Russia’s central bank now mandates the registration of foreign exchange trade contracts involving digital rights, aiming to enhance oversight, integrate cryptocurrencies, and ensure financial stability. Bank of Russia Tightens Grip on Crypto Deals and Digital Tokens Russia’s central bank, the Bank of Russia, has introduced regulations to manage foreign exchange operations involving digital rights. Digital […]

Russia’s central bank now mandates the registration of foreign exchange trade contracts involving digital rights, aiming to enhance oversight, integrate cryptocurrencies, and ensure financial stability. Bank of Russia Tightens Grip on Crypto Deals and Digital Tokens Russia’s central bank, the Bank of Russia, has introduced regulations to manage foreign exchange operations involving digital rights. Digital […] Russian nationals face charges for allegedly using cryptocurrency mixers to launder proceeds from ransomware, wire fraud, and theft, obscuring illicit funds’ origins, the DOJ says. Russian Nationals Face DOJ Charges for Laundering Cryptocurrency Theft Proceeds The U.S. Department of Justice (DOJ) announced on Jan. 10 the indictment of three Russian nationals for operating cryptocurrency mixers […]

Russian nationals face charges for allegedly using cryptocurrency mixers to launder proceeds from ransomware, wire fraud, and theft, obscuring illicit funds’ origins, the DOJ says. Russian Nationals Face DOJ Charges for Laundering Cryptocurrency Theft Proceeds The U.S. Department of Justice (DOJ) announced on Jan. 10 the indictment of three Russian nationals for operating cryptocurrency mixers […] The Russian government has started selling part of the 1,032 bitcoins seized from former investigator Marat Tambiev, convicted of taking bribes. Russian Authorities Seize Real Estate Belonging to Bribery-Convicted Official The Russian government has reportedly begun selling a portion of over 1,032 bitcoins (BTC) seized from a former investigator, Marat Tambiev, who was convicted of […]

The Russian government has started selling part of the 1,032 bitcoins seized from former investigator Marat Tambiev, convicted of taking bribes. Russian Authorities Seize Real Estate Belonging to Bribery-Convicted Official The Russian government has reportedly begun selling a portion of over 1,032 bitcoins (BTC) seized from a former investigator, Marat Tambiev, who was convicted of […] Russian Telegram users now have more media freedom than Europeans, as EU censorship grows—raising alarms over the future of free expression across digital platforms. Pavel Durov Exposes Media Censorship Divide Between EU and Russia Telegram’s CEO, Pavel Durov, has criticized media restrictions in the European Union, highlighting what he described as greater freedom for Russian […]

Russian Telegram users now have more media freedom than Europeans, as EU censorship grows—raising alarms over the future of free expression across digital platforms. Pavel Durov Exposes Media Censorship Divide Between EU and Russia Telegram’s CEO, Pavel Durov, has criticized media restrictions in the European Union, highlighting what he described as greater freedom for Russian […]

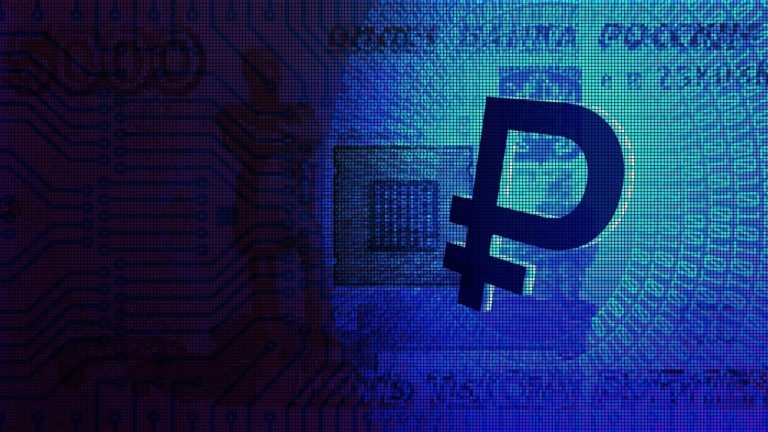

Russia’s largest bank has reportedly joined the country’s digital ruble pilot program ahead of a mid-2025 launch of the central bank digital currency (CBDC). The Russian news agency Interfax reports that Russia’s top financial institution, Sberbank, is now a participant in the program, which conducts transactions with digital rubles. The pilot will eventually involve 22 […]

The post Russia’s Largest Bank Joins Digital Ruble Pilot Program Ahead of 2025 Launch: Report appeared first on The Daily Hodl.

