4 years in, MicroStrategy’s Bitcoin gamble beats Warren Buffett’s warning

MicroStrategy’s stock value is up by 1,000% since its first Bitcoin purchase, while Warren Buffett and Berkshire Hathaway have missed the boat.

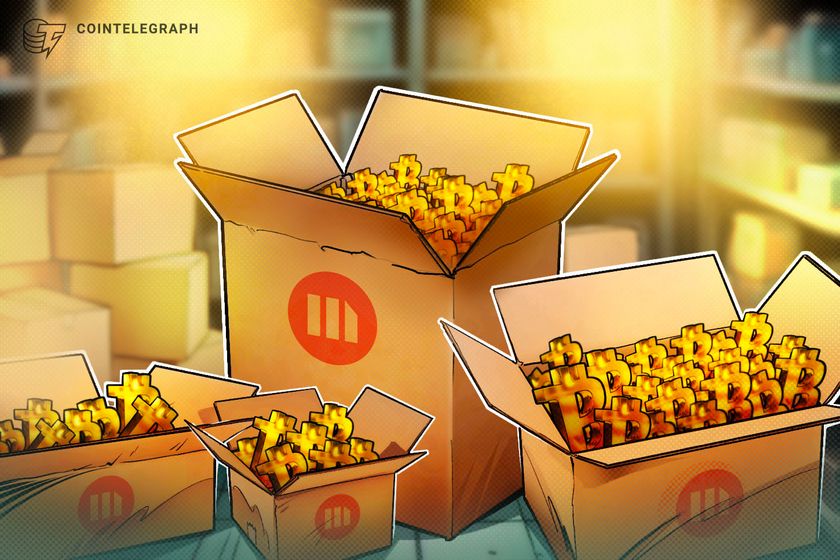

MicroStrategy purchased its first Bitcoin (BTC) stash on Aug. 10, 2020, becoming the first public-traded company to adopt the cryptocurrency as its primary treasury reserve asset. Four years later, the bold move has evolved into a defining strategy for the company that has outpaced even the returns of Warren Buffett’s Berkshire Hathaway.

As of Aug. 10, 2024, MicroStrategy had 226,500 BTC worth $13.771 billion in reserves, which it acquired at an average cost of around $37,000. With Bitcoin currently trading at approximately $60,500, MicroStrategy is now sitting on unrealized profits of about $5.39 billion.

Despite the substantial gains, Michael Saylor’s company has maintained its Bitcoin holdings, choosing not to liquidate any of its accumulated assets. It has expressed its intention to continue accumulating Bitcoin, further evidenced by its most recent purchase on Aug. 1.

Go to Source

Author: Yashu Gola

Related posts:

- Warren Buffett invests $1B in Bitcoin-friendly neobank, dumps Visa and Mastercard stocks

- Warren Buffett’s ‘crypto stock’ beats Apple and Amazon — but not Bitcoin

- Warren Buffett was wrong about a ‘rat poison’ Bitcoin portfolio, data shows

- Bitcoin centralized by corporate giants should not be feared – Michael Saylor