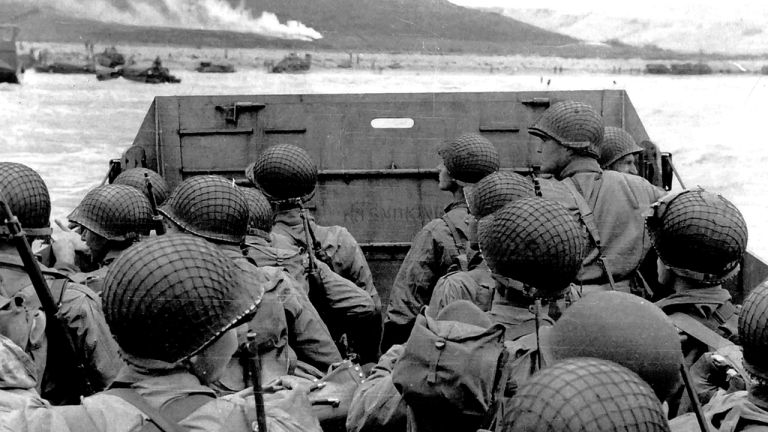

Early Bitcoin pioneers such as Roger Ver navigated legal and financial risks comparable to soldiers “running into machine gunfire,” investor Trace Mayer said in a recent interview, underscoring the high-stakes environment that shaped cryptocurrency’s rise. Bitcoin’s ‘Omaha Beach’: Early Investors Risked Prison to Build Crypto’s Future Mayer, an early bitcoin ( BTC) advocate and investor, […]

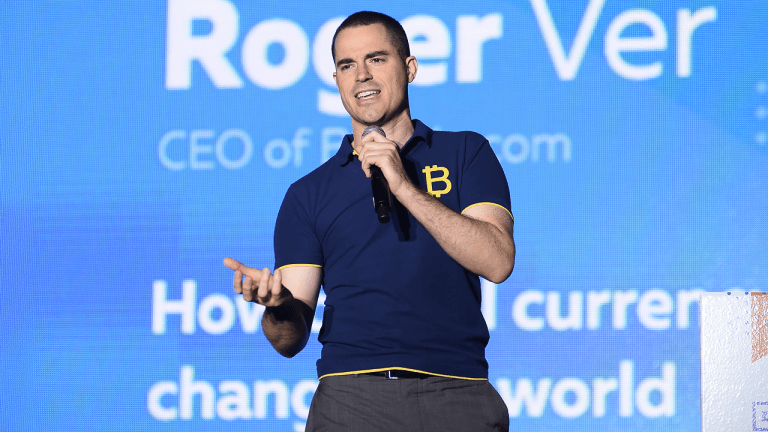

Early Bitcoin pioneers such as Roger Ver navigated legal and financial risks comparable to soldiers “running into machine gunfire,” investor Trace Mayer said in a recent interview, underscoring the high-stakes environment that shaped cryptocurrency’s rise. Bitcoin’s ‘Omaha Beach’: Early Investors Risked Prison to Build Crypto’s Future Mayer, an early bitcoin ( BTC) advocate and investor, […] Bitcoin.com CEO Corbin Fraser revisits Bitcoin Cash’s origin story, the divisions that followed, and how that led him and many others to EVM and DeFi. Big Blocks, Forks, and Internal Drama: The Origin Story of Bitcoin Cash Corbin Fraser, CEO of Bitcoin.com, recently addressed a common misconception within the crypto community regarding the creation of […]

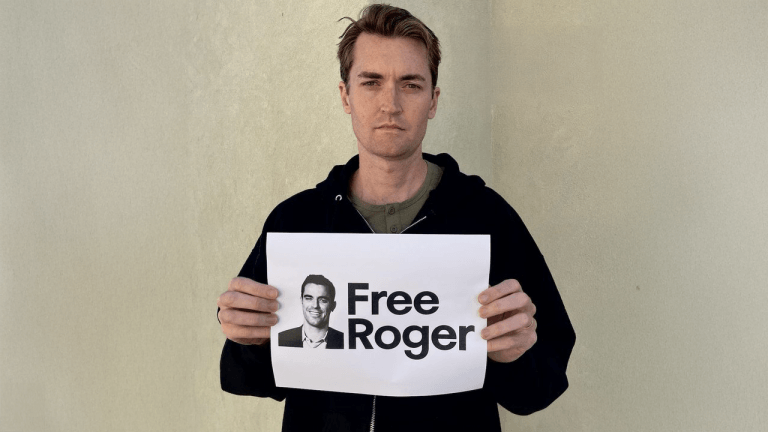

Bitcoin.com CEO Corbin Fraser revisits Bitcoin Cash’s origin story, the divisions that followed, and how that led him and many others to EVM and DeFi. Big Blocks, Forks, and Internal Drama: The Origin Story of Bitcoin Cash Corbin Fraser, CEO of Bitcoin.com, recently addressed a common misconception within the crypto community regarding the creation of […] This week, a chorus of voices has risen in support of Roger Ver, the cryptocurrency pioneer embroiled in an extradition battle with the U.S. over allegations of tax-related offenses. On Sunday, Marla Maples, the second wife of U.S. President Donald Trump, took to X, urging Trump and his team to abandon the legal pursuit against […]

