Despite conventional wisdom, analysts at banking giant JPMorgan Chase say that the new Bitcoin Futures ETF is not the reason behind BTC’s surge to a new all-time high. Company strategists tell Bloomberg that concerns over inflation are driving up the top crypto’s price, rather than excitement over the launch of the first-ever BTC Futures ETF. […]

The post Bitcoin ETF Is Not Fueling Top Cryptocurrency’s Rise to Record Highs, Says JPMorgan appeared first on The Daily Hodl.

JPMorgan strategists say that interest in the newly launching BITO Bitcoin ETF could cool after a week or so.

Bitcoin (BTC) broke its all-time high price level following the launch of ProShares’ Bitcoin Strategy exchange-traded fund (BITO) on Tuesday, but JPMorgan Chase strategists believe the key driver behind the price jump is investor concern over inflation.

The BITO launch, which saw the highest ever first-day natural volume for an ETF, is “unlikely to trigger a new phase of significantly more fresh capital entering Bitcoin,” JPMorgan strategists said in a note.

Instead, JPMorgan believes that as gold failed to respond to concerns over rising cost pressures in the last couple of weeks, Bitcoin’s renewed role as a better hedge against inflation in the eyes of investors is the main reason for the current bull run. The team highlighted that the shift away from gold ETFs into Bitcoin funds is gathering speed since September and “supports a bullish outlook for Bitcoin into year-end.”

JPMorgan strategists exemplified the waning interest after the first week following the launch of the Purpose Bitcoin ETF (BTCC) in Canada, claiming that the initial hype surrounding BITO could also fade after a week.

As the first Bitcoin futures-linked ETF in the United States, ProShares’ Bitcoin Strategy ETF started trading on the New York Stock Exchange on Oct. 19 at an opening price of $40 per share. It enables investors to have direct exposure to cryptocurrency futures in a regulated market.

Related: Bitcoin futures ETF hits $1B AUM in a record-breaking two days

JPMorgan’s comments echo others in traditional finance. Billionaire investor Carl Icahn praised Bitcoin as a great hedge against inflation as the next market crisis looms on the horizon.

Bill Winters, the CEO of British bank Standard Chartered, recently noted the passing of a long period of low inflation, adding that “it’s perfectly reasonable for people to want an alternative to fiat currency.”

