The largest US-based crypto exchange wants to prevent crypto from thriving in offshore jurisdictions. In a new blog post, Coinbase says leaving crypto to flourish abroad where entities are not subject to US laws will only enable bad actors to easily use digital assets for illicit purposes. “We maintain a robust compliance program, which includes […]

The post Coinbase Says Pushing Crypto Offshore May Increase Amount of Illicit Activity appeared first on The Daily Hodl.

A major crypto exchange platform is adding compulsory Know Your Customer (KYC) rules for its customers as a means of embracing regulations. According to a new press release, KuCoin, a Seychelles-based crypto exchange, will be rolling out mandatory KYC authentication rules for its customers starting on July 15, 2023. The change would force current customers […]

The post KuCoin Rolls Out Mandatory KYC Rules for All Customers To ‘Embrace Regulation’ appeared first on The Daily Hodl.

The technology is getting so advanced, deepfakes may soon become undetectable by a human verifier, said Jimmy Su, Binance's Chief Security Officer.

Deepfake technology used by crypto fraudsters to bypass know-your-customer (KYC) verification on crypto exchanges such as Binance is only going to get more advanced, Binance's chief security officer warns.

Deepfakes are made using artificial intelligence tools that use machine learning to create convincing audio, images or videos featuring a person’s likeness. While there are legitimate use cases for the technology, it can also be used for scams and hoaxes.

Deep fake AI poses a serious threat to humankind, and it's no longer just a far-fetched idea. I recently came across a video featuring a deep fake of @cz_binance , and it's scarily convincing. pic.twitter.com/BRCN7KaDgq

— DigitalMicropreneur.eth (@rbkasr) February 24, 2023

Speaking to Cointelegraph, Binance chief security officer Jimmy Su said there has been a rise in fraudsters using the tech to try and get past the exchange’s customer verification processes.

“The hacker will look for a normal picture of the victim online somewhere. Based on that, using deep fake tools, they’re able to produce videos to do the bypass.”

Su said the tools have become so advanced that they can even correctly respond to audio instructions designed to check whether the applicant is a human and can do so in real-time.

“Some of the verification requires the user, for example, to blink their left eye or look to the left or to the right, look up or look down. The deep fakes are advanced enough today that they can actually execute those commands,” he explained.

However, Su believes the faked videos are not at the level yet where they can fool a human operator.

“When we look at those videos, there are certain parts of it we can detect with the human eye,” for example, when the user is required to turn their head to the side,” said Su.

“AI will overcome [them] over time. So it's not something that we can always rely on.”

In August 2022, Binance’s chief communications officer Patrick Hillmann warned that a “sophisticated hacking team” was using his previous news interviews and TV appearances to create a “deepfake” version of him.

The deepfake version of Hillmann was then deployed to conduct Zoom meetings with various crypto project teams promising an opportunity to list their assets on Binance — for a price, of course.

Hackers created a "deep fake" of me and managed to fool a number of unsuspecting crypto projects. Crypto projects are virtually under constant attack from cybercriminals. This is why we ask most @binance employees to remain anonymous on LinkedIn. https://t.co/tScNg4Qpkx

— Patrick Hillmann (@PRHillmann) August 17, 2022

“That's a very difficult problem to solve,” said Su, when asked about how to combat such attacks.

“Even if we can control our own videos, there are videos out there that are not owned by us. So one thing, again, is user education.”

Related: Binance off the hook from $8M Tinder ‘pig butchering’ lawsuit

Binance is planning to release a blog post series aimed at educating users about risk management.

In an early version of the blog post featuring a section on cybersecurity, Binance said that it uses AI and machine learning algorithms for its own purposes, including detecting unusual login patterns and transaction patterns and other "abnormal activity on the platform."

