On-chain analyst PlanB says that Bitcoin is now on an imminent path that could potentially take BTC to new highs faster than most believe. In a new strategy session, PlanB provides an update on his stock-to-flow (S2F) model for Bitcoin, which aims to forecast the longer-term market cycles based on BTC’s halvings, when miners’ rewards […]

The post PlanB Says Bitcoin Price Explosion to $60,000 Range Imminent As BTC Halving Approaches appeared first on The Daily Hodl.

As the end of 2022 approaches, a great number of bitcoin proponents are questioning whether or not the bottom is in as far as the official end of the crypto winter is concerned. The current bitcoin bear run just entered the longest bottom formation since the 2013-2015 bitcoin bear market. Moreover, analysts note that most […]

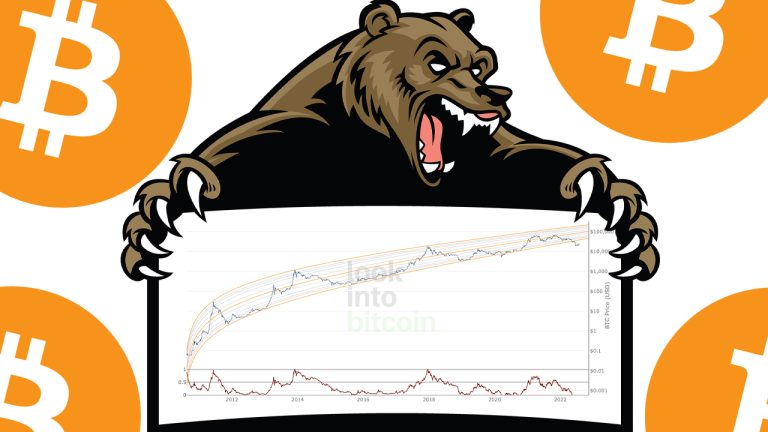

As the end of 2022 approaches, a great number of bitcoin proponents are questioning whether or not the bottom is in as far as the official end of the crypto winter is concerned. The current bitcoin bear run just entered the longest bottom formation since the 2013-2015 bitcoin bear market. Moreover, analysts note that most […] The 2022 bear market has been brutal as more than $2 trillion in value has been wiped away from the crypto economy. In addition to record values lost, the crypto winter has managed to break a number of popular bitcoin price models like the rainbow price chart and Plan B’s infamous stock-to-flow model. Moreover, since […]

The 2022 bear market has been brutal as more than $2 trillion in value has been wiped away from the crypto economy. In addition to record values lost, the crypto winter has managed to break a number of popular bitcoin price models like the rainbow price chart and Plan B’s infamous stock-to-flow model. Moreover, since […]

At least some were buying the dip below $20,000, data shows, while PlanB fields fresh criticism of his stock-to-flow BTC price models.

Bitcoin (BTC) held steady at the June 20 Wall Street open as nervous traders waited for a short-term trend decision.

Data from Cointelegraph Markets Pro and TradingView showed BTC/USD climbing to just shy of $21,000 at the time of writing, a three-day high.

The weekend had spooked the majority of the market and liquidated speculators with a trip to $17,600, marking Bitcoin’s lowest levels since November 2020.

Now, with United States equities cool at the start of the week, comparative calm characterized the largest cryptocurrency.

“Nice reaction off of the bottom of our 16K–20K demand zone,” popular trading account Credible Crypto commented on the weekend’s price action.

“12 hours of bleeding erased in 2. No confirmation this is the reversal yet though. Focus on key HTF levels and don't get too caught up staring at the red 5-minute candles — they can be erased in an instant.”

When in doubt, zoom out

— Crypto Tony (@CryptoTony__) June 20, 2022

The idea of focusing on HTF, or higher timeframe price structures was shared by various commentators as the week began.

“BTC is in a macro bottoming period for this cycle,” fellow trader and analyst Rekt Capital continued.

“Over the next years, investors will be rewarded for buying here. Yet, many still wait for $BTC to go even lower to buy. It's like waiting for Summer to come, and finally it's 33C outside but now we hope for 35C.”

Rekt Capital additionally described a $20,000 BTC price as a “gift” to buyers.

“BTC data science shows that anything below $35,000 is an area that has historically yielded outsized ROI for long-term Bitcoin investors,” part of a tweet on the day read.

On-chain analytics resource Whalemap meanwhile highlighted dip-buying by major investors at levels below the seminal $20,000.

New whale level has formed over the weekend's dump.

— whalemap (@whale_map) June 20, 2022

The accumulation is quite large, >100k BTC, and happened on the 18th of June.