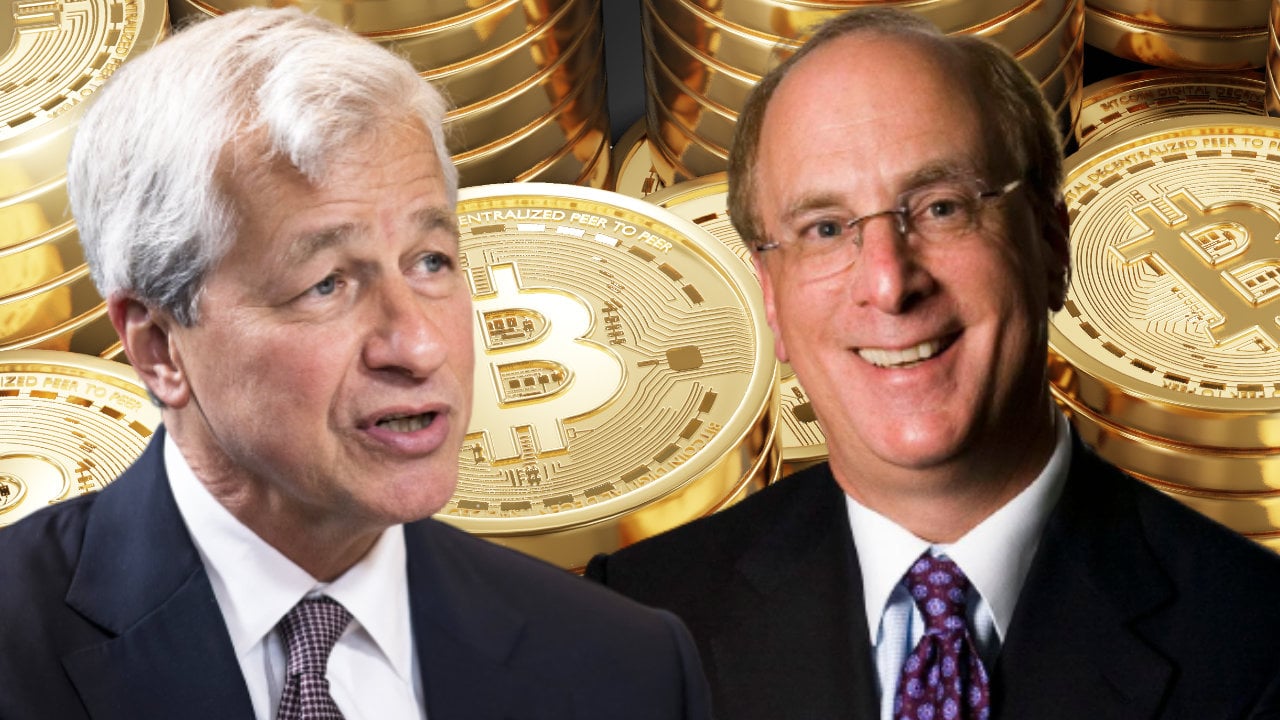

The chief executive officer of the world’s largest asset manager, Blackrock, says he is “more on the Jamie Dimon camp” when asked whether he thinks bitcoin is worthless. However, the executive says he is fascinated by people’s interest in crypto and sees “a huge role for a digitized currency.” Blackrock’s CEO Sides With JPMorgan’s Jamie […]

The chief executive officer of the world’s largest asset manager, Blackrock, says he is “more on the Jamie Dimon camp” when asked whether he thinks bitcoin is worthless. However, the executive says he is fascinated by people’s interest in crypto and sees “a huge role for a digitized currency.” Blackrock’s CEO Sides With JPMorgan’s Jamie […]

“The reason I own Bitcoin is because the U.S. government and every government in the western hemisphere is printing money now to the end of time,” said Billionaire Barry Sternlicht.

Following JPMorgan CEO Jamie Dimon's recent comments that Bitcoin is worthless, two well known billionaires have leapt to its defense — although both of them say Ether has some even more desirable properties.

During an interview with CNBC's Squawk Box on Oct. 13, Barry Sternlicht, the co-founder of Starwood Capital Group said that gold was actually “worthless” and he is hodling Bitcoin (BTC) because every government in the “western hemisphere” is printing endless amounts of money.

Sternlicht is estimated to have a net worth of around $4.4 billion and is known for his investments in the real estate market via Starwood Capital Group. The investment firm was founded in 1991 and reportedly has around $95 billion worth of assets under management (AUM).

Sternlicht was asked for his take on Jamie Dimon’s reiterated skepticism over BTC being “worthless.”

“Gold is kind of worthless too, and so is silver, I mean they have some industrial uses but they are minor. The reason I own Bitcoin is because the U.S. government and every government in the western hemisphere is printing money now to the end of time,” he said.

Dallas Mavericks owner Mark Cuban, who has a net worth of $4.3B, echoed similar sentiments when he spoke to CNBC Make IT on Wednesday. Cuban said that BTC is “better than gold,” before going on to say that he thinks Ethereum has the “most upside” as an investment.

Despite favoring BTC over gold, Sternlicht also went on to qualify his support for Bitcoin with praise for Ethereum.

“Bitcoin is a dumb coin, it has no real purpose other than a store of value, and it's crazily volatile. So Ether, I own some of that, it's a programmable Bitcoin and there are tons of other coins that are built on that system.”

“I've become very interested in blockchain technology as a whole, and the digital ledger which is going to change everything, we’re probably in inning one,” he added.

Related: Billionaire Bill Miller advocates for Bitcoin, but doubtful on altcoins

Not every billionaire is on board the crypto train however. Larry Fink the chairman of the world’s largest asset manager BlackRock ($9.4 trillion AUM) stated that he’s “probably more on the Jamie Dimon camp.”

