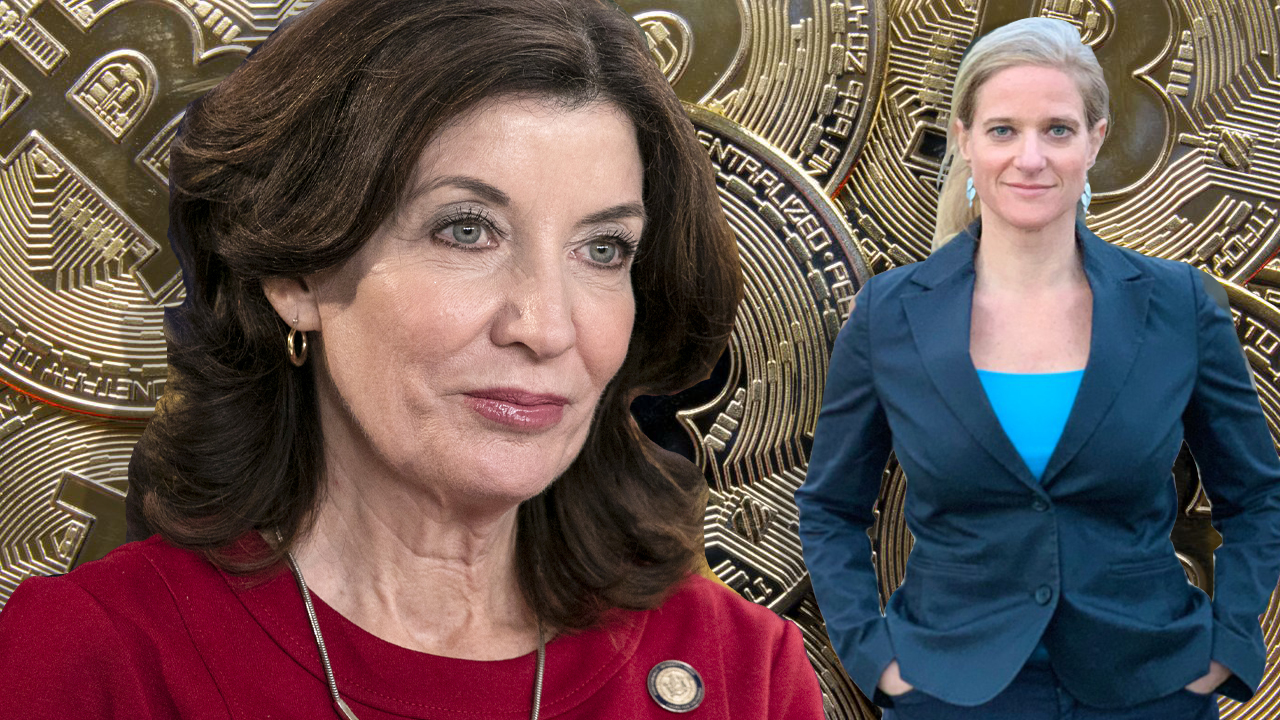

President-elect Donald Trump is considering appointing Perianne Boring, chief executive of the Chamber of Digital Commerce, as Chair of the Commodity Futures Trading Commission (CFTC). According to a new report by Fox Business, anonymous sources familiar with the matter say that Trump is considering Boring to take the reins of the regulatory agency, partially due […]

The post Donald Trump Considering Chamber of Digital Commerce CEO Perianne Boring for CFTC Chair: Report appeared first on The Daily Hodl.

The U.S. president remains the last barrier to recalling the problematic anti-crypto resolution by the SEC.

In a 60 to 38 vote, United States senators passed H.J. Res. 109, a resolution nullifying the U.S. Securities and Exchange Commission’s (SECs) Staff Accounting Bulletin No. 121. The commission’s rule requires banks to keep customers’ digital assets on their balance sheets, with capital maintained against them — a measure many lawmakers and industry leaders have criticized as stifling innovation.

“The tally, a stunning 60 ‘Yeas’ in the Senate vote, sends a strong signal that both houses of Congress, across the political divide, clearly disapprove of this rule,” stated crypto advocacy group the Blockchain Association.

However, before the resolution passed in the U.S. House of Representatives, President Joe Biden said he intended to veto the bill to “protect investors in crypto-asset markets and to safeguard the broader financial system.”

