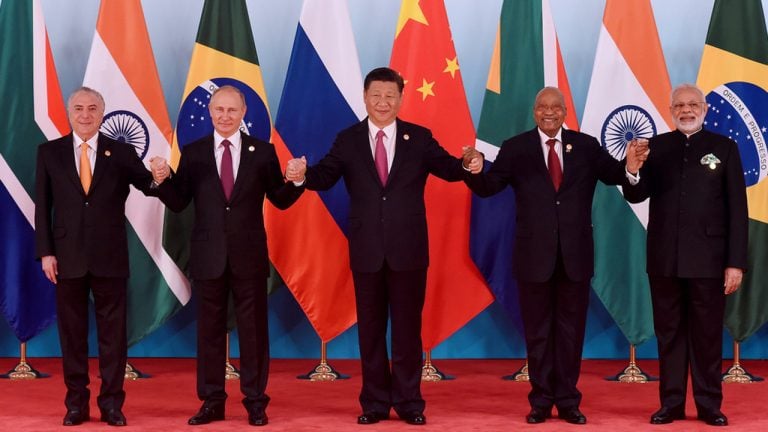

BRICS nations are considering adopting the petroyuan for oil trade as part of their ongoing dedollarization efforts, according to economic expert Herbert Poenisch. He noted the BRICS group may discuss alternatives to the petrodollar at their Kazan summit. He highlighted Saudi Arabia’s potential shift towards the petroyuan and Russia’s plans to reduce dollar reliance. However, […]

BRICS nations are considering adopting the petroyuan for oil trade as part of their ongoing dedollarization efforts, according to economic expert Herbert Poenisch. He noted the BRICS group may discuss alternatives to the petrodollar at their Kazan summit. He highlighted Saudi Arabia’s potential shift towards the petroyuan and Russia’s plans to reduce dollar reliance. However, […]

China may have banned the use of cryptocurrencies, but stablecoins might have a role to play in the proliferation of its national currency.

Although China has closed its doors to decentralized cryptocurrencies, Circle CEO Jeremy Allaire believes that stablecoins could play a role in the proliferation of China’s digital yuan.

Allaire, who heads up the company behind the United States dollar-backed stablecoin USD Coin (USDC), suggested that a yuan-based stablecoin might be China’s best bet for driving the adoption of its national currency in an interview with the South China Morning Post.

“If eventually the Chinese government wants to see the RMB [yuan] used more freely in trade and commerce around the world, it may be that stablecoins are the path to do that more than the central bank digital currency.”

China cracked down on the use of cryptocurrencies in 2021 while simultaneously blazing the trail for the trial, testing and issuing of its digital yuan central bank digital currency (CBDC). As of January 2023, the Chinese government noted that some 13 billion digital yuan are in circulation.

Interestingly, the digital yuan website claims that the currency will replace the dollar, Tether (USDT) and all other stablecoins, while stipulating that the CBDC will not be a stablecoin. The website allows users to exchange cryptocurrency for digital yuan through MetaMask or its own conversion portal.

Related: Hong Kong’s regulatory lead sets it up to be major crypto hub

Allaire conceded that China is unlikely to warm toward using decentralized cryptocurrencies and stated that Hong Kong’s progressive attitude toward the crypto sector could signal subversive support from the mainland.

The Circle CEO also noted that moves by various governments and central banks around the world to develop CBDCs that move away from “legacy technology into more modern distributed ledger technology” was positive, but it should not be misconstrued as a move toward accepting decentralized and self-sovereign systems:

“There’s a whole bunch of things that are useful from that, but I view that as very different from the work that the private sector does to innovate on the public internet.”

Nevertheless, the digital yuan is finding its way across Chinese borders. As Cointelegraph previously reported, Singapore-based, cryptocurrency-friendly bank DBS has developed a digital yuan merchant solution allowing Chinese businesses to receive payments in the CBDC.

The service allows clients based in mainland China to receive or collect digital yuan and have settlements made directly to yuan-based bank accounts.

Collect this article as an NFT to preserve this moment in history and show your support for independent journalism in the crypto space.

Magazine: Asia Express: China expands CBDC’s tentacles, Malaysia is HK’s new crypto rival

Within the next decade, the U.S. dollar will play a much less dominant role than it is today, according to Jeffrey Sachs. The renowned economist listed a few factors for the diminishing status of the greenback such as its use as a political weapon by Washington, the introduction of currencies like the digital yuan, and […]

Within the next decade, the U.S. dollar will play a much less dominant role than it is today, according to Jeffrey Sachs. The renowned economist listed a few factors for the diminishing status of the greenback such as its use as a political weapon by Washington, the introduction of currencies like the digital yuan, and […] An idea to establish an Asian Monetary Fund has caught the attention of the Chinese leadership, the head of the Malaysian government revealed. The prime minister believes there is no reason for his country, which is hurting from a strong U.S. dollar, to remain dependent on the greenback. Malaysia Prepares to Trade With China in […]

An idea to establish an Asian Monetary Fund has caught the attention of the Chinese leadership, the head of the Malaysian government revealed. The prime minister believes there is no reason for his country, which is hurting from a strong U.S. dollar, to remain dependent on the greenback. Malaysia Prepares to Trade With China in […]

Multiple Chinese city governments have given away millions worth of e-CNY to try to promote consumption around the holiday season.

