$160K at next halving? Model counts down to new Bitcoin all-time high

A bold prediction states that BTC price can gain 500% between now and April 2024.

Bitcoin (BTC) price action may lack momentum this month, but one popular analyst is still eyeing new all-time highs.

In his latest analysis, TechDev confirmed that he believes BTC/USD will see a “parabolic top” around the 2024 block subsidy halving.

Can Bitcoin p gain 500% in a year?

Less than twelve months away, Bitcoin’s next halving is already the topic of debate among market participants.

Some argue that the event will lay the foundations for the next all-time high, in line with previous halving cycles.

For TechDev, however, the new BTC price record should come sooner rather later — specifically, in Q2 next year.

The idea was originally covered in a Market Update blog post earlier in May. This week, meanwhile, it was described as his “primary time-based idea.”

A chart uploaded to Twitter showed the path to the Q2 top dotted with resistance lines — Fibonacci retracement levels and the current all-time high from 2021.

Ultimately, BTC/USD should top out at around $160,000, it predicts.

TechDev additionally updated a log scale BTC price prediction which he nonetheless acknowledged was unlikely to come true.

“Not a forecast. Not a prediction. Not even my primary idea,” a prior update from August 2022 stated.

Formed using a simple log curve, the idea puts BTC/USD at a similar price level, but sooner — by the end of 2023.

Update: #Bitcoin on adjusted log time

Time = log(weeks)^3.44

Next period meets curve at 160-180K December 2023.

Observation based on a sample of 2. pic.twitter.com/GH3zjEsdti

— TechDev (@TechDev_52) May 23, 2023

Short-term bullish takes absent

How Bitcoin will behave for the rest of 2023 in the run-up to the halving continues to divide opinion.

Related: Bitcoin Halving: How it works and Why it matters

As Cointelegraph reported, some market participants expect a deeper price correction, with veteran analyst Philip Swift not discounting the chance of a return to $20,000 in the coming months.

After weeks of cooling, few voices are betting on the kind of upside seen in Q1 to make a comeback in the short term.

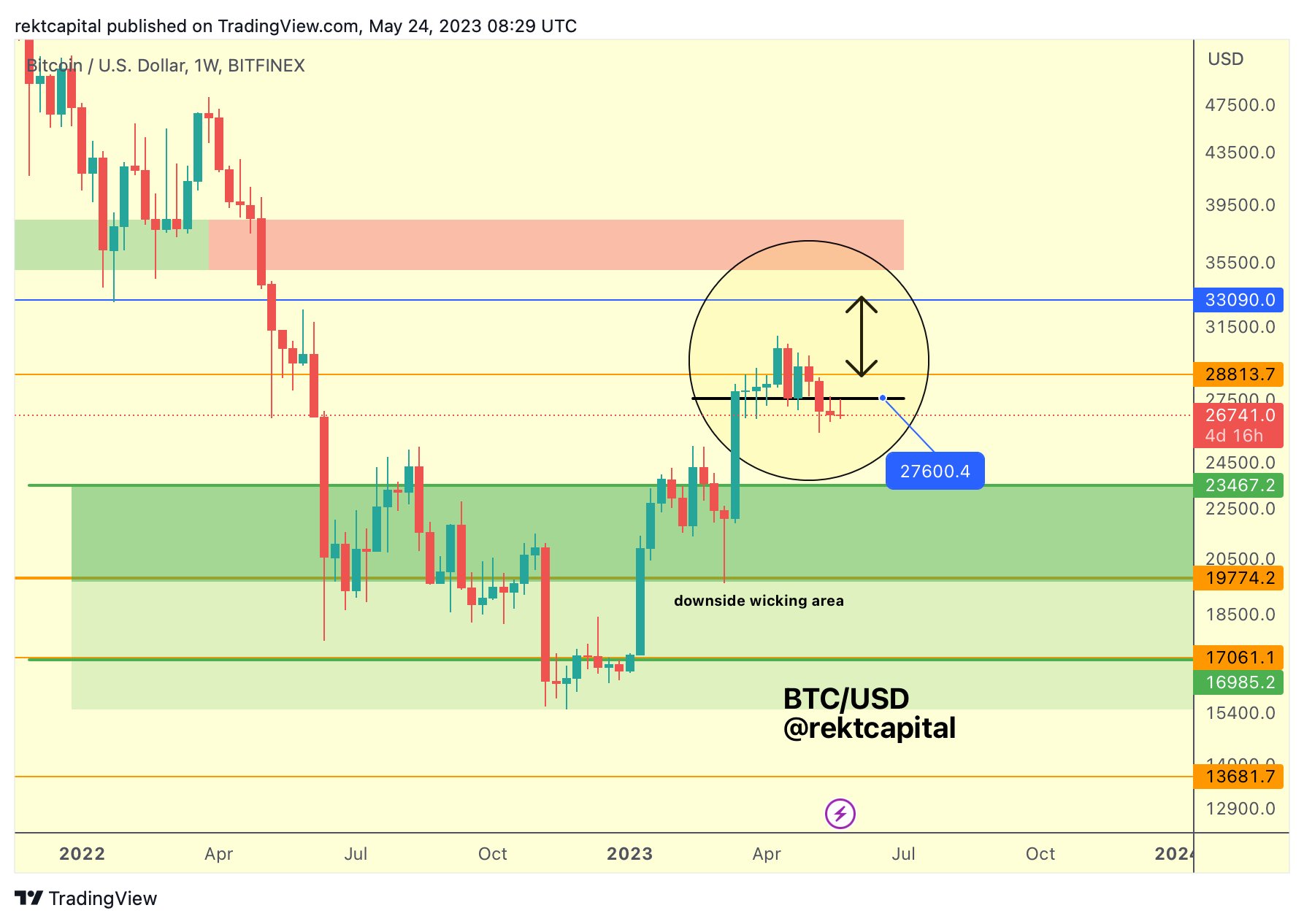

In ongoing research, popular trader and analyst Rekt Capital reiterated that Bitcoin was failing to keep hold of support levels required for upward continuation.

“BTC continues to reject from ~$27600. Weeks ago, this level was decisively lost as support. And for the past 2 weeks – it is a firm resistance,” he tweeted on May 24.

“$BTC is technically positioned for downside. If BTC cannot reclaim $27600 as support soon, BTC will go lower in time.”

An accompanying chart showed BTC/USD behavior on weekly timeframes.

Magazine: Alameda’s $38B IRS bill, Do Kwon kicked in the assets, Milady frenzy: Asia Express

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Go to Source

Author: William Suberg