Alexey Zhikharev, director of the Renewable Energy Development Association (REDA), revealed that cryptocurrency mining accounts for almost 1% of Russia’s energy consumption. He stated that as the industry grows, miners will increasingly employ renewable energy sources. Russia’s Cryptocurrency Mining Energy Expenditure Nears 1% of the Nation’s Total The growth in Russia’s cryptocurrency mining industry energy […]

Alexey Zhikharev, director of the Renewable Energy Development Association (REDA), revealed that cryptocurrency mining accounts for almost 1% of Russia’s energy consumption. He stated that as the industry grows, miners will increasingly employ renewable energy sources. Russia’s Cryptocurrency Mining Energy Expenditure Nears 1% of the Nation’s Total The growth in Russia’s cryptocurrency mining industry energy […] Russia is set to make the digital ruble mandatory for banks and large merchants by 2025, pushing widespread adoption through universal QR code payments. Russia Moves to Mandate Digital Ruble for Banks and Merchants A bill has been introduced to Russia’s State Duma that seeks to make the use of the digital ruble, Russia’s central […]

Russia is set to make the digital ruble mandatory for banks and large merchants by 2025, pushing widespread adoption through universal QR code payments. Russia Moves to Mandate Digital Ruble for Banks and Merchants A bill has been introduced to Russia’s State Duma that seeks to make the use of the digital ruble, Russia’s central […] Russia’s largest bank, Sberbank, has joined the expanding digital ruble pilot, signaling stronger momentum as the country advances its central bank digital currency initiative. Russia Expands Digital Ruble Pilot with Key Banking Giants Sberbank, Tbank, and Tochka Bank have officially joined Russia’s digital ruble pilot program, the Central Bank of Russia has revealed through its […]

Russia’s largest bank, Sberbank, has joined the expanding digital ruble pilot, signaling stronger momentum as the country advances its central bank digital currency initiative. Russia Expands Digital Ruble Pilot with Key Banking Giants Sberbank, Tbank, and Tochka Bank have officially joined Russia’s digital ruble pilot program, the Central Bank of Russia has revealed through its […]

This week’s Crypto Biz explores Bitcoin’s landmark year, Crypto.com’s new custody service, Russia’s partial ban on crypto mining and taxes on staking rewards in the US.

Bitcoin has had such a historic year! Nearly 16 years after its network debuted, cryptocurrency solidified its status as a mainstream financial instrument with the approval of 11 exchange-traded funds in January.

The ETFs’ launch marked one of the most successful debuts in history thanks to institutional demand, with Bitcoin-focused funds attracting over $113.5 billion by the end of the year. This influx helped push Bitcoin’s (BTC) price to record highs of $100,000 in December, largely sustained by professional buyers.

The impact was felt across the broader market, with institutional investors leading a rise in over-the-counter (OTC) transactions. Kraken exchange, for instance, has seen a 220% year-over-year increase in its OTC markets. “Long story short, OTC is going gangbusters right now,” reportedly said Tim Ogilvie, head of institutional at Kraken.

Source: CoinGlass

Russia recently enacted a ban on crypto mining operations in 10 regions until 2031, citing high energy consumption issues as the cause. Deputy Prime Minister Alexander Novak stated that this list might expand. Russia Issues Crypto Mining Restrictions in 10 Regions The future of cryptocurrency mining in Russia is in jeopardy. The Russian cabinet recently […]

Russia recently enacted a ban on crypto mining operations in 10 regions until 2031, citing high energy consumption issues as the cause. Deputy Prime Minister Alexander Novak stated that this list might expand. Russia Issues Crypto Mining Restrictions in 10 Regions The future of cryptocurrency mining in Russia is in jeopardy. The Russian cabinet recently […]