In recent years, the IRS has made one thing abundantly clear – if you make money from crypto, they want their cut. So if you’re underreporting or outright avoiding crypto taxes, be warned: the penalties are steep. Before you take the wrong turn, learn the risks from crypto tax experts, Koinly. Is cryptocurrency taxed? The […]

In recent years, the IRS has made one thing abundantly clear – if you make money from crypto, they want their cut. So if you’re underreporting or outright avoiding crypto taxes, be warned: the penalties are steep. Before you take the wrong turn, learn the risks from crypto tax experts, Koinly. Is cryptocurrency taxed? The […] Left your crypto taxes until the last second? Here’s how to get your crypto taxes done by April 18 with the least amount of friction possible. The IRS has been really clear that cryptocurrency is definitely taxed – and that they’re able to track crypto investments through various channels. In brief, crypto is subject to […]

Left your crypto taxes until the last second? Here’s how to get your crypto taxes done by April 18 with the least amount of friction possible. The IRS has been really clear that cryptocurrency is definitely taxed – and that they’re able to track crypto investments through various channels. In brief, crypto is subject to […] The IRS might not be the best at keeping ahead of the crypto curve, but if you think you can hide your Bitcoin gains – think again. Crypto tax calculator Koinly is here to explain just how the IRS can track your crypto.

Got gains or income from crypto? The IRS would like their […]

The IRS might not be the best at keeping ahead of the crypto curve, but if you think you can hide your Bitcoin gains – think again. Crypto tax calculator Koinly is here to explain just how the IRS can track your crypto.

