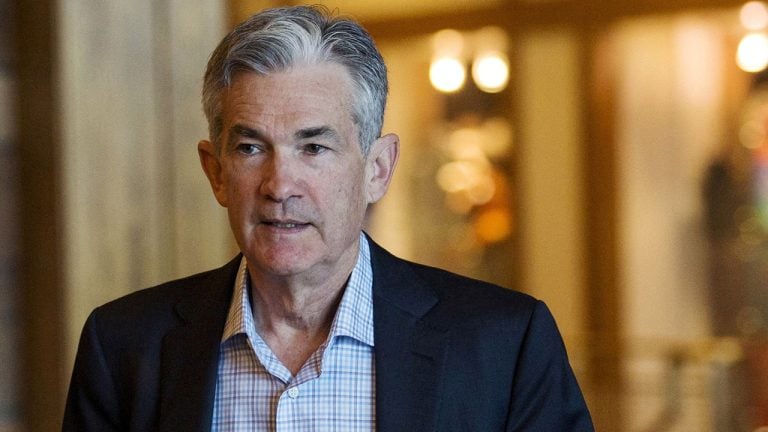

Legendary investor Charlie Munger may have once called Bitcoin “rat poison squared” — but that doesn't mean crypto traders should ignore his years of investing wisdom.

Legendary investor and billionaire Charlie Munger, known as the right-hand man of Warren Buffet who helped build investment powerhouse Berkshire Hathaway, has passed away at 99 years of age.

Munger’s family informed Berkshire “that he peacefully died this morning at a California hospital,” according to a company announcement on Nov. 28.

Munger, who served as vice chairman at Buffet’s empire since 1978, accumulated a net worth of $2.6 billion and was routinely praised for adopting a sound investment and stock-picking philosophy throughout his tenure at Berkshire.

While Bitcoin and cryptocurrencies weren’t favored investments for Munger and Buffet, who once referred to Bitcoin (BTC) as “rat poison” and “rat poison squared,” crypto traders could still benefit from Munger’s learnings over his 60 years of investing experience. Here are some approaches to investment that Munger swore by:

Only invest in what you know

Munger said Berkshire Hathaway would often categorize stocks into one of three baskets when evaluating a potential investment.

“We have three baskets for investing: yes, no, and too tough to understand.”

The latter could explain why Munger and Buffet never invested in Bitcoin and cryptocurrencies, but the takeaway message is that they avoided investing in what they didn’t know.

Buffet has previously admitted he and Munger — both regarded as tech skeptics — were “too dumb to realize” the potential of Amazon’s e-commerce business in the 1990s and underestimated the company’s founder, Jeff Bezos.

Berkshire didn’t invest in Microsoft or Google either. “We blew it,” Munger once said, reflecting on the firm’s decision not to invest in Google.

Despite that, Berkshire stuck to the sectors it knew inside out, such as the banking and food and beverage sectors, making huge profits from investments in Bank of America, American Express, Coca-Cola Co, and later Apple after initially deciding not to invest in it.

Charlie Munger’s formula for success is simple and perfect:

— John LeFevre (@JohnLeFevre) November 28, 2023

- Spend less than you earn

- Invest prudently

- Avoid toxic people and toxic activities

- Defer gratification

- Never stop learning pic.twitter.com/8IiJNngsdg

Munger and Buffet also mastered the art of valuation by interrogating a firm’s balance sheet before making an investment decision, which Munger once said is the only intelligent way to invest.

“All intelligent investing is value investing [...] You must value the business in order to value the stock.”

While blockchains and protocols can’t often be valued via a discounted cash flow model or other traditional methods, plenty of insights can be obtained from on-chain data — from the number of daily active users and transaction volumes to total value locked (relative to market cap) and net inflows and outflows, to name a few.

Temperament, not IQ, is a bigger contributor to investment success

Munger was never been one to dive headfirst into a new trend, preferring to stay on the more conservative side of investing.

He’s previously said many “high IQ” people are terrible investors because they have terrible temperaments. “Great investors,” on the other hand, tread with caution and think things through:

"The great investors are always very careful. They think things through. They take their time. They're calm. They're not in a hurry. They don't get excited. They just go after the facts, and they figure out the value. And that's what we try to do."

“You need to keep raw irrational emotion under control,” Munger said in another comment.

Related: Bitcoin is a ‘disgusting’ product that comes ‘out of thin air,’ says Charlie Munger

Having been in the investment arena for over 60 years, Munger says patience is also of great importance when accumulating wealth.

“The big money is not in the buying or the selling, but in the waiting.”

Build conviction and stomach volatility

Munger has seen Berkshire’s investment portfolio dip several times over the decades, such as the Black Monday crash in 1987, the financial crisis in 2007-2008 and most recently, the COVID-19 pandemic.

He once stressed that long-term investors must learn to stand by their investments when unfavorable macroeconomic conditions trigger market downfalls:

"If you're not willing to react with equanimity to a market price decline of 50% two or three times a century, you're not fit to be a common shareholder and you deserve the mediocre result you're going to get."

“There are going to be periods when there’s a lot of agony and other periods when there’s a boom,” Munger said in a separate comment. “You just have to learn to live through them.”

Charlie Munger has passed away.

— Pomp (@APompliano) November 28, 2023

RIP to a legend

Munger was born on Jan. 1, 1924 — meaning he passed away 34 days shy of his 100th birthday.

"Berkshire Hathaway could not have been built to its present status without Charlie's inspiration, wisdom and participation," Buffett said in a statement.

Magazine: This is your brain on crypto: Substance abuse grows among crypto traders