Economist and gold advocate Peter Schiff has sounded the alarm on the Federal Reserve’s latest actions, linking a significant rate cut to rising gold prices and a weakening U.S. dollar. His warning about a deepening recession and rising inflation adds weight to concerns about future economic stability. “It’s game over for the Fed,” Schiff stressed. […]

Economist and gold advocate Peter Schiff has sounded the alarm on the Federal Reserve’s latest actions, linking a significant rate cut to rising gold prices and a weakening U.S. dollar. His warning about a deepening recession and rising inflation adds weight to concerns about future economic stability. “It’s game over for the Fed,” Schiff stressed. […]

A political deadlock over the U.S. debt ceiling and its potential impact on the price of Bitcoin, which is already up 75% in 2023.

On April 26, House Republicans scarcely passed their bill to increase the U.S. debt ceiling. This led to analysts already weighing its potential impact on the price of Bitcoin (BTC), ranging from extremely bearish to overly bullish.

Ultimately, U.S. dollar liquidity is the key to both of these opposing viewpoint.

Some analysts, including Jesse Meyers, the COO of investment firm Onramp, believe raising the debt ceiling would prompt the Federal Reserve to print more money, thus boosting capital inflows into "risky" assets like Bitcoin.

The debt ceiling represents the maximum amount of money the U.S. government can borrow to pay its bills.

Related: Fed balance sheet adds $393B in two weeks — Will this send Bitcoin price to $40K?

Raising it means they can issue more debt to generate more capital. But since the Fed is not buying bonds anymore thanks to its "quantitative tightening," and the flow of available M2 money supply crashing, the U.S. government debt may find it hard to attract buyers.

In other words, a deflationary recession that Meyers believes will force the Fed to return to its quantitive easing policy.

"When the debt ceiling is lifted and credit-contraction leads to economic crisis... They will have to print money on a massive scale," he noted, reminding:

"Bitcoin was the winner during the last round of stimulus."

The government has already hit its $31.4 trillion debt ceiling in January 2023. So, it theoretically cannot generate more capital until the Senate passes the House-passed bill.

However, it's unlikely to pass the Senate and Biden has also vowed to veto the bill.

The standoff could result in the U.S. government defaulting on its debt in June, which poses negative consequences for the U.S. dollar, according to Jeff John Roberts, crypto editor at Fortune.

"If [Republicans] decide to go the kamikaze route during the current debt ceiling standoff, it will deliver another major hit to the dollar's credibility—and a further boost to Bitcoin," he noted.

Former U.S. Treasury Secretary Lawrence Summers meanwhile downplays the fears associated with a potential debt default, noting that the odds of it happening stands under 2%.

Summers:

"I think the odds that we will default in the sense of insolvency, and over some interval people who hold bonds will not be able to get paid, are - assuming the absence of a major war - certainly under 2% over the next decade."

Presenting a similar outlook, analyst TedTalksMacro says extending the debt ceiling would ensure that the Fed continues contracting its balance sheet through the ongoing QT.

That points to lower liquidity and, in turn, more downside pressure for Bitcoin.

"One caveat to the liquidity down/sideways for the rest of 2023 would be the Fed winding up or slowing the current pace QT," TedTalksMacro adds.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Bloomberg Intelligence’s senior commodity strategist, Mike McGlone, has warned that the U.S. economy is “heading towards a severe deflationary recession,” emphasizing that the Federal Reserve is still tightening. “Typically, when you have commodities collapsing at this velocity in the past, the Fed has already been easing, and they’re still vigilant against that,” he cautioned. Strategist […]

Bloomberg Intelligence’s senior commodity strategist, Mike McGlone, has warned that the U.S. economy is “heading towards a severe deflationary recession,” emphasizing that the Federal Reserve is still tightening. “Typically, when you have commodities collapsing at this velocity in the past, the Fed has already been easing, and they’re still vigilant against that,” he cautioned. Strategist […] After the British pound sterling tapped an all-time low against the U.S. dollar on September 26, the Bank of England (BOE) said it would halt its monetary tightening policy and start buying long-dated bonds again. Approximately two weeks later, the BOE detailed on Monday that it was doubling the size of its debt buy-backs by […]

After the British pound sterling tapped an all-time low against the U.S. dollar on September 26, the Bank of England (BOE) said it would halt its monetary tightening policy and start buying long-dated bonds again. Approximately two weeks later, the BOE detailed on Monday that it was doubling the size of its debt buy-backs by […] With inflation soaring in the U.S., economists from monetary policy analytics and forecasting firm LH Meyer say the U.S. Federal Reserve could stop shrinking its balance sheet earlier than expected. However, critics have said the U.S. central bank hasn’t really shrunk the Fed’s balance at all, and the entity has been accused of keeping quantitative […]