This week, a chorus of voices has risen in support of Roger Ver, the cryptocurrency pioneer embroiled in an extradition battle with the U.S. over allegations of tax-related offenses. On Sunday, Marla Maples, the second wife of U.S. President Donald Trump, took to X, urging Trump and his team to abandon the legal pursuit against […] As bitcoin pioneer Roger Ver battles extradition to the U.S. over tax-related charges, associates globally are spotlighting his anonymous philanthropy, from disaster relief to empowering underserved communities. A Beacon of Generosity: Supporters Highlight Roger Ver’s Global Philanthropic Legacy Roger Ver, the cryptocurrency advocate also known as “Bitcoin Jesus,” faces a potential 100-year prison sentence if […]

As bitcoin pioneer Roger Ver battles extradition to the U.S. over tax-related charges, associates globally are spotlighting his anonymous philanthropy, from disaster relief to empowering underserved communities. A Beacon of Generosity: Supporters Highlight Roger Ver’s Global Philanthropic Legacy Roger Ver, the cryptocurrency advocate also known as “Bitcoin Jesus,” faces a potential 100-year prison sentence if […] Though the Trump administration has softened regulatory oversight targeting select cryptocurrency firms and absolved Ross Ulbricht via a full pardon, many believe that systemic inequities demand further redress. Since Ulbricht’s release, a vocal contingent now highlights the plight of those ensnared within what they term a draconian justice apparatus, urging Trump to extend pardons to […]

Though the Trump administration has softened regulatory oversight targeting select cryptocurrency firms and absolved Ross Ulbricht via a full pardon, many believe that systemic inequities demand further redress. Since Ulbricht’s release, a vocal contingent now highlights the plight of those ensnared within what they term a draconian justice apparatus, urging Trump to extend pardons to […]

Ethereum (ETH) creator Vitalik Buterin says that the US government’s targeting of early Bitcoin (BTC) pioneer Roger Ver is an “absurd” and unreasonable persecution. Ver, an early Bitcoin investor who later decided to support the Bitcoin Cash (BCH) fork, was arrested in Spain in late April of 2024 at the direction of the U.S. Department of […]

The post Vitalik Buterin Calls Charges Against Bitcoin OG Roger Ver ‘Absurd’ and Something To Stand Against appeared first on The Daily Hodl.

Ethereum co-founder Vitalik Buterin on March 1, 2025, criticized Roger Ver’s possible sentence for alleged nonviolent tax offenses, calling the case politically motivated and disproportionate. Ethereum Co-Founder Vitalik Buterin Criticizes Selective Prosecution Against Roger Ver Buterin’s remarks follow a public statement by Silk Road founder Ross Ulbricht, who earlier defended Ver and decried harsh penalties […]

Ethereum co-founder Vitalik Buterin on March 1, 2025, criticized Roger Ver’s possible sentence for alleged nonviolent tax offenses, calling the case politically motivated and disproportionate. Ethereum Co-Founder Vitalik Buterin Criticizes Selective Prosecution Against Roger Ver Buterin’s remarks follow a public statement by Silk Road founder Ross Ulbricht, who earlier defended Ver and decried harsh penalties […] On Thursday, Ross Ulbricht, the founder of the Silk Road, posted on social media expressing that Roger Ver warrants support and that “no one should spend the rest of their life in prison over taxes.” Ross Ulbricht Rallies Support for Roger Ver After regaining his freedom earlier this year, following Donald Trump’s inauguration and the […]

On Thursday, Ross Ulbricht, the founder of the Silk Road, posted on social media expressing that Roger Ver warrants support and that “no one should spend the rest of their life in prison over taxes.” Ross Ulbricht Rallies Support for Roger Ver After regaining his freedom earlier this year, following Donald Trump’s inauguration and the […] Roger Ver, the cryptocurrency pioneer known as “Bitcoin Jesus,” is fighting against what he calls politically motivated lawfare, urging President Donald Trump to intervene as his extradition to the U.S. looms. Roger Ver Calls on Trump to End Political Persecution as Extradition Looms In a recent Coindesk interview, Roger Ver detailed his battle against what […]

Roger Ver, the cryptocurrency pioneer known as “Bitcoin Jesus,” is fighting against what he calls politically motivated lawfare, urging President Donald Trump to intervene as his extradition to the U.S. looms. Roger Ver Calls on Trump to End Political Persecution as Extradition Looms In a recent Coindesk interview, Roger Ver detailed his battle against what […] Roger Ver, an early bitcoin investor and outspoken advocate for financial freedom, recently sat down with Mario Nawfal for a revealing interview about his ongoing legal battle. Roger Ver Speaks: ‘This Isn’t About Taxes It’s About My Political Views’ Roger Ver, who renounced his U.S. citizenship in 2014, faces allegations of tax evasion, charges he […]

Roger Ver, an early bitcoin investor and outspoken advocate for financial freedom, recently sat down with Mario Nawfal for a revealing interview about his ongoing legal battle. Roger Ver Speaks: ‘This Isn’t About Taxes It’s About My Political Views’ Roger Ver, who renounced his U.S. citizenship in 2014, faces allegations of tax evasion, charges he […]