The government of Palau has taken a major step towards integrating blockchain technology into its economy with the launch of Palau Invest, a digital savings bond platform. This initiative, developed in collaboration with Japan, offers citizens a unique opportunity to invest in national infrastructure projects and boost economic growth. Palau Launches Blockchain-Based Savings Bonds The […]

The government of Palau has taken a major step towards integrating blockchain technology into its economy with the launch of Palau Invest, a digital savings bond platform. This initiative, developed in collaboration with Japan, offers citizens a unique opportunity to invest in national infrastructure projects and boost economic growth. Palau Launches Blockchain-Based Savings Bonds The […]

A massive fund designed to help families save money for college is largely untapped, according to a new report. California’s taxpayer-funded program CalKIDS has allocated hundreds of millions of dollars in college savings funds that are untouched and available, reports the ABC-affiliated news station KXTV. The fund offers at least $175 to Californians born after July […]

The post $621,000,000 Available and Untapped in Massive, Little-Known State Fund for Families: Report appeared first on The Daily Hodl.

Crypto struggles to reach beyond its base. With ETFs now live, financial advisers are key to wider adoption.

Registered investment advisers (RIAs) — the personalized financial planners that manage everyday investors’ portfolios — are now gatekeeping the next phase of crypto’s adoption.

Despite soaring valuations, crypto has struggled to reach beyond its core investor base. Even spot Bitcoin (BTC) and Ether (ETH) exchange-traded funds (ETFs) — which finally launched in the United States in 2024 after years of anticipation — have yet to break the mold. The approximately $60 billion poured into the funds this year has largely come from crypto-native retail investors and hedge funds, several analysts told Cointelegraph.

To reach everyday investors — and vastly enlarge its market — crypto must win over RIAs.

A staggering $1.65 trillion in US savings accounts set aside for retirement is now forgotten, lost and unclaimed, according to a new study. A surge in career changes throughout the so-called “great resignation” has triggered a major rise in lost 401(k) accounts, says the savings consolidation company Capitalize. The firm says the number of forgotten […]

The post $1,650,000,000,000 Sitting in Forgotten and Unclaimed US Savings Accounts – Here’s How To Track It Down appeared first on The Daily Hodl.

Americans have burned through a staggering $1.76 trillion in savings since 2020, according to new consumer data. Stats from the Federal Reserve show Americans reached a peak of $2.3 trillion in savings between 2020 and 2021. Today, that number is down to $533 billion, according to new numbers from the U.S. Department of Commerce and […]

The post $1,760,000,000,000 in Americans’ Savings Burned Since 2020 As Credit Card Debt Hits All-Time High appeared first on The Daily Hodl.

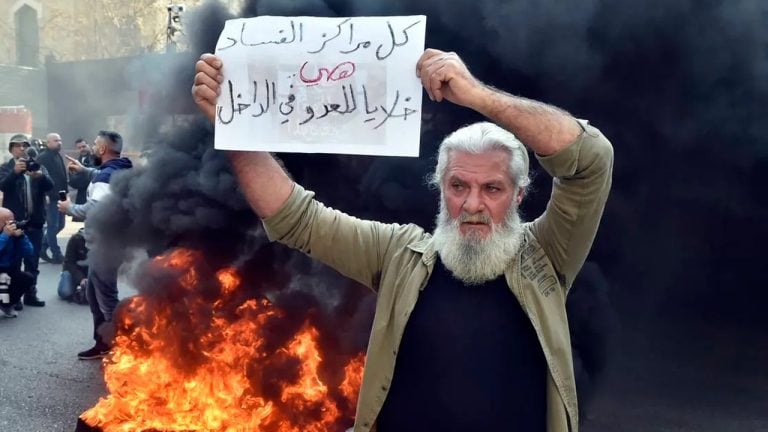

Amid Lebanon’s financial crisis, significant demonstrations have erupted in Beirut targeting financial institutions. Outraged Lebanese depositors, witnessing their savings vanish, have resorted to smashing bank windows, setting fires, and engaging in riots. Simultaneously, leaders of Lebanon’s central bank face grave allegations of fraud, embezzlement, and political corruption. Lebanese Citizens Left Penniless as Financial Institutions Crumble […]

Amid Lebanon’s financial crisis, significant demonstrations have erupted in Beirut targeting financial institutions. Outraged Lebanese depositors, witnessing their savings vanish, have resorted to smashing bank windows, setting fires, and engaging in riots. Simultaneously, leaders of Lebanon’s central bank face grave allegations of fraud, embezzlement, and political corruption. Lebanese Citizens Left Penniless as Financial Institutions Crumble […]

Track your expenses and savings goals using budgeting apps to build your emergency fund.

Building an emergency fund is a crucial part of financial planning. With the help of budgeting apps, it has become easier to save money and build an emergency fund. This article will discuss the characteristics of an emergency fund and general steps to building an emergency fund using budgeting apps.

An emergency fund is a pool of money that you set aside to cover unexpected expenses or income loss. It acts as a financial safety net and can help one avoid debt or financial hardship in case of an emergency. The following traits describe an emergency fund:

Always manage your own money.

— Dave Ramsey (@DaveRamsey) April 27, 2023

You should surround yourself with a team of people smarter than you, but you make the decisions.

Related: How ChatGPT can help with personal finance management

Here are some steps to build an emergency fund using budgeting apps:

Here are a few examples of budgeting apps that can help you build an emergency fund:

With the help of the free budgeting tool Mint, you can keep tabs on your spending, make a budget, and establish savings targets. You can monitor progress toward your savings objectives and set up automatic transfers from your checking account to your savings account. Additionally, Mint provides reminders when budgets become exceeded or when a bill is due, which can save you money by preventing unforeseen expenses.