Millions of dollars worth of China’s Central Bank Digital Currency (CBDC) has been handed out across the country over the Lunar New Year period in a bid to boost its takeup.

According to a Feb. 6 report in the Global Times, an English-language outlet of the state-ran People’s Daily newspaper, around 200 “activities” for the e-CNY were launched across the country during the holiday period.

These "activities" were made to “promote consumption” — the first of such since the government recently relaxed COVID-19 restrictions.

Multiple cities reportedly gave away over $26.5 million, or 180 million yuan worth of the CBDC in programs such as subsidies and consumption coupons.

One example provided by the outlet included the Shenzhen local government handing out over $14.7 million (100 million yuan) worth of e-CNY to subsidize the catering industry in the city.

A Feb. 1 China Daily report said Hangzhou issued each resident a $12 (80 yuan) e-CNY voucher on Jan. 16 with the total giveaway costing the city around $590,000, or 4 million yuan.

Some of these initiatives proved to be very popular among residents.

Citing data from the e-commerce platform Meituan, the Global Times rreport stated that e-CNY given away by the Hangzhou city government for the New Year celebrations was taken up by residents within nine seconds.

Related: Bank of China ex-advisor calls Beijing to reconsider crypto ban

The last few months has seen the government enacti other targets and features to boost the usage of the CBDC.

On Feb. 1, senior ruling party officials in Suzhou city set a tentative key performance indicator for the end of 2023 to have $300 billion (2 trillion yuan) worth of e-CNY transactions in the city.

The target is ambitious considering cumulative e-CNY transactions had crossed $14 billion (100 billion yuan) in October 2022, two years after the CBDC’s launch.

In late December last year, in a bid to attract new users the e-CNY wallet app introduced the ability to send “red packets,” called hongbao in China, which is used for gifting money around the holidays.

The wallet app received an update in early January allowing users to make contactless payments using Android phones — even if their device is without internet or power.

In December, a former Chinese central banker called the results of the e-CNY trials “not ideal,” and admitted, “usage has been low, highly inactive.”

During the last month, Russia’s ruble has dropped 16.48% against the U.S. dollar as energy and commodity prices have slowed over the last few weeks. Russia’s central bank revealed two weeks ago that it is further distancing itself from U.S. dollar dependence by purchasing the Chinese yuan on foreign exchange markets. Roughly around the same […]

During the last month, Russia’s ruble has dropped 16.48% against the U.S. dollar as energy and commodity prices have slowed over the last few weeks. Russia’s central bank revealed two weeks ago that it is further distancing itself from U.S. dollar dependence by purchasing the Chinese yuan on foreign exchange markets. Roughly around the same […] China’s sovereign currency, the yuan, has slid significantly in value during the last few months as it has shed 8% against the U.S. dollar during the first half of 2022. China’s fiat currency is currently the weakest it has been against the U.S. dollar in roughly two years. Amid the depreciating yuan, China is suffering […]

China’s sovereign currency, the yuan, has slid significantly in value during the last few months as it has shed 8% against the U.S. dollar during the first half of 2022. China’s fiat currency is currently the weakest it has been against the U.S. dollar in roughly two years. Amid the depreciating yuan, China is suffering […] Authorities in two Chinese cities are promoting the digital yuan as a payment method in the public transportation system. Commuters on the subway of Ningbo and those taking the bus in Guangzhou will be able to purchase their tickets using the state-issued digital currency. Residents and Visitors of Another 2 Chinese Cities to Pay Transit […]

Authorities in two Chinese cities are promoting the digital yuan as a payment method in the public transportation system. Commuters on the subway of Ningbo and those taking the bus in Guangzhou will be able to purchase their tickets using the state-issued digital currency. Residents and Visitors of Another 2 Chinese Cities to Pay Transit […] Financial sanctions imposed on Russia over its invasion of Ukraine may result in reduced dominance of the U.S. currency, according to a high-ranking official at the International Monetary Fund (IMF). The confrontation could lead to fragmentation of the world’s current monetary system, the top representative warned. New Currency Blocs May Emerge Amid Mounting Restrictions on […]

Financial sanctions imposed on Russia over its invasion of Ukraine may result in reduced dominance of the U.S. currency, according to a high-ranking official at the International Monetary Fund (IMF). The confrontation could lead to fragmentation of the world’s current monetary system, the top representative warned. New Currency Blocs May Emerge Amid Mounting Restrictions on […] The new digital yuan, currently undergoing trials, can help to increase the international usage of China’s national fiat, experts have stated. As the renminbi (RMB, CNY) is becoming one of the world’s most important currencies, the People’s Bank of China is planning to conduct cross-border tests with the yuan’s digitized version, the e-CNY. Digital Yuan […]

The new digital yuan, currently undergoing trials, can help to increase the international usage of China’s national fiat, experts have stated. As the renminbi (RMB, CNY) is becoming one of the world’s most important currencies, the People’s Bank of China is planning to conduct cross-border tests with the yuan’s digitized version, the e-CNY. Digital Yuan […]