AI Eye: ‘Biggest ever’ leap in AI, cool new tools, AIs are the real DAOs

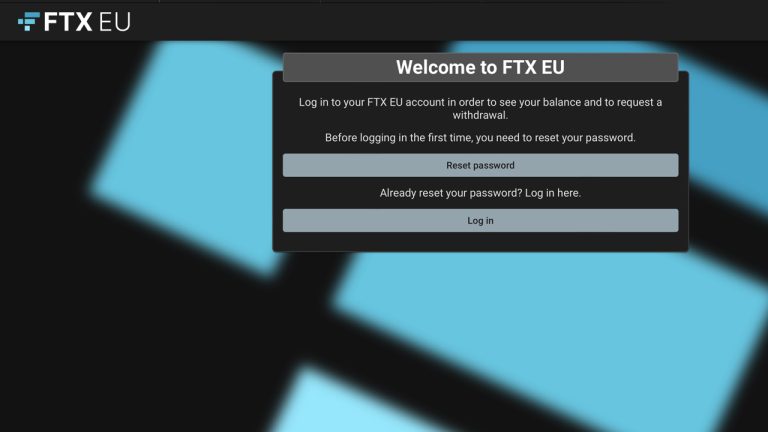

FTX’s European subsidiary, FTX Europe, has launched a new website, ftxeurope.eu, for users to withdraw funds from the now-defunct cryptocurrency platform. Withdrawal requests must be submitted through the new website and will be “subject to customary know-your-customer and anti-money-laundering checks.” FTX’s European Arm Opens Withdrawals to Customers According to a press release published on Friday, […]

FTX’s European subsidiary, FTX Europe, has launched a new website, ftxeurope.eu, for users to withdraw funds from the now-defunct cryptocurrency platform. Withdrawal requests must be submitted through the new website and will be “subject to customary know-your-customer and anti-money-laundering checks.” FTX’s European Arm Opens Withdrawals to Customers According to a press release published on Friday, […] Banks in Pakistan plan to launch an electronic platform for know-your-customer procedures that will be operating on a national level. The blockchain-based system will allow them to exchange the personal information of customers through what they describe as a decentralized and self-regulated network. Banks of Pakistan Looking to Employ Blockchain for KYC Checks Pakistan Banks’ […]

Banks in Pakistan plan to launch an electronic platform for know-your-customer procedures that will be operating on a national level. The blockchain-based system will allow them to exchange the personal information of customers through what they describe as a decentralized and self-regulated network. Banks of Pakistan Looking to Employ Blockchain for KYC Checks Pakistan Banks’ […] Localbitcoins, the Helsinki, Finland-based bitcoin exchange founded in 2012, is closing operations after over a decade of service. The company’s operators attribute the shutdown to the “ongoing crypto-winter,” which has left them unable to continue offering their bitcoin trading services. The Challenges Faced by Localbitcoins and its Ultimate Demise in the Crypto Market The first […]

Localbitcoins, the Helsinki, Finland-based bitcoin exchange founded in 2012, is closing operations after over a decade of service. The company’s operators attribute the shutdown to the “ongoing crypto-winter,” which has left them unable to continue offering their bitcoin trading services. The Challenges Faced by Localbitcoins and its Ultimate Demise in the Crypto Market The first […] Coinbase has agreed to pay a $100 million settlement with the New York Department of Financial Services (NYDFS), according to a consent order signed by the NYDFS superintendent Adrienne Harris on Jan. 4, 2023. New York’s financial regulator said compliance problems were detected and the exchange’s anti-money laundering controls were inadequate from 2020 through 2021. […]

Coinbase has agreed to pay a $100 million settlement with the New York Department of Financial Services (NYDFS), according to a consent order signed by the NYDFS superintendent Adrienne Harris on Jan. 4, 2023. New York’s financial regulator said compliance problems were detected and the exchange’s anti-money laundering controls were inadequate from 2020 through 2021. […] Cryptocurrency exchange Bybit has announced upcoming changes to its know-your-customer (KYC) policy that will limit certain operations for unverified customers. The stricter requirements concern coin purchases with fiat money, NFT transactions, and withdrawal limits. Bybit to Limit Services for Traders Who Have Not Passed Identity Verification Crypto exchange Bybit will restrict some services that are […]

Cryptocurrency exchange Bybit has announced upcoming changes to its know-your-customer (KYC) policy that will limit certain operations for unverified customers. The stricter requirements concern coin purchases with fiat money, NFT transactions, and withdrawal limits. Bybit to Limit Services for Traders Who Have Not Passed Identity Verification Crypto exchange Bybit will restrict some services that are […]

The blockchain security firm has uncovered a new tactic used by crypto scammers as the industry continues to improve its fraud detection capabilities.

