On Wednesday, U.S. spot bitcoin exchange-traded funds (ETFs) experienced another high-activity trading session, pulling in $458.54 million in gains. Meanwhile, ether ETFs also saw inflows, with $24.22 million moving into the nine funds. U.S. Bitcoin and Ether ETFs Absorb Millions – A Key Shift in Market Dynamics Data from sosovalue.xyz showed that $458.54 million was […]

On Wednesday, U.S. spot bitcoin exchange-traded funds (ETFs) experienced another high-activity trading session, pulling in $458.54 million in gains. Meanwhile, ether ETFs also saw inflows, with $24.22 million moving into the nine funds. U.S. Bitcoin and Ether ETFs Absorb Millions – A Key Shift in Market Dynamics Data from sosovalue.xyz showed that $458.54 million was […] Twenty days have passed since the debut of U.S. spot ethereum exchange-traded funds (ETFs), encompassing 14 trading sessions to date. During this period, the overall net inflows have dipped to a loss of $405.94 million. Nevertheless, Blackrock’s ETHA and Fidelity’s FETH have witnessed significant gains. ETHA’s net inflows are approaching the $1 billion milestone, while […]

Twenty days have passed since the debut of U.S. spot ethereum exchange-traded funds (ETFs), encompassing 14 trading sessions to date. During this period, the overall net inflows have dipped to a loss of $405.94 million. Nevertheless, Blackrock’s ETHA and Fidelity’s FETH have witnessed significant gains. ETHA’s net inflows are approaching the $1 billion milestone, while […] Based on Thursday’s data, the 11 U.S. spot bitcoin exchange-traded funds (ETFs) experienced another day of net inflows following Wednesday’s increases. Statistics indicate that $31.16 million was absorbed primarily by Blackrock’s IBIT, although the amount would have been higher if not for the reduction seen by Grayscale’s GBTC. Bitcoin ETF Market Prints $59B Total Value […]

Based on Thursday’s data, the 11 U.S. spot bitcoin exchange-traded funds (ETFs) experienced another day of net inflows following Wednesday’s increases. Statistics indicate that $31.16 million was absorbed primarily by Blackrock’s IBIT, although the amount would have been higher if not for the reduction seen by Grayscale’s GBTC. Bitcoin ETF Market Prints $59B Total Value […] Spot bitcoin exchange-traded funds (ETFs) trading in the United States experienced their fourth straight day of net inflows on Friday. Data from sosovalue.xyz shows $73.05 million was added during the trading sessions, with Blackrock’s IBIT leading the pack. Spot Bitcoin ETFs Enjoy Four-Day Inflow Streak On Friday, the 11 spot bitcoin ETFs saw $73.05 million […]

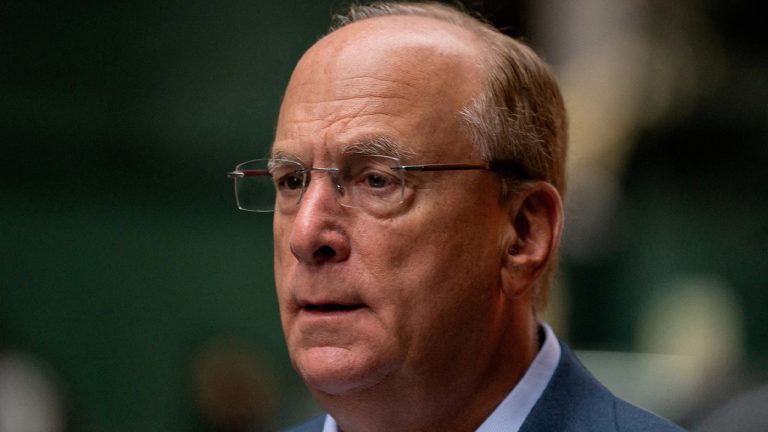

Spot bitcoin exchange-traded funds (ETFs) trading in the United States experienced their fourth straight day of net inflows on Friday. Data from sosovalue.xyz shows $73.05 million was added during the trading sessions, with Blackrock’s IBIT leading the pack. Spot Bitcoin ETFs Enjoy Four-Day Inflow Streak On Friday, the 11 spot bitcoin ETFs saw $73.05 million […] Blackrock’s CEO, Larry Fink, stated in an interview on Friday that he does not anticipate a “big recession” in the United States. However, he believes that “inflation is going to be stickier for longer.” In contrast to the U.S. central bank’s 2% goal, Fink predicts that “we’re going to have a 4ish floor in inflation.” […]

Blackrock’s CEO, Larry Fink, stated in an interview on Friday that he does not anticipate a “big recession” in the United States. However, he believes that “inflation is going to be stickier for longer.” In contrast to the U.S. central bank’s 2% goal, Fink predicts that “we’re going to have a 4ish floor in inflation.” […]

Binance CEO Changpeng Zhao said self-custody is a “fundamental human right,” while Michael Saylor said self-custody is necessary to prevent powerful actors from accumulating and abusing power.