Prior to that, a large portion of Dec 2018 Bitcoins have moved from the previous 4k bottom... Could be OTC

Looks like a great short-term support pic.twitter.com/rJbV26ZifG

Bitcoin heading below its prior halving cycle all-time high, meanwhile, increased pressure on the popular stock-to-flow (S2F) BTC price models — and criticism of them.

Related: 'Worst quarter ever' for stocks — 5 things to know in Bitcoin this week

As market analyst Zack Voell openly called S2F a "scam" on social media, quant analyst PlanB, its creator, maintained that the theory behind it remained sound.

"Most indicators (S2F, RSI, 200WMA, Realized, etc.) are at extreme levels," he explained in part of a Twitter post on June 18.

"Does that mean that all indicators are 'invalidated' 'debunked'? No. Investing is a game of probabilities and indicators give situational awareness: BTC is oversold."

Voell's comments had come after BTC/USD dipped below the second standard deviation band relative to the S2F predicted price for the first time.

Bitcoin isn't dead.

— Zack Voell (@zackvoell) June 19, 2022

But the Stock-to-Flow scam absolutely is. pic.twitter.com/ZYZ0NR8n92

As PlanB noted, Bitcoin's relative strength index, or RSI, was at its lowest level in history over the weekend. A classic overbought vs. oversold indicator, RSI essentially suggests that BTC/USD is trading much lower than its fundamentals warrant, based on historical context.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph.com. Every investment and trading move involves risk, you should conduct your own research when making a decision.

The pseudonymous crypto analyst Plan B says that, barring a black swan event, all the indicators point to a bright future for Bitcoin (BTC) in the coming months. In a YouTube interview with Blockware Intelligence, the quantitative analyst lays out the case for why he thinks numerous Bitcoin metrics look so positive. “At the risk […]

The post Quant Analyst Plan B Says Bitcoin Currently Presenting Best Opportunity for Bulls in Entire History of BTC appeared first on The Daily Hodl.

While there’s been an awful lot of calls for bitcoin to reach six-digits in value in 2021, as the end of the year draws closer, it doesn’t seem like $100K per bitcoin will happen. Bitwise Asset Management’s chief investment officer Matt Hougan told the press on Monday that “$100,000 by the end of the year […]

While there’s been an awful lot of calls for bitcoin to reach six-digits in value in 2021, as the end of the year draws closer, it doesn’t seem like $100K per bitcoin will happen. Bitwise Asset Management’s chief investment officer Matt Hougan told the press on Monday that “$100,000 by the end of the year […]

Will Bitcoin break above six figures before Christmas? PlanB’s Stock-to-Flow model suggests $100,000 BTC could be imminent.

Bitcoin (BTC) has broken into new all-time highs, with the asset last changing hands in the mid $67,000-range.

During the final hour of Nov. 8 UTC time, BTC pushed into uncharted prices, with bulls firmly taking control of the markets as price action retested Oct. 20’s previous high of roughly $67,000.

The milestone comes on a historic date for Bitcoin, with analysts noting that Bitcoin’s market cap pushed above $1 million for the first time on Nov. 8, 2010.

Crypto Twitter appears to be rejoicing over the new all-time high, with many onlookers appearing to read the price-high as restoring their faith in the Stock-to-Flow (S2F) model from the pseudonymous analyst “PlanB” — which has gained significant popularity due to its eerie accuracy in predicting monthly closing prices for BTC.

The model measures the outstanding reserves of a given asset divided by its rate of annual production. PlanB first published their S2F model in March 2019 in a bid to quantify, measure, and predict the scarcity of Bitcoins, then estimating that Bitcoin would reach a market cap of $1 trillion after the May 2020 halving.

Using S2F, PlanB predicted with startling accuracy that Bitcoin would close August near $47,000 and end September near $43,000, while over-estimating October’s closing price by just 3%.

Looking ahead, S2F suggests that Bitcoin will close November above $98,000 and tag $135,000 by the end of the year, with many punters basing predictions that Bitcoin will trade in the six-figure price range before 2022 on PlanB’s outlook for the markets.

Related: Bitcoin hodlers ‘only halfway’ to selling BTC after new $500K price prediction

PlanB also pioneered the Stock-to-Flow Cross-Asset (S2FX) model in April 2020, which seeks to predict how the BTC markets may respond to changes in S2F dynamics based on how gold and silver have performed historically.

Using the S2FX model, PlanB has speculated that this bull cycle could see Bitcoin trade for $288,000 next year, with the analyst stating the markets will need to see “some real fireworks in 2022” for the projection to play out.

