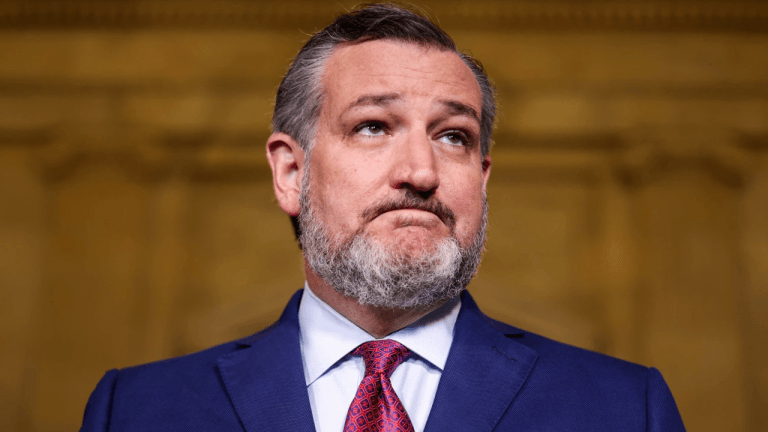

The Senate voted 70-28 to crush an IRS rule targeting DeFi developers, delivering a sweeping crypto victory now heading to Trump’s desk for final approval. Senate Overturns IRS Crypto Rule in Landmark Victory for Decentralized Innovation U.S. Senator Ted Cruz (R-TX) announced on March 26 that his resolution to overturn a controversial Internal Revenue Service […]

The Senate voted 70-28 to crush an IRS rule targeting DeFi developers, delivering a sweeping crypto victory now heading to Trump’s desk for final approval. Senate Overturns IRS Crypto Rule in Landmark Victory for Decentralized Innovation U.S. Senator Ted Cruz (R-TX) announced on March 26 that his resolution to overturn a controversial Internal Revenue Service […] Congress just delivered a massive win for crypto innovation, overturning the controversial IRS crypto rules that critics say stifled digital asset growth and pushed development overseas. US House and Senate Overturn IRS Crypto Rules, Easing Compliance Burdens The U.S. House of Representatives approved H.J. Res. 25 on March 11, aiming to overturn the previous administration’s […]

Congress just delivered a massive win for crypto innovation, overturning the controversial IRS crypto rules that critics say stifled digital asset growth and pushed development overseas. US House and Senate Overturn IRS Crypto Rules, Easing Compliance Burdens The U.S. House of Representatives approved H.J. Res. 25 on March 11, aiming to overturn the previous administration’s […] The U.S. Senate overwhelmingly rejected an IRS crypto rule targeting DeFi, dealing a major blow to regulations critics say would cripple crypto innovation and threaten digital privacy. Senate Overturns IRS DeFi Rule With a 70-28 Vote The U.S. Senate passed a resolution on March 4, led by Senator Ted Cruz (R-TX), to overturn an Internal […]

The U.S. Senate overwhelmingly rejected an IRS crypto rule targeting DeFi, dealing a major blow to regulations critics say would cripple crypto innovation and threaten digital privacy. Senate Overturns IRS DeFi Rule With a 70-28 Vote The U.S. Senate passed a resolution on March 4, led by Senator Ted Cruz (R-TX), to overturn an Internal […] The Blockchain Association is urging Congress to support a measure sponsored by Sen. Ted Cruz that aims to overturn the Internal Revenue Service’s decentralized finance broker rule. Broker Rule Threatens U.S. DeFi Leadership The Blockchain Association has urged the U.S. Congress to pass a measure sponsored by Senator Ted Cruz that seeks to “overturn the […]