With inflation soaring in the U.S., economists from monetary policy analytics and forecasting firm LH Meyer say the U.S. Federal Reserve could stop shrinking its balance sheet earlier than expected. However, critics have said the U.S. central bank hasn’t really shrunk the Fed’s balance at all, and the entity has been accused of keeping quantitative […] According to the latest Bureau of Labor Statistics Consumer Price Index (CPI) report, U.S. inflation remains scorching hot as it has risen at the fastest yearly rate since 1981. June’s CPI data reflected a 9.1% year-over-year increase, even though a number of bureaucrats and economists thought May’s CPI data would be the record peak. US […]

According to the latest Bureau of Labor Statistics Consumer Price Index (CPI) report, U.S. inflation remains scorching hot as it has risen at the fastest yearly rate since 1981. June’s CPI data reflected a 9.1% year-over-year increase, even though a number of bureaucrats and economists thought May’s CPI data would be the record peak. US […] After April’s consumer price index (CPI) report was published, a number of American economists and bureaucrats said that inflation had peaked and it was possible that inflation would subside. However, statistics from the U.S. Labor Department indicate the CPI increased 8.6% from a year earlier, as the month of May’s inflation data reached another lifetime […]

After April’s consumer price index (CPI) report was published, a number of American economists and bureaucrats said that inflation had peaked and it was possible that inflation would subside. However, statistics from the U.S. Labor Department indicate the CPI increased 8.6% from a year earlier, as the month of May’s inflation data reached another lifetime […] Following the Federal Reserve’s rate hike on Wednesday, economist Peter Schiff has had a lot to say since the U.S. central bank raised the benchmark rate by half a percentage point. Schiff further believes we are in a recession and says “it will be much worse than the Great Recession that followed the 2008 Financial […]

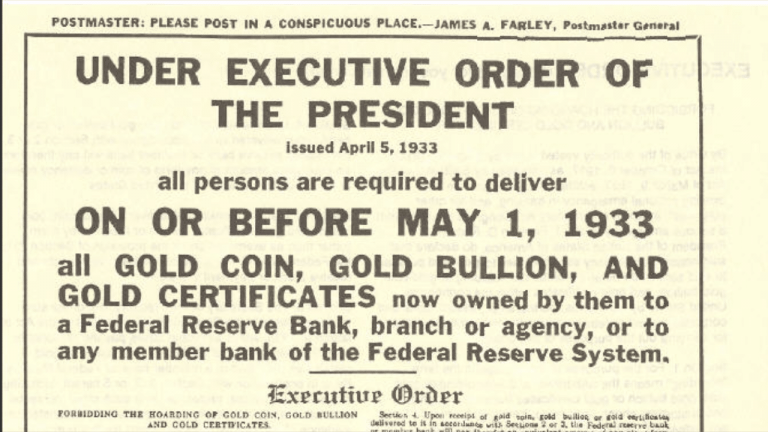

Following the Federal Reserve’s rate hike on Wednesday, economist Peter Schiff has had a lot to say since the U.S. central bank raised the benchmark rate by half a percentage point. Schiff further believes we are in a recession and says “it will be much worse than the Great Recession that followed the 2008 Financial […] This past Tuesday, April 5, was the 89th anniversary of Executive Order 6102 when the U.S. government would strictly “forbid the hoarding of gold coin, gold bullion, and gold certificates within the continental United States.” While the global economy seems to be heading toward disaster and the U.S. dollar’s strength is being examined, many have […]

This past Tuesday, April 5, was the 89th anniversary of Executive Order 6102 when the U.S. government would strictly “forbid the hoarding of gold coin, gold bullion, and gold certificates within the continental United States.” While the global economy seems to be heading toward disaster and the U.S. dollar’s strength is being examined, many have […] Inflation in the United States continues to rise as it climbed at its fastest rate in 40 years since February 1982. Statistics from the U.S. Labor Department’s Consumer Price Index (CPI) jumped 7.5% higher than it was a year ago. US Inflation Continues to Surge On Thursday, the U.S. Labor Department published its CPI report […]

Inflation in the United States continues to rise as it climbed at its fastest rate in 40 years since February 1982. Statistics from the U.S. Labor Department’s Consumer Price Index (CPI) jumped 7.5% higher than it was a year ago. US Inflation Continues to Surge On Thursday, the U.S. Labor Department published its CPI report […]