Industry heavyweights have urged crypto investors and traders to self-custody their crypto assets amid the significant market uncertainty brought on by the collapse of FTX.

In a Nov. 13 tweet to his 7.6 million followers, Binance CEO Changpeng “CZ” Zhao pushed the crypto community to store their own crypto via self-custody crypto wallets.

“Self custody is a fundamental human right. You are free to do it anytime. Just make sure you do do it right,” he said, recommending investors to start with small amounts in order to learn the technology and tooling first:

Self custody is a fundamental human right.

— CZ Binance (@cz_binance) November 13, 2022

You are free to do it at any time.

Just make sure you do do it right.

Recommend start with small amounts to learn the tech/tools first.

Mistakes here can be very costly.

Stay #SAFU

Speaking to Cointelegraph during the Pacific Bitcoin conference on Nov. 10-11, MicroStrategy executive chairman Michael Saylor also discussed the merits of self-custody given the current market environment.

Saylor suggested that self-custody not only provides investors with property rights, it also prevents powerful actors from corrupting the network and its participants:

“In systems where there is no self-custody, the custodians accumulate too much power and then they can abuse that power.”

“So self-custody is very valuable for this broad middle class, as it tends to create [...] this power of checks and balances on every other actor in the system that causes them to be in continual competition to provide transparency and virtue,” he explained.

Backstage interview with the charming Michael @saylor ⚡️

— Joe Nakamoto (@JoeNakamoto) November 11, 2022

✅ check @Cointelegraph to read his advice on how to handle the bear market

@pacificbitcoin

pic.twitter.com/yWZmEsgQar

Saylor also made the argument that self-custody plays an important role in maintaining the integrity and security of blockchains because it increases decentralization:

“If you can’t self-custody your coin, there’s no way to establish a decentralized network.”

The recent events that transpired last week appear to have already pushed many investors and traders towards self-custody solutions.

Since the sudden collapse of FTX in early November, the number of Bitcoin (BTC) withdrawals on centralized exchanges reached a 17-month high, according to on-chain analytics firm Glassnode:

#Bitcoin $BTC Number of Exchange Withdrawals (7d MA) just reached a 17-month high of 3,424.315

— glassnode alerts (@glassnodealerts) November 13, 2022

View metric:https://t.co/QyB7zouWee pic.twitter.com/Su4biTEM7h

While at the same time, net inflows into self-custody wallets have soared.

Smart contract wallet Safe — previously Gnosis Safe — reported over $800 million in net inflows since last Tuesday when the FTX saga began to spiral out of control:

Over $800M net in-flows into @Safe since last Tuesday. $325M on Thursday alone. Looks like a flight to self-custody. pic.twitter.com/hiuij9dp7s

— lukasschor.eth | Safe (@SchorLukas) November 13, 2022

The outflow from centralized exchanges caused by the FTX meltdown also created problems for hardware-based cryptocurrency wallet provider Ledger — who were temporarily unable to process a mass influx of inflows due to scalability issues.

The token of the Binance-acquired self-custody wallet Trust Wallet (TWT) also increased 84% to $2.19 over the last 48 hours before cooling off to $1.83, according to CoinGecko.

The token allows token holders to participate in deciding how the wallet operates and what technical updates are to be made.

Related: Self-custody is key during extreme market conditions: Here's what experts say

Investor confidence in centralized exchanges took another hit on Nov. 13 when Crypto.com accidentally sent 320,000 ETH to Gate.io.

Ethereum bull and host of The Daily Gwei Anthony Sassano on Nov. 13 called out the crypto exchange over its mistake and later stated that investors should not store assets on centralized exchanges “for longer than you need to.”

Meanwhile, Blockchain Association head of policy Jake Chervinsky said that self-custody education should be one of the first things newcomers learn, while Bitcoin proponent Dan Held told his 642,800 Twitter followers that self-custody is a crucial element to self-sovereignty:

Self custody your Bitcoin and run a full node.

— Dan Held (@danheld) November 12, 2022

That’s how you achieve self sovereignty.

Don’t trust, verify.