"I'm not a student of Bitcoin and where it's going to go so I can't tell you whether it's going to $80K or $0. But I do believe there is a huge role for a digitized currency," he said.

The CEO of global investment bank JPMorgan, Jamie Dimon, says bitcoin is “worthless,” questioning whether the supply of bitcoin is actually limited. He also noted that blockchain and stablecoins can be real, emphasizing that governments are going to regulate the industry. Bitcoin Is Worthless and Supply May Not Be Capped, JPMorgan CEO Jamie Dimon Suggested […]

The CEO of global investment bank JPMorgan, Jamie Dimon, says bitcoin is “worthless,” questioning whether the supply of bitcoin is actually limited. He also noted that blockchain and stablecoins can be real, emphasizing that governments are going to regulate the industry. Bitcoin Is Worthless and Supply May Not Be Capped, JPMorgan CEO Jamie Dimon Suggested […]

The bullish analogy appears as Bitcoin reserves across all the crypto exchanges fall to their lowest in the previous 12 months, suggesting holding sentiment among traders.

Bitcoin (BTC) looks poised to pursue a run-up towards $100,000 as its price breaks out of a classic bullish structure.

Dubbed as Bull Pennant, the setup represents a price consolidation period with converging trendlines that form after a strong move higher. It ultimately prompts the price to break out in the direction of its previous trend to a level typically at length higher by as much as the size of the initial large move.

On Bitcoin weekly charts, the cryptocurrency appeared to have been trending inside a similar consolidation structure, with its price fluctuating inside a Triangle-like structure following a strong move higher (Flagpole).

Last week, Bitcoin broke above the structure's upper trendline as it rose by 13.5% with rising trading volumes to boot. As a result, the cryptocurrency's breakout move indicated its potential to rise by as much as the size of its previous trend (nearly $50,000).

Measuring from the point of breakout (~$48,200), the Bull Pennant's upside target thereby comes out to be another $50,000 higher, i.e., almost $100,000.

The technical setup projected Bitcoin at $100,000 no longer after many analysts envisioned the cryptocurrency at the same, six-digital valuation.

A team of researchers at Standard Chartered, headed by its global head of emerging market currency research, Geoffrey Kendrick, predicted BTC to hit $100,000 by early next year. They cited Bitcoin's potential to become "the dominant peer-to-peer payment method for the global unbanked" behind their bullish prediction.

David Gokhshtein, the founder of Gokhshtein Media and PAC Global, also imagined Bitcoin above $100,000 before the end of 2021. The executive based his bullish outlook on the amount of available fiat liquidity in the market, which, according to him, has prompted leading Wall Street players to purchase Bitcoin.

"Not everybody's going to come out publicly and tell you that they're buying bitcoin, but they are," Gokhshtein told Business Insider.

"There's too much money in the market. Way too much money. Institutions did not come in here to play for five minutes."

His statements appeared after George Soros' investment firm revealed at a Bloomberg event that it owns Bitcoin, sending the cryptocurrency spiking. That soon followed up with JPMorgan & Chase's latest report that showed institutional investors' preference for Bitcoin over Gold as an inflation hedge.

In an earlier study published in May, the banking giant projected Bitcoin to reach $140,000 in the long term.

On-chain indicators highlighted a rise in holding sentiment among Bitcoin traders.

Related: Tesla may have made more money holding Bitcoin than selling cars

In detail, the Bitcoin reserves held across all crypto exchanges recently dropped to their lowest levels in a year, as per data provided by blockchain analytics firm CryptoQuant. The decline illustrated traders' intention to hold their Bitcoin tokens close than trading them for other fiat/digital assets.

Therefore, declining Bitcoin balances on exchanges typically follow up with rise in the BTC price.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph.com. Every investment and trading move involves risk, you should conduct your own research when making a decision.