5. Mint

— Kunjal Kanabar (@kunjalkanabar) May 8, 2023

Personal finance management app to track spending, create budgets and manage bills.https://t.co/Fkmst2H13F

YNAB is a paid budgeting app that assists with creating a budget and tracking expenses. It offers an “Age of Money” feature that predicts how long funds will last. The app encourages assigning every dollar a job, such as allocating money for an emergency fund. Savings goals for the emergency fund can be set and tracked.

PocketGuard is a free budgeting tool that allows users to track their spending and create savings objectives. Users have the option to set up automatic transfers to savings accounts and construct a budget. The app provides alerts for reaching the budget cap and approaching bill due dates. The “In My Pocket” function shows the available money to put into the emergency fund.

Related: 9 Essential finance terms you must know

The free budgeting tool EveryDollar was developed by Dave Ramsey, a personal finance expert. Its feature called “Baby Steps” walks users through the process of creating an emergency fund in addition to allowing users to set and track budgets. EveryDollar also offers information on spending patterns and opportunities for savings to increase the emergency fund.

Personal Capital is a free app that can help track spending, create a budget, and set up savings goals. It also offers tools for investment planning and retirement savings. With Personal Capital, users can see a breakdown of their net worth and set up automatic savings transfers to an emergency fund.

A growing number of banking institutions in Russia are offering customers the option to save in Chinese yuan. The trend coincides with declining demand for U.S. dollar and euro deposits amid currency restrictions that triggered a flight of funds to bank accounts abroad. Demand for Dollar, Euro Accounts Expected to Drop Further, Requests for Yuan […]

A growing number of banking institutions in Russia are offering customers the option to save in Chinese yuan. The trend coincides with declining demand for U.S. dollar and euro deposits amid currency restrictions that triggered a flight of funds to bank accounts abroad. Demand for Dollar, Euro Accounts Expected to Drop Further, Requests for Yuan […]

Set achievable financial objectives and use effective strategies to track progress and achieve success.

Before setting a financial goal, it’s important to have a clear understanding of your current financial situation, including income, debt, expenses and assets. Once you have a clear understanding of your current financial situation, you can start setting financial goals that align with your values and priorities.

Here are six steps to set and achieve your financial goals.

Set both short- and long-term financial goals as your first step. Your objectives should be specific, measurable, achievable, relevant and time-bound (SMART). One’s short-term objectives might be, for instance, saving $500 for an emergency fund or paying off $1,000 in credit card debt within the next six months, while their long-term objectives might be setting aside $10,000 for a down payment on a home or investing $100,000 for retirement within the following 10 years.

In crypto it’s important to have SMART goals.

— mBMN.eth (@m_BMN_) July 4, 2022

After that, make a good game plan, take action, re-evaluate and assess your progress.

It may seem simple, but only a focused and perseverant mind will get it done.

Similarly, in terms of crypto, one’s short-term objectives might be to purchase a specific quantity of Bitcoin (BTC) or Ether (ETH) within the next three months, whereas their long-term objectives might be to hold a specific quantity of a particular cryptocurrency for an extended period of time.

Create a strategy to achieve your goals after you’ve defined them. This strategy should outline the precise steps you’ll take to accomplish your objectives. For instance, if your goal is to buy a certain amount of BTC within the next three months, your plan may include researching and choosing a reputable crypto exchange, setting up a crypto wallet and regularly monitoring the price of Bitcoin to make an informed purchase.

To determine whether you are on track to achieving your financial objectives, monitor your progress frequently. This will assist you in identifying any areas where your plan might need to be modified.

Staying disciplined is crucial when it comes to achieving financial goals. Stick to your plan and avoid any unnecessary spending that could derail your progress.

Be prepared to adjust your plan if necessary. Because life can be erratic and unforeseen costs occasionally appear, you might need to modify your plan.

When you reach your financial objectives, congratulate yourself on a job well done. This will encourage you to keep striving for your upcoming objective.

Related: Why do we need cryptocurrencies?

Here are some strategies for setting financial goals using cryptocurrencies:

Related: How to build a crypto portfolio without spending any money or time trading

Being a #??? maxi is like putting all your eggs in one basket, then jumping up and down with excitement every time the basket moves. Remember, diversity is the key to success in any investment strategy. #Cryptocurrency #Investing #blockchain #crypto

— ᙢinus ᙡells (@MinusWells) February 20, 2023

Before investing in cryptocurrencies, it is essential to understand the risks involved and make informed decisions based on your risk tolerance and investment goals. Precaution is necessary with any investment asset, including cryptocurrencies, because investments always carry some degree of risk. Assessment helps investors minimize potential losses and maximize returns.

According to Lynette Zang, chief market analyst at ITM Trading, U.S. banks have the legal authority to confiscate people’s funds due to legislation passed by Congress. In a recent interview, Zang discussed how the purchasing power of the U.S. dollar has dwindled to “roughly three cents,” her belief that central bank digital currencies (CBDCs) will […]

According to Lynette Zang, chief market analyst at ITM Trading, U.S. banks have the legal authority to confiscate people’s funds due to legislation passed by Congress. In a recent interview, Zang discussed how the purchasing power of the U.S. dollar has dwindled to “roughly three cents,” her belief that central bank digital currencies (CBDCs) will […]