The Blockchain Association is urging Congress to support a measure sponsored by Sen. Ted Cruz that aims to overturn the Internal Revenue Service’s decentralized finance broker rule. Broker Rule Threatens U.S. DeFi Leadership The Blockchain Association has urged the U.S. Congress to pass a measure sponsored by Senator Ted Cruz that seeks to “overturn the […] Lawmakers are pushing back on a Biden administration rule redefining decentralized finance participants as “brokers,” warning it risks stifling U.S. cryptocurrency innovation and driving it overseas. Biden’s Crypto Rule Sparks Backlash: Will It Push Blockchain Innovation Overseas? U.S. Senator Ted Cruz (R-Texas) and Representative Mike Carey (R-Ohio) have introduced a joint resolution aimed at overturning […]

Lawmakers are pushing back on a Biden administration rule redefining decentralized finance participants as “brokers,” warning it risks stifling U.S. cryptocurrency innovation and driving it overseas. Biden’s Crypto Rule Sparks Backlash: Will It Push Blockchain Innovation Overseas? U.S. Senator Ted Cruz (R-Texas) and Representative Mike Carey (R-Ohio) have introduced a joint resolution aimed at overturning […] Axios reports that Sen. Ted Cruz, a Republican from Texas, plans to wield the Congressional Review Act (CRA) next week to challenge a tax regulation that infringes on the rights of cryptocurrency brokers. This move is seen not just as a procedural tactic but as a principled stand against the expanding reach of governmental authority […]

Axios reports that Sen. Ted Cruz, a Republican from Texas, plans to wield the Congressional Review Act (CRA) next week to challenge a tax regulation that infringes on the rights of cryptocurrency brokers. This move is seen not just as a procedural tactic but as a principled stand against the expanding reach of governmental authority […] Rep. Buddy Carter (R-GA) has introduced the Fair Tax Act, a sweeping proposal to dismantle the federal tax code, abolish the IRS, and replace it with a national consumption tax—a move aimed at restoring individual economic freedom and limiting government overreach. Buddy Carter’s Fair Tax Act In a so-called act of principled defiance against an […]

Rep. Buddy Carter (R-GA) has introduced the Fair Tax Act, a sweeping proposal to dismantle the federal tax code, abolish the IRS, and replace it with a national consumption tax—a move aimed at restoring individual economic freedom and limiting government overreach. Buddy Carter’s Fair Tax Act In a so-called act of principled defiance against an […] Some in the crypto community assumed the IRS was backpedaling on reporting requirements, but all requirements are still firmly in place, the agency simply announced a grace period for exchanges to upgrade their technology. IRS Grants Crypto Exchanges More Time to Implement Platform Upgrades Confusion ran rampant on Thursday after several publications posted ambiguous headlines […]

Some in the crypto community assumed the IRS was backpedaling on reporting requirements, but all requirements are still firmly in place, the agency simply announced a grace period for exchanges to upgrade their technology. IRS Grants Crypto Exchanges More Time to Implement Platform Upgrades Confusion ran rampant on Thursday after several publications posted ambiguous headlines […]

The Internal Revenue Service (IRS) is suspending the implementation of new tax rules that will affect investors who hold crypto assets in centralized exchanges. On July 9th, 2024, the Treasury Department and the IRS published the final rules for determining the order of selling crypto assets held in centralized finance (CeFi) platforms. Investors should choose […]

The post IRS Postpones Implementation of New Tax Rules for Crypto Asset Holders Interacting With Centralized Exchanges appeared first on The Daily Hodl.

The IRS will allow crypto holders on centralized exchanges to bypass strict tax regulations in 2025, preserving flexibility in reporting and tracking digital asset sales. IRS Announces Temporary Relief for Some Crypto Holders The Internal Revenue Service (IRS) has issued a temporary relief measure, which is expected to benefit cryptocurrency holders using centralized finance (cefi) […]

The IRS will allow crypto holders on centralized exchanges to bypass strict tax regulations in 2025, preserving flexibility in reporting and tracking digital asset sales. IRS Announces Temporary Relief for Some Crypto Holders The Internal Revenue Service (IRS) has issued a temporary relief measure, which is expected to benefit cryptocurrency holders using centralized finance (cefi) […]