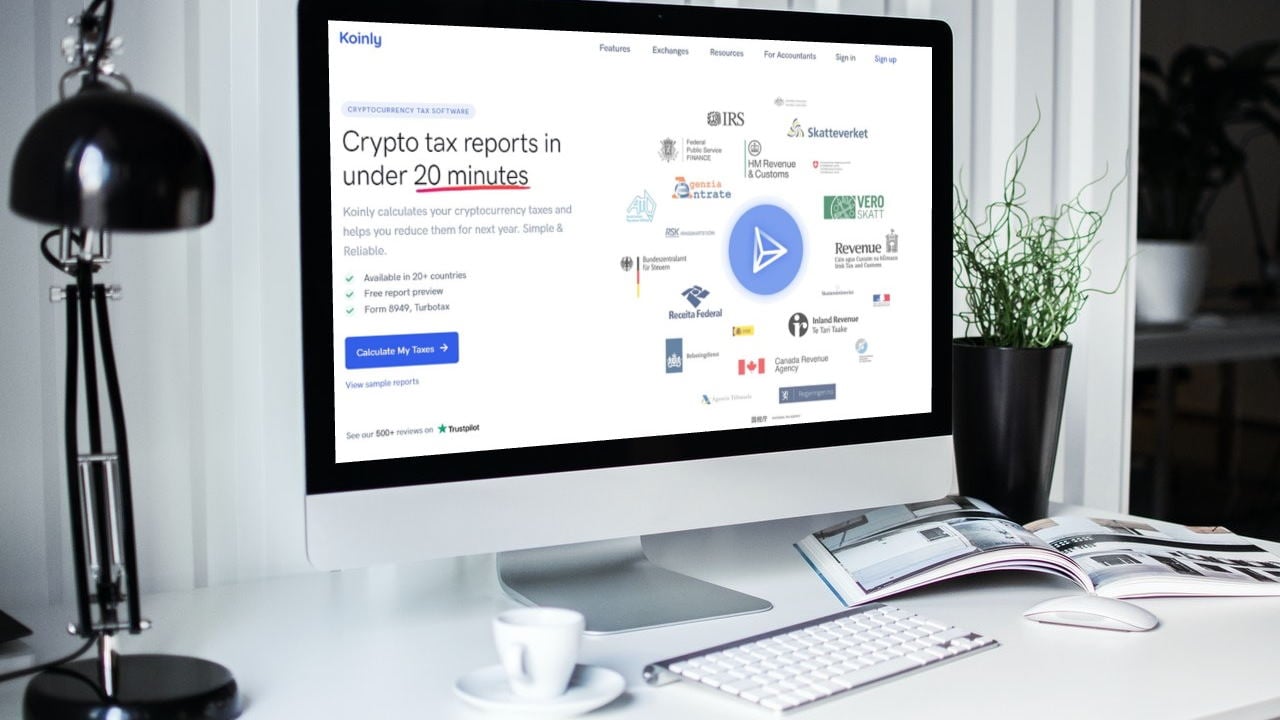

Got gains or income from crypto? The IRS would like their […] Koinly is a leading a cryptocurrency tax calculator and portfolio tracker for traders, investors and accountants. There are many features that make it stand out from the competition, and this article will present five key reasons why Koinly is actually the best crypto tax software in the world today. These include a wide range of […]

Koinly is a leading a cryptocurrency tax calculator and portfolio tracker for traders, investors and accountants. There are many features that make it stand out from the competition, and this article will present five key reasons why Koinly is actually the best crypto tax software in the world today. These include a wide range of […] Koinly is a tax solution for cryptocurrency investors and accountants. Anyone who owns multiple exchange accounts or wallets knows the pains when it comes to declaring taxes. Koinly was built to solve this very problem – by integrating with all major blockchains and exchanges Koinly reduces crypto tax reporting to a few minutes of work. […]

Koinly is a tax solution for cryptocurrency investors and accountants. Anyone who owns multiple exchange accounts or wallets knows the pains when it comes to declaring taxes. Koinly was built to solve this very problem – by integrating with all major blockchains and exchanges Koinly reduces crypto tax reporting to a few minutes of work. […] Cryptocurrency users can face a lot of challenges finding the right information needed for reporting taxes. Koinly, a leading cryptocurrency tax calculator and portfolio tracker for traders, has created the ultimate guide to help. Koinly Presents The Ultimate Bitcoin Tax Guide for 2022 Crypto tax regulations and laws can be confusing, leaving investors with many […]

Cryptocurrency users can face a lot of challenges finding the right information needed for reporting taxes. Koinly, a leading cryptocurrency tax calculator and portfolio tracker for traders, has created the ultimate guide to help. Koinly Presents The Ultimate Bitcoin Tax Guide for 2022 Crypto tax regulations and laws can be confusing, leaving investors with many […]

The taxman commeth for Australian crypto investors and Binance wants to help them out.

The Australian branch of leading cryptocurrency exchange Binance has increased the ability for users to accurately report tax liabilities amidst increased pressure from local tax authorities.

Binance has partnered with cryptocurrency tax startup Koinly to assist users grappling with ever-increasing tax obligations down under. Binance users in Australia have been offered access to Koinly’s tax reporting solution through the integration.

Koinly was founded in 2018 and supports over 600 exchanges and wallets, enabling users to sync their full crypto trading history with one central ATO-compliant platform.

The move comes as the Australian Tax Office (ATO) increases its effort to collect taxes on cryptocurrency gains. In July last year, the ATO targeted 350,000 crypto asset investors and holders with a letter regarding undeclared cryptocurrency gains.

In May 2021, the ATO doubled down with its efforts, reminding 100,000 Australian crypto users to report all gains on their tax returns — with a further 300,000 people expected to be prompted to do so as they lodge their returns. It estimated that there are over 600,000 taxpayers that have invested in crypto-assets in recent years. The ATO uses data matching with exchanges to identify users who may have tax bills.

In an announcement shared with Cointelegraph, Koinly founder Robin Singh explained:

“The ATO is collecting bulk records data from Australian crypto exchanges and comparing it to amounts entered on previous tax returns. Failure to declare crypto gains can attract a penalty of 75% of the outstanding tax liability.”

Binance is also increasing its educational efforts down under by hosting an end of financial year tax masterclass in collaboration with Koinly on July 22.

Related: Two-fifths of Aussie millennials think crypto investments beat real estate

Sam Teoh, of Binance Australia, stated that the crypto community has voiced their concern around tax compliance, adding “with approximately one in six Australians investing in crypto, taxpayers and tax agents alike are on a steep learning curve.”

Australians are not the only ones coming under the watchful eye of the taxman. In late May, the U.S. Treasury proposed crypto transactions over $10,000 be reported to the Internal Revenue Service.