates […]

13 years ago today, the anonymous creator of the Bitcoin protocol kickstarted the network by mining the genesis block. Satoshi started the genesis block on Saturday, January 3, 2009, at precisely 1:15 p.m. (EST), and since then more than 700,000 blocks have been mined into existence. Kickstarting the Bitcoin Network Today, bitcoiners and cryptocurrency advocates […]

SynFutures’ decentralized Bitcoin Hash Rate Futures aim to let miners long or short Bitcoin mining difficulty.

Decentralized derivatives exchange SynFutures announced a new product called Bitcoin (BTC) Hash Rate Futures that uses the biggest cryptocurrency’s ever-changing mining difficulty as a basis to open long or short positions.

Touted as fully decentralized hash rate futures, SynFutures’ new offering would let users trade on Bitcoin mining difficulty with Wrapped BTC (wBTC).

The hash rate and mining difficulty are two core mechanics of Bitcoin that have become even more popular with the miners’ exodus following China’s crackdown. The Bitcoin network requires mining difficulty to readjust in every 2,016 blocks to counter the Bitcoin hash rate — the amount of computing power dedicated to mining.

As explained by Cointelegraph in detail, this two-way mechanism maintains a constant block time, or how long it takes to find each new block while mining Bitcoin.

According to the announcement, SynFutures developed the Hash Rate Futures, now in closed alpha, by designing an oracle to validate Bitcoin block headers directly and extract the mining difficulty. Each futures contract represents the expected block mining reward in BTC for a difficulty resetting period at a given difficulty level.

Miners would be able to short the Hash Rate Futures to hedge against the risk of mining difficulty increases or long electricity futures to determine the power cost.

Related: How to mine Bitcoin: Everything you need to know

SynFutures founder and CEO Rachel Lin said that the team wanted to allow traders to hedge against all the factors affecting their mining returns. She added:

“There hasn’t been a derivatives product targeting mining difficulty, which is vital to a miner knowing how much return their rigs are going to generate. With Hash Rate Futures, we’re filling in this gap for miners.”

Last month, SynFutures closed a $14-million Series A funding round led by Polychain Capital with the participation of a host of prominent crypto investors, including Pantera Capital, Framework and Wintermute.

Cambridge research shows that China’s Bitcoin mining power fell by 40% before the crackdown, while the United States’ hash power has quadrupled.

China’s crackdown on Bitcoin (BTC) mining due to energy consumption concerns is widely regarded as the trigger for the miners’ exodus from Asia to Western countries. But new research by the Cambridge Centre for Alternative Finance suggests that the shift in mining power started before China’s renewed scrutiny.

Reuters reported that China’s total computing power connected to the Bitcoin network, or hash rate, fell from 75.5% in September 2019 to 46% in April 2021, before the Asian country even officially announced the mining crackdown.

During the same 18-month period, the United States quadrupled its share of the global Bitcoin hash rate from 4% to 16.8% to become the second-largest producer of Bitcoin. Another country often named a potential destination for miners’ relocation, Kazakhstan, increased its share to 8% and became a primary Bitcoin producer.

After experiencing massive power outages in the mining hub of Xinjiang in April, Chinese authorities started investigating the energy consumption involved in Bitcoin mining. Officials announced strict supervision of mining activities due to carbon concerns, triggering the relocation of several industrial miners out of China.

Related: Bitcoin mining ban an easy decision for China, says Bitmain EMEA partner

Calling China’s mining ban a temporary inconvenience, iMining CEO Khurram Shroff said that the diversified location of mining facilities is great news for the rest of the world. “The Toronto Stock Exchange recently listed the world’s first Bitcoin ETF,” he exemplified, “[Canada] is already ahead of the curve, in terms of mainstreaming cryptocurrencies.”

Some experts see China’s crackdown on Bitcoin mining as an easy decision. Bitmain’s EMEA partner recently told Cointelegraph that the country is required to reduce its carbon footprint to get funding from the International Monetary Fund or the World Bank and Bitcoin mining was a convenient target to minimize energy consumption.