There is a lot of discussion lately about the U.S. government’s debt ceiling and whether Congress will act before defaulting. In a recent interview, Christine Lagarde, the president of the European Central Bank (ECB), said she is confident the U.S. can maintain its debt obligations. However, she warned that if the U.S. were to default […]

There is a lot of discussion lately about the U.S. government’s debt ceiling and whether Congress will act before defaulting. In a recent interview, Christine Lagarde, the president of the European Central Bank (ECB), said she is confident the U.S. can maintain its debt obligations. However, she warned that if the U.S. were to default […]

Elizabeth Warren has long been a crypto-critic, and appears to be making it a focus as her re-election bid kicks off.

The United States Senator for Massachusetts Elizabeth Warren is making her “anti-crypto” agenda one of the centerpieces of her re-election campaign, despite polls suggesting the majority of Americans think crypto is a key innovation for the future.

In a March 30 Tweet, Warren suggested she was fighting to put “government on the side of working families,” and prominently quoted a Politico headline that said: “Elizabeth Warren is building an Anti-crypto Army.”

The ‘Pro-crypto Army’ took to Twitter to lambast the Senator. Popular YouTuber Coin Bureau ridiculed the strategy, saying, “Imagine thinking that building an 'anti-crypto army' is going to win you votes?” while crypto advocate Lord TJ suggested that the stance will “push innovation offshore.”

While the Senator undoubtedly has access to her own private polling on the issues, recent polls commissioned by the industry suggest the stance will not be a vote winner among the majority of the population.

In a Feb. 24 survey commissioned by crypto exchange Coinbase, a whopping 76% of the representative sample believed that “cryptocurrency and blockchain are the future.”

A survey commissioned by digital asset management firm Grayscale Investments in November 2022 shared similar sentiments, with the responses interestingly suggesting that 59% of Democrats consider crypto to be the future of finance. That's more than the 51% of Republicans who said the same thing.

However in Warren's favor, the crises of 2022 such as the collapses of BlockFi, FTX, and Terra Luna have weighed heavily on crypto sentiment among the public, with a recent survey from Morning Consult finding that trust in crypto had plummeted over the course of the year.

The phrase “Elizabeth Warren is building an anti-crypto army” was first featured in a Feb. 14 Politico article, which claimed she was “starting to recruit conservative Senate Republicans to her anti-crypto cause and getting some early positive vibes from bank lobbyists.”

Related: Elizabeth Warren is pushing the Senate to ban your crypto wallet

The Senator appears to have taken a liking to the phrase, however, considering she has prominently featured it in her re-election campaign.

Warren has long been a vocal critic of crypto, and even suggested that it will ruin the economy in a Wall Street Journal op-ed soon after the collapse of crypto exchange FTX.

On Feb. 14 Warren vowed to re-introduce an Anti-Money Laundering (AML) bill she had previously pushed, which would extend to decentralized finance (DeFi) and Decentralized autonomous organizations (DAOs), while also requiring unhosted wallets, miners, and validators to implement AML policies.

Web3 Gamer: Shrapnel wows at GDC, Undead Blocks hot take, Second Trip

Republicans in the U.S. House of Representatives are criticizing the White House, saying the Biden administration’s approach to crypto assets threatens the nascent industry. In a new memo addressed to the members of the House Committee on Financial Services, Republicans acknowledge that digital assets are a thriving trillion-dollar market. “Today, the total digital asset market […]

The post US House Republicans Blast Biden Administration’s Attack on the Crypto Ecosystem appeared first on The Daily Hodl.

The group's policy head doubted a divided Congress can create crypto legislation but said it doesn’t give regulators absolute authority in the interim.

Despite attempts to police cryptocurrency through enforcement actions, United States financial regulators “are bound by legal reality” and Congress will ultimately decide crypto regulations the policy expert for the crypto advocacy group Blockchain Association has suggested.

The association's chief policy officer, Jake Chervinsky, shared his views in an extensive Feb. 14 Twitter thread on the state of crypto policy.