The chief executive of the Chamber of Digital Commerce says that Bitcoin (BTC) could hit a seven-figure price tag by 2029 if adoption continues at the current rate. In a new interview on CNBC Television, Perianne Boring, the crypto advocacy group’s founder and CEO, says that BTC’s fair value price is likely already somewhere between […]

The post Bitcoin Could Hit $1,000,000 a Coin by 2029, Says Chamber of Digital Commerce CEO – Here’s Why appeared first on The Daily Hodl.

The Chamber of Digital Commerce has accused the SEC of trying to impose securities regulations via the “back door” of an insider trading lawsuit.

The United States Securities and Exchange Commission has again been accused of overstepping its authority and unfairly labeling crypto assets as securities, this time in its insider trading case against ex-Coinbase employees.

In an amicus brief filing on Feb. 22, the U.S.-based Chamber of Digital Commerce argued the case should be dismissed as it represented an expansion of the SEC’s “regulation by enforcement” campaign and seeks to characterize secondary market transactions as securities transactions.

We have serious concerns about the SEC’s attempt to label these tokens as securities in the context of an enforcement action against third parties who had nothing to do with creating, distributing or marketing those assets. This is not a healthy policymaking process. Dismiss! https://t.co/06WAJ65Ckl

— Perianne (@PerianneDC) February 22, 2023

“This case represents a stealthy, yet dramatic and unprecedented effort to expand the SEC’s jurisdictional reach and threatens the health of the U.S. marketplace for digital assets,” wrote Perianne Boring, founder and CEO of the Chamber of Digital Commerce.

The Chamber highlighted the “SEC’s encroachment into the digital assets market” was never authorized by Congress, and noted in other Supreme Court cases it has been ruled that regulators must first be granted authority by Congress.

“By acting without Congressional authorization, [the SEC] continues to contribute to a chaotic regulatory environment, harming the very investors it is charged to protect,” it wrote on Twitter.

The Chamber also argued that in bringing claims of securities fraud, the SEC was essentially asking the court to uphold that secondary market trades in the nine digital assets mentioned in an insider trading case against a former Coinbase employee constitute securities transactions, which it suggested was “problematic.”

This novel attempt by @SECGov to impose securities regulations via the “back door” of an insider trading action raises serious due process concerns & will result in an array of consequences that will harm investors and threaten digital assets. Thus, it should be dismissed!

— Chamber of Digital Commerce (@DigitalChamber) February 22, 2023

“We have serious concerns about [the SEC’s] attempt to label these tokens as securities in the context of an enforcement action against third parties who had nothing to do with creating, distributing or marketing those assets,” Perianne added.

The Chamber cited the LBRY v SEC case in its brief, in which the judge had ruled that secondary market transactions would not be designated as securities transactions.

The judge had been persuaded by a paper from commercial contract attorney Lewis Cohen, which pointed out that no court had ever acknowledged the underlying asset was a security at any point since the landmark SEC v W. J. Howey Co. ruling — a case which set the precedent for determining whether a security transaction exists.

The latest amicus brief follows a similar filing from advocacy group the Blockchain Association on Feb. 13, which also argued that the SEC had exceeded its authority in the case and claimed it was “the latest salvo in the SEC’s apparent ongoing strategy of regulation by enforcement in the digital assets space.”

Related: Gary Gensler’s SEC is playing a game, but not the one you think

An amicus brief is filed by an amicus curiae, or “friend of the court,” which is an individual or organization not involved with a case but can assist the court by offering relevant information or insight.

The SEC in July sued former Coinbase Global product manager Ishan Wahi, brother Nikhil Wahi, and associate Sameer Ramani, alleging that the trio had used confidential information obtained by Ishan to make $1.5 million in gains from trading 25 different cryptocurrencies.

The state of New York passed a bill that puts a moratorium on specific types of cryptocurrency mining operations that leverage carbon-based energy sources. The policy will place a two-year ban on proof-of-work (PoW) mining if the assembly bill is approved by New York governor Kathy Hochul. New York PoW Mining Moratorium Legislation to Be […]

The state of New York passed a bill that puts a moratorium on specific types of cryptocurrency mining operations that leverage carbon-based energy sources. The policy will place a two-year ban on proof-of-work (PoW) mining if the assembly bill is approved by New York governor Kathy Hochul. New York PoW Mining Moratorium Legislation to Be […]