Crypto scammers have been accessing a “cheap and easy” black market of individuals willing to put their name and face on fraudulent projects — all for the low price of $8, blockchain security firm CertiK has uncovered.

These individuals, described by CertiK as “Professional KYC actors” would, in some cases, voluntarily become the verified face of a crypto project, gaining trust in the crypto community prior to an “insider hack or exit scam.”

Other uses of these KYC actors include using their identities to open up bank or exchange accounts on behalf of the bad actors.

According to a Nov. 17 blog post, CertiK analysts were able to find over 20 underground marketplaces hosted on Telegram, Discord, mobile apps, and gig websites to recruit KYC actors for as low as $8 for simple “gigs” like passing the KYC requirements “to open a bank or exchange account from a developing country.”

Pricier jobs involve the KYC actor putting their face and name on a fraudulent project. CertiK noted that most actors are seemingly exploited as they are based in developing countries “with an above-average concentration in South-East Asia” and paid around $20 or $30 per role.

Meanwhile, more complex requirements or verification processes could fetch an even higher asking price, particularly if the KYC actors are residents of countries considered a low money laundering risk.

Some roles paid up to $500 a week if an actor was to play the role of CEO for a malicious project but the KYC actor market was “marginal” compared to the market for already KYCed bank and crypto exchange accounts according to CertiK.

Crypto to fiat — or vice-versa — conversions were also cited as a significant percentage of the transactions seen on these marketplaces with CertiK calculating that more than 500,000 members in marketplace sizes ranging from 4,000 to 300,000 were buyers and sellers on these black markets.

Related: Scary stats: $3B stolen in 2022 as of ‘Hacktober,’ doubling 2021

CertiK warned that over 40 websites claiming to vet crypto projects and offer “KYC badges” are “worthless” as the services are “too superficial to detect fraud or simply too amateur to detect insider threats.”

They added the teams behind these websites are “missing the needed “investigation methodology, training, and experience” meaning these badges are then leveraged by scammers to mislead the community and investors.

That being said, the industry has been working hard and is gaining ground in its fight against crypto scammers. A tool released in October by traditional finance giant Mastercard combines artificial intelligence and blockchain data to help find and prevent fraud.

Contrary to popular belief, the open nature of blockchain transactions means it’s harder for fraudsters to hide the movement of funds. Another recent example has been the work of French authorities using on-chain analysis to find and charge five people who stole nonfungible tokens (NFT) through a phishing scam.

Equifax, which suffered a huge data breach in 2017, has partnered with privacy-centric blockchain company Oasis Labs for a decentralized ID offering for Web3 companies.

Credit reporting company Equifax, known for suffering from one of the largest customer data breaches to date, has partnered with blockchain company Oasis Labs to build a Know Your Customer (KYC) solution.

Equifax and Oasis said on Oct. 26 that the latter would be building a decentralized identity management and KYC solution for the industry on Oasis’ platform which will leverage Application Programming Interfaces (APIs) from Equifax to help with checks and user identification.

The announcement made no mention of the exact technology which will underpin this offering and Cointelegraph’s request for comment was not immediately responded to by either company.

Both firms believe there hasn’t been a KYC solution tailored to Web3 with “strong privacy protection” and their proposed offering is set to address this gap by issuing anonymized KYC credentials to individuals’ wallets.

This credential will be continuously updated according to the announcement and Oasis pledges its “privacy-preserving capabilities” will ensure data is processed in confidence whilst maintaining a trail on the company's blockchain.

Web3 firms offering similar solutions based around decentralized identity are Dock and Quadrata with each offering a product built around decentralized identity.

The partnership could have some Web3 natives concerned considering the significant data breach Equifax suffered in 2017. Around 163 million worldwide private records were compromised with 148 million being U.S. citizens making it the 13th largest data breach in U.S. history according to cybersecurity company UpGuard.

Related: Zero-knowledge KYC could solve the privacy vs compliance conundrum — VC partner

Attackers targeted a third-party web portal with a known vulnerability that was patched but Equifax had failed to update to the latest version, the hackers gained access to the firms' servers for around two and a half months all the while siphoning millions of records containing sensitive information.

It was reported that Equifax spent $1.4 billion on legal fees and strengthening its security posture following the incident. The U.S. Federal Trade Commission and Consumer Financial Protection Bureau issued a $700 million fine in July 2019 which the firm settled.