According to JPMorgan this week’s rally has been driven by institutional investors hedging against inflation with Bitcoin.

Bitcoin (BTC) has led a 35% rally this week by soaring far above the $50,000 resistance level and restoring a $1 trillion market capitalization to the asset.

According to a note shared by JPMorgan with clients on Thursday, the recent increase in price for BTC was predominantly attributed to institutional investors looking for a hedge to inflation.

"The re-emergence of inflation concerns among investors has renewed interest in the usage of Bitcoin as an inflation hedge," the analysts said, arguing there has been a shift in perception as to the merits of BTC in relation to gold.

"Institutional investors appear to be returning to Bitcoin perhaps seeing it as a better inflation hedge than gold"

Institutions aren't alone there: Shark Tank star Kevin O’Leary stated earlier this week that crypto now accounts for a larger allocation in his portfolio than gold does.

The momentum toward Bitcoin is in contrast to a JPMorgan report in May, when analysts noted big investors at the time were switching out of Bitcoin and into traditional gold.

The implicit endorsement of Bitcoin by major banks and regulators is going to accelerate the collapse of #Gold and the rise of #Bitcoin as the preferred safe-haven store of value for both institutional and retail investors.https://t.co/7os1ojenHs

— Michael Saylor⚡️ (@michael_saylor) October 7, 2021

JPMorgan provided two other factors it believes are behind the current rally:

"The recent assurances by US policy makers that there is no intention to follow China's steps towards banning the usage or mining of cryptocurrencies," the analysts noted, as well as:

"The recent rise of the Lightning Network and 2nd layer payments solutions helped by El Salvador's Bitcoin adoption."

Unlike other analysts this week, JPMorgan did not cite speculation around the imminent approval of a Bitcoin futures ETF as a significant driver of the price.

BTC now trades at $53,884.76 according to CoinMarketCap at the time of writing.

Related: Crypto exposure has positive impact on investment portfolios, study shows

Despite some divisions of JPMorgan expressing a growing interest in crypto assets and blockchain initiatives, CEO Jamie Dimon stated in an interview on Oct. 22 that he remains a skeptic of BTC and even compared it to “a little bit of fool’s gold”.

Global investment bank JPMorgan says institutional investors are returning to bitcoin, seeing the cryptocurrency as a better hedge than gold. The firm’s analysts describe three key drivers boosting the price of bitcoin in recent weeks, including assurances that U.S. policymakers will not ban cryptocurrencies. JPMorgan Sees Renewed Interest in Bitcoin JPMorgan published a research note […]

Global investment bank JPMorgan says institutional investors are returning to bitcoin, seeing the cryptocurrency as a better hedge than gold. The firm’s analysts describe three key drivers boosting the price of bitcoin in recent weeks, including assurances that U.S. policymakers will not ban cryptocurrencies. JPMorgan Sees Renewed Interest in Bitcoin JPMorgan published a research note […]

JPMorgan Chase chairman and CEO Jamie Dimon is voicing skepticism about the future of Bitcoin (BTC). In an interview with Axios on HBO, Dimon says that the flagship cryptocurrency lacks “intrinsic value” and will not escape regulation. “It’s got no intrinsic value. And regulators are going to regulate the hell out of it. If people […]

The post JPMorgan CEO Jamie Dimon Doubles Down on Bitcoin Criticism, Says BTC Has No Intrinsic Value appeared first on The Daily Hodl.

The CEO of global investment bank JPMorgan, Jamie Dimon, says that bitcoin has no intrinsic value and “regulators are going to regulate the hell out of it.” He emphasized: “If people are using it for tax avoidance and sex trafficking and ransomware, it’s going to be regulated, whether you like it or not.” JPMorgan’s Boss […]

The CEO of global investment bank JPMorgan, Jamie Dimon, says that bitcoin has no intrinsic value and “regulators are going to regulate the hell out of it.” He emphasized: “If people are using it for tax avoidance and sex trafficking and ransomware, it’s going to be regulated, whether you like it or not.” JPMorgan’s Boss […]