Liquid staking claims top spot in DeFi: Binance report

A Binance spokesperson highlighted that there are things to be wary of when liquid staking, including smart contract vulnerabilities, slashing risks and price fluctuations.

Liquid staking is a decentralized finance (DeFi) subsector that lets users earn yield by staking their tokens without losing their liquidity. It has become the biggest DeFi sector in terms of total value locked (TVL), according to crypto exchange Binance’s Half-Year Report 2023.

Within the report, the crypto exchange highlighted that liquid staking had dethroned decentralized exchanges (DEXs) as the top-ranking DeFi category by TVL as of April 2023.

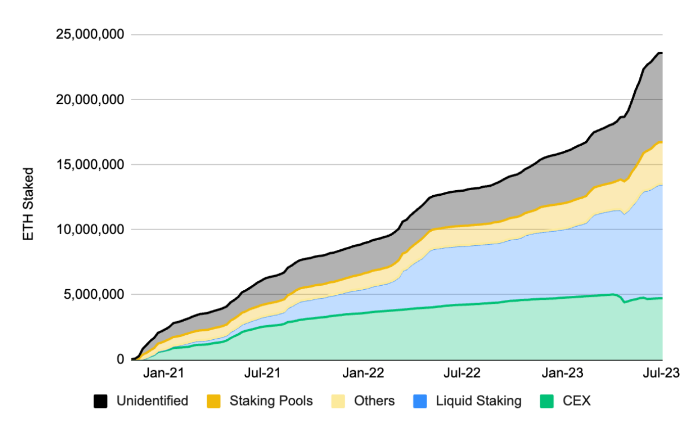

The staking mechanism was a crucial part of staking Ether (ETH) before the Ethereum Shanghai upgrade when users were unable to freely unstake their ETH. By then, liquid staking tokens (LSTs) provided users with liquidity while they earned yield with their ETH.

On April 13, the Shanghai update went live on the Ethereum mainnet, allowing users to withdraw their staked ETH. Despite this, the report said that liquid staking still continued to grow. “Interestingly, growth continues to be extremely strong post-Shanghai, with liquid staking being the most common way for users to stake ETH,” Binance wrote.

Related: Rapid growth in DeFi-focused Ethereum liquid staking derivatives platforms raises eyebrows

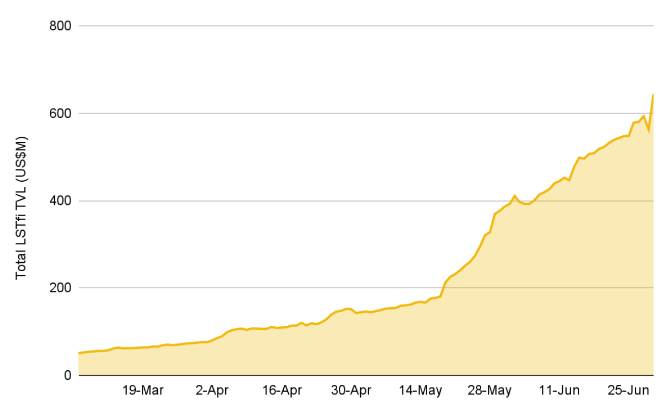

In addition, the Binance report also noted the emergence of the term “LSTfi,” which is also sometimes called “LSDfi.“ The term combines liquid staking and DeFi, with projects like yield-trading protocols, indexing services, and projects allowing users to mint stablecoins using LSTs as collateral categorized as LSTfi protocols.

According to the report, the market is relatively concentrated on the top protocols during its early stages. However, Binance predicted this will change as more new projects emerge under this category in the near future.

While liquid staking has become popular of late, users still need to be mindful of some aspects. In a statement, a Binance spokesperson told Cointelegraph that users need to be wary of some risks associated with liquid staking. This includes exposure to smart contract vulnerabilities, slashing risks and price risks. They explained:

“Liquid staking involves users interacting with an additional layer of smart contract, which might expose them to the potential of bugs in the smart contracts used by liquid staking protocols. Therefore, it is important that users do their own research.”

In addition, the Binance spokesperson said that validators who fail to perform their duties get penalized by having some of their staked assets “slashed.” This means that users must be wary and make sure that they don’t stake through a penalized validator. This will help them avoid losses. “It’s important for users to choose protocols that diversify staked assets across a range of reputable node operators,” they said.

Lastly, users must be wary of price risks. According to Binance, users can potentially get a mismatch between the LST and the underlying token due to market price fluctuation. This could also happen due to various reasons, including smart contract issues.

Despite the positive growth of the liquid staking subsector, the DeFi sector generally performed worse than the global crypto market. According to the report, even though DeFi unlocked new use cases, the space’s dominance saw a 0.5% decline against the broader crypto space.

Collect this article as an NFT to preserve this moment in history and show your support for independent journalism in the crypto space.

Magazine: How smart people invest in dumb memecoins: 3-point plan for success

Go to Source

Author: Ezra Reguerra