He noted neither the Securities and Exchange Commission (SEC) nor the Commodity Futures Trading Commission (CFTC) “has the authority to comprehensively regulate crypto.”

14/ No matter how many enforcement actions the SEC and CFTC bring, they are bound by legal reality:

— Jake Chervinsky (@jchervinsky) February 14, 2023

Neither has the authority to comprehensively regulate crypto, neither can obtain it through any amount of enforcement, and neither will ever have it without an act of Congress.

Chervinsky believed a deal on crypto legislation seems “unlikely, given the ideological gap between House Republicans and Senate Democrats.” He accused the SEC and CFTC of overstepping their authority in an attempt to “get things done” without Congress.

Chervinsky called for the industry to remain calm following the recent flurry of activity from “crypto’s chief antagonist,” the SEC, and pointed to its crackdown on staking services as an example.

13/ The SEC's main tactic is regulation by enforcement, and it struck again last week by labeling Kraken’s staking service a security.

— Jake Chervinsky (@jchervinsky) February 14, 2023

That's frustrating, but it doesn't change much for anyone else. Settlements aren't the law, and every set of facts is unique. Others will fight.

The SEC’s Feb. 9 settlement with crypto exchange Kraken, that banned the exchange from ever offering staking services to U.S. customers, was publicly rebuked by SEC Commissioner Hester Peirce.

In a Feb. 9 dissenting statement, Peirce argued that regulation by enforcement “is not an efficient or fair way of regulating” an emerging industry.

Related: US lawmakers and experts debate SEC's role in crypto regulation

Chervinsky suggested litigation is one way the crypto industry can push for good policy, noting the judiciary plays an important role in dictating policy that has been “ignored.”

20/ FIFTH, we can litigate.

— Jake Chervinsky (@jchervinsky) February 14, 2023

Policy is made in all three branches of government, and we’ve ignored the judiciary for too long.

At the core of crypto is a fight for civil liberty, a fight that calls for impact litigation.

Our best allies may be in the courts. Let's go find them.

Crypto exchange Coinbase also faces an SEC probe similar to what resulted in Kraken’s settlement.

Coinbase CEO and co-founder, Brian Armstrong, has taken a more resolute stance, claiming that getting rid of crypto staking would be terrible for the U.S.

Armstrong argued in a Feb. 12 Twitter post that Coinbase’s staking services are not securities and would “happily defend this in court if needed.”

Coinbase's staking services are not securities. We will happily defend this in court if needed.https://t.co/GtTOz77YV3

— Brian Armstrong (@brian_armstrong) February 12, 2023

Judge’s rulings in landmark cases create a legal precedent. If such a case were brought to court and a judge decided Coinbase’s staking services did not classify as securities, other crypto companies in a similar position could use the precedent as part of their defense.

On Feb. 10, 2023, Republicans Patrick McHenry of North Carolina and Bill Huizenga of Michigan, both members of the U.S. House of Representatives, sent a letter to Securities and Exchange Commission (SEC) chairman Gary Gensler seeking answers about the arrest of FTX co-founder Sam Bankman-Fried prior to his scheduled testimony before the House Financial Services […]

On Feb. 10, 2023, Republicans Patrick McHenry of North Carolina and Bill Huizenga of Michigan, both members of the U.S. House of Representatives, sent a letter to Securities and Exchange Commission (SEC) chairman Gary Gensler seeking answers about the arrest of FTX co-founder Sam Bankman-Fried prior to his scheduled testimony before the House Financial Services […] Several U.S. House of Representatives Republicans have proposed legislation that would significantly decrease funding for the Internal Revenue Service (IRS). The move comes after the newly elected Speaker, Kevin McCarthy, stated that he would challenge the funding granted to the U.S. tax agency in the previous year. Biden Administration Opposes Bill for Rescinding Funding for […]

