Bitcoin’s BRC20 Token Economy Skyrockets 192% to $279 Million in Just Four Days

Four days ago, the market capitalization of all the BRC20 tokens built on top of the Bitcoin network was a modest $95 million. However, over the past four days, the BRC20 market valuation has seen tremendous growth, increasing by 192% and reaching $279 million.

More Than 13,000 BRC20 Tokens Built on Bitcoin Are Now Worth $279M

The BRC20 token standard, which is built on top of the Bitcoin network, is gaining momentum and the BRC20 token economy is flourishing. As of Sunday, May 7, 2023, the BRC20 token economy is valued at $279.07 million, with approximately 13,530 tokens in circulation. This marks a significant increase from just four days ago when the BRC20 token market capitalization was $95 million and there were around 10,487 BRC20 tokens.

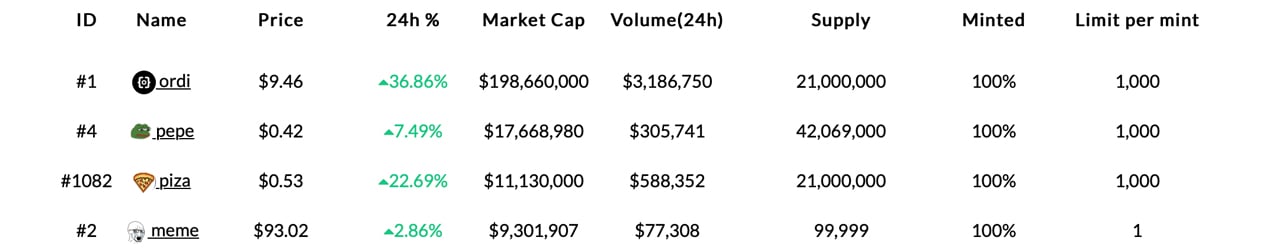

The top ten most valuable BRC20 tokens today are ordi, pepe, piza, meme, moon, punk, domo, oshi, xing, and shib. Ordi is currently the most valuable BRC20 coin, with a single ordi token exchanging hands for $9.46. With a market valuation of $200 million, ordi dominates the entire BRC20 token market capitalization by more than 71%.

Pepe, another BRC20 coin (not to be confused with the ERC20 meme coin with the same name), has a market capitalization of around $17.6 million. The top five BRC20 token market valuations, which include ordi, pepe, piza, meme, and moon, account for 86.55% of the $279.07 million total. Not only is ordi the top BRC20 coin in terms of market capitalization, but it has also generated $3.1 million in 24-hour trade volume.

As of May 7, 2023, Dune Analytics recorded 3.11 million BRC20 transactions. Bitcoin miners have earned 214 bitcoin (BTC), which is equivalent to $6.2 million, from the BRC20 ecosystem. While creators of these tokens have implemented various supply caps, data from brc-20.io reveals that out of the top 118 BRC20 tokens by market cap, 80 of them have opted for a max supply of 21 million.

What do you think the future holds for the BRC20 token economy? Share your thoughts in the comments section below.

Go to Source

Author: Jamie Redman