As you know S2F model predicts $100K average for this halving period (and based on floor model we reach $100K this yr). But S2FX model predicts $288K average this cycle (we need some real fireworks in 2022 for that). Let's see where this 2nd leg of the bull market will take us pic.twitter.com/ttiNT5yMKe

— PlanB (@100trillionUSD) November 8, 2021

A recent Twitter poll from PlanB found that of 242,000 respondents, 39.8% believe Bitcoin will top out above $100,000 by Christmas, while 31.4% expect BTC to be trading for $288,000, and 23.8% anticipate the markets will fail to break above six-figures by Dec. 25.

$820 million in BTC options expire on Oct. 15, and data signals that bulls are set to celebrate another positive week.

Everyone is talking about a six-figure Bitcoin (BTC) price now that the digital asset has broken out of its multi-month downtrend and confirmed that a bullish trend is in play.

If Bitcoin happens to enter a parabolic move toward $110,000, that would finally match PlanB’s Stock-to-Flow model prediction. According to the pseudonymous analyst, the scarcity and valuation of gold and other precious metals and “Elon Musk’s energy FUD and China’s mining crackdown” are a few of the factors responsible for the past five months of 50% or higher inaccuracy in the model.

Bulls’ hopes mostly cling to an exchange-traded fund being approved by the United States Securities and Exchange Commission. Currently, there are multiple requests pending review between Oct. 18 and Nov. 1, but the regulator could postpone its final decision.

Oct. 15’s $830 million options expiry was largely impacted by the 20% price rally initiated on Oct. 4, which most likely eliminated 92% of the put (sell) options.

The aftermath of China’s mining crackdown was an important event that might have fueled investor sentiment, and research shows the U.S. accounting for 35.4% of the Bitcoin hash rate.

Furthermore, as Cointelegraph reported, the U.S. states of Texas and Ohio are also expected to receive additional large-scale Bitcoin mining centers, which will effectively boost the U.S. crypto market share even higher.

Following last week’s $370 million estimated net profit from the BTC options expiry, bulls had more firepower, and this is evident in this Friday’s $820 million expiry. This advantage explains why the call (buy) options open interest is 43% larger than the neutral-to-bearish put options.

As the above data shows, bears placed $335 million in bets for Friday’s expiry, but it appears that they were caught by surprise, as 92% of the put (sell) options are likely to become worthless.

In other words, if Bitcoin remains above $56,000 on Oct. 15, only $36 million worth of neutral-to-bearish put options will be activated on Friday’s 8:00 am UTC expiry.

Below are the four likeliest scenarios for Oct. 15’s expiry. The imbalance favoring either side represents the theoretical profit. In other words, depending on the expiry price, the quantity of call (buy) and put (sell) contracts becoming active varies:

This raw estimate considers call options being exclusively used in bullish bets and put options in neutral-to-bearish trades. However, investors might have used a more complex strategy that typically involves different expiry dates.

In every scenario, bulls have absolute control of this Friday’s expiry, and there are a handful of reasons for them to keep the price above $56,000. On the other hand, bears need a 7% negative move below $54,000 to avoid a loss of $235 million or higher.

Nevertheless, traders must consider that during bull runs, the amount of effort a seller needs to pressure the price is immense and usually ineffective. Analytics point to a considerable advantage from call (buy) options, fueling even more bullish bets next week.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph. Every investment and trading move involves risk. You should conduct your own research when making a decision.

Bitcoin prices have been better after the second week of September, hovering around $46.5K to $48.5K per unit during the last two days. Meanwhile, bitcoin proponents still believe a significant second-leg up will be happening this year and a recent survey published by Plan B with 123,410 votes shows people believe bitcoin will reach $100K […]

Bitcoin prices have been better after the second week of September, hovering around $46.5K to $48.5K per unit during the last two days. Meanwhile, bitcoin proponents still believe a significant second-leg up will be happening this year and a recent survey published by Plan B with 123,410 votes shows people believe bitcoin will reach $100K […] The price of bitcoin jumped over the $47K handle on Friday afternoon and at 4:15 p.m. (EDT) the price tapped $47,929 per unit. Bitcoin has jumped over 8% today and is more than 45% up over the course of the last month. Bitcoin’s Value Jumped 45% Last Month The crypto economy grew to around $1.99 […]

The price of bitcoin jumped over the $47K handle on Friday afternoon and at 4:15 p.m. (EDT) the price tapped $47,929 per unit. Bitcoin has jumped over 8% today and is more than 45% up over the course of the last month. Bitcoin’s Value Jumped 45% Last Month The crypto economy grew to around $1.99 […]