The Blockchain Integrity Act, a piece of legislation that seeks to put a 2-year moratorium on using cryptocurrency mixers, was introduced by U.S. Congressman Sean Casten on March 7 in the U.S. House of Representatives. Co-sponsored by Reps. Bill Foster, Brad Sherman, and Emanuel Cleaver, the bill proposes to conduct a study on the issue […]

The Blockchain Integrity Act, a piece of legislation that seeks to put a 2-year moratorium on using cryptocurrency mixers, was introduced by U.S. Congressman Sean Casten on March 7 in the U.S. House of Representatives. Co-sponsored by Reps. Bill Foster, Brad Sherman, and Emanuel Cleaver, the bill proposes to conduct a study on the issue […]

A Republican Congressman has reportedly been indicted for his alleged role in a fraudulent “Nigerian Prince” crypto scam. According to a new report by The New York Times, George Santos, a U.S. Representative of New York, has been charged for allegedly perpetrating a scheme that resembles the classic Nigerian Prince email fraud. The report says […]

The post Republican Congressman Indicted for Role in ‘Nigerian Prince’ Fraudulent Crypto Scheme: The New York Times appeared first on The Daily Hodl.

Jamie Dimon, CEO of JPMorgan, stated that he favored abolishing the debt limit, giving the government the faculties to extend its debt without congressional action. Dimon also stated that even the drama surrounding the build-up to extending or not extending the debt limit could cause panic, as the U.S. economy is foundational for the world. […]

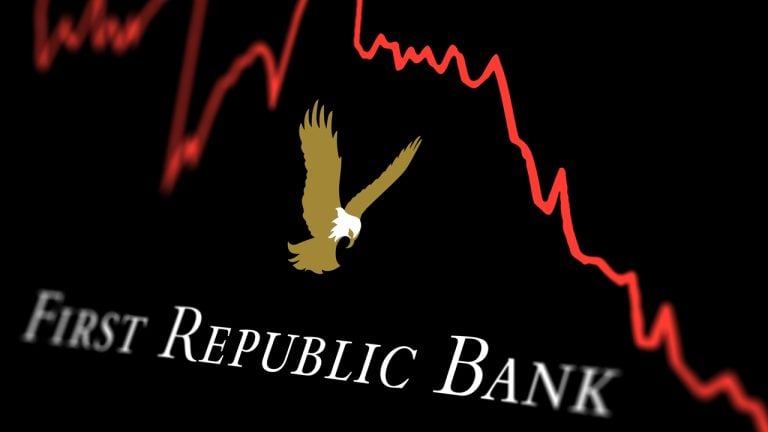

Jamie Dimon, CEO of JPMorgan, stated that he favored abolishing the debt limit, giving the government the faculties to extend its debt without congressional action. Dimon also stated that even the drama surrounding the build-up to extending or not extending the debt limit could cause panic, as the U.S. economy is foundational for the world. […] After the second largest bank failure in history, the U.S. Securities and Exchange Commission (SEC) is reportedly investigating First Republic Bank executives for allegedly engaging in insider trading. Two sources have claimed that the securities regulator is scrutinizing the bank’s executives for making trades using confidential information. Although the sources have not named any specific […]

After the second largest bank failure in history, the U.S. Securities and Exchange Commission (SEC) is reportedly investigating First Republic Bank executives for allegedly engaging in insider trading. Two sources have claimed that the securities regulator is scrutinizing the bank’s executives for making trades using confidential information. Although the sources have not named any specific […]

The “work has been done” for stablecoin regulation in the U.S., but many in Washington D.C. are feeling “burned” and “betrayed” over the FTX collapse last year.

The United States Congress needs to take control of crypto legislation and make it a more “open process” where the entire marketplace is looked at “comprehensively,” suggests Kristin Smith, CEO of the Blockchain Association — a prominent U.S. crypto industry nonprofit.

In a Feb. 22 Bloomberg interview, Smith said the industry needs U.S. lawmakers to lead crypto legislation despite it making the process “very slow,” with regulators “stepping in” in the interim.

Smith noted that despite regulators “moving very quickly,” progress on legislation is happening “behind closed doors,” suggesting it’s vital for more industry involvement in an “open process,” which would involve Congress.

Smith believes the issue with regulators leading legislation with enforcement actions and settlements relates to “very specific facts and circumstances.”

She explained it’s a difficult position for Congress at the moment, as many in Washington D.C. who “were close” to former FTX CEO Sam Bankman-Fried and FTX feel “burned” and “betrayed” over the collapse of the cryptocurrency exchange in November 2022.

Smith is hopeful that stablecoin regulation will soon happen in the U.S., saying Congress has been looking at it “since 2019” and the “work has been done.” She said it “came close” to happening last year before the collapse of FTX.

Related: FTX poked the bear and the bear is pissed — O’Leary on the crypto crackdown

She added that crypto risks are different from traditional financial services, so regulators must spend more time looking at market regulation and “tailor to those risks.”

Smith suggested that stablecoin and “market side” regulation should be a higher priority than focusing on legislating crypto-related criminal activity, saying that public ledgers make it “much more transparent” than we see in the traditional financial system.

This comes after the Blockchain Association’s chief policy officer, Jake Chervinsky, took to Twitter on Feb. 15, stating that no matter how many enforcement actions the Securities and Exchange Commission and Commodity Futures Trading Commission bring, they are “bound by legal reality,” adding that “neither” has the authority to “comprehensively regulate crypto.”

U.S. financial regulators will now work together to create modalities for clear-cut crypto regulations in America.

The U.S. House of Representatives on Tuesday passed H.R. 1602 — the Eliminate Barriers to Innovation Act — introduced by Congressman Patrick McHenry (R-NC).

H.R. 1602 was among six bipartisan financial services-related bills passed by Congress on Tuesday with the McHenry-sponsored legislation focusing on regulatory clarity for cryptocurrencies.

Introduced back in March, the bill seeks to clarify the roles of agencies like the Securities and Exchange Commission and the Commodity Futures Trading Commission in the policing of cryptocurrencies in the U.S.

The bill also seeks to answer the ongoing debate of whether crypto tokens are securities or commodities.

Addressing the floor of the House during the passage of the bill, Representative McHenry remarked:

“[This bill] requires the Securities and Exchange Commission and the Commodity Futures Trading Commission to establish a working group focused on digital assets. This is the first step in opening up the dialogue between our regulators and market participants and move to needed clarity.”

#BREAKING: The House just passed 6 bipartisan Financial Services bills, including Ranking Member @PatrickMcHenry’s Eliminate Barriers to Innovation Act.

— Financial Services GOP (@FinancialCmte) April 20, 2021

Learn more: https://t.co/jYrqQbSxXf

Watch the Ranking Member’s remarks pic.twitter.com/BAAyEf91qy

Following the approval of the bill, Congress now has 90 days to establish the working group among participants from the SEC, CFTC, and the private sector.

The private sector participants will draw from fintech and financial services companies as well as small and medium scale enterprises and academia.

Once constituted, the working group will have a year to issue a report analyzing the current crypto regulatory climate. The panel’s work will also focus on matters like crypto custody, cybersecurity, private key management, and investor protection concerns.

The patchwork nature of crypto regulations in the U.S. continues to be a source of some frustration among industry stakeholders in the country. Some industry insiders have argued that the U.S. was at risk of losing ground in the emerging digital economy due to the lack of regulatory clarity for digital assets.

Earlier in April, Goldman Sachs CEO David Solomon predicted a big evolution for crypto regulations in the U.S.