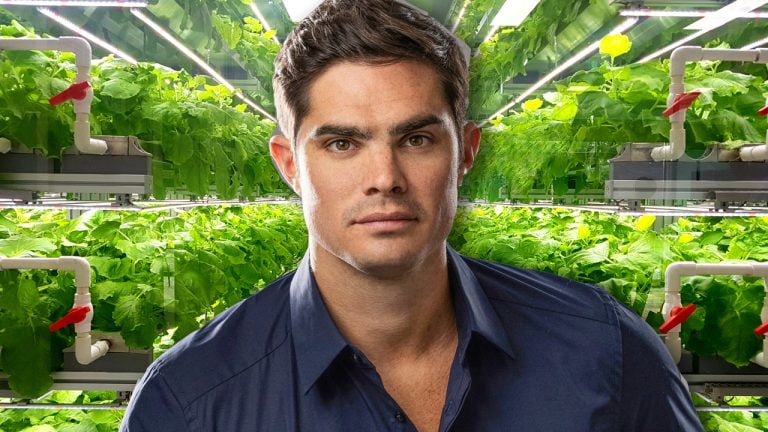

Several U.S. House of Representatives Republicans have proposed legislation that would significantly decrease funding for the Internal Revenue Service (IRS). The move comes after the newly elected Speaker, Kevin McCarthy, stated that he would challenge the funding granted to the U.S. tax agency in the previous year. Biden Administration Opposes Bill for Rescinding Funding for […] After discovering that ten holding firms associated with FTX Digital and Alameda Research invested roughly $5.4 billion into nearly 500 firms and projects, people have been curious about a few specific investments. One specific investment made by FTX Ventures Ltd. was for $25 million into the Ohio-based firm 80 Acres, a company that specializes in […]

After discovering that ten holding firms associated with FTX Digital and Alameda Research invested roughly $5.4 billion into nearly 500 firms and projects, people have been curious about a few specific investments. One specific investment made by FTX Ventures Ltd. was for $25 million into the Ohio-based firm 80 Acres, a company that specializes in […] Former FTX CEO Sam Bankman-Fried (SBF) has been talking a lot more since his exchange collapsed a few weeks ago, as he’s spoken at the New York Times Dealbook Summit, sat down with Good Morning America host George Stephanopoulos, and recently conducted an interview with New York Magazine. While doing all of these interviews, SBF […]

Former FTX CEO Sam Bankman-Fried (SBF) has been talking a lot more since his exchange collapsed a few weeks ago, as he’s spoken at the New York Times Dealbook Summit, sat down with Good Morning America host George Stephanopoulos, and recently conducted an interview with New York Magazine. While doing all of these interviews, SBF […] On Nov. 30, 2022, the former FTX CEO Sam Bankman-Fried (SBF) discussed FTX’s collapse at the New York Times’ Dealbook Summit with Andrew Ross Sorkin in his first live-appearance interview since the crypto exchange’s downfall. SBF told the Dealbook Summit host that he was “deeply sorry about what happened” and further stressed that he “didn’t […]

On Nov. 30, 2022, the former FTX CEO Sam Bankman-Fried (SBF) discussed FTX’s collapse at the New York Times’ Dealbook Summit with Andrew Ross Sorkin in his first live-appearance interview since the crypto exchange’s downfall. SBF told the Dealbook Summit host that he was “deeply sorry about what happened” and further stressed that he “didn’t […] On Nov. 29, 2022, the crypto supporter and reporter, Tiffany Fong, published an interview with the former FTX CEO Sam Bankman-Fried (SBF) that was recorded 13 days before the interview was released. During the interview, SBF discussed who he thinks may have hacked FTX and he further denied he had a backdoor installed to funnel […]

On Nov. 29, 2022, the crypto supporter and reporter, Tiffany Fong, published an interview with the former FTX CEO Sam Bankman-Fried (SBF) that was recorded 13 days before the interview was released. During the interview, SBF discussed who he thinks may have hacked FTX and he further denied he had a backdoor installed to funnel […]