UK crypto businesses to comply with FATF Travel Rule beginning in September

The U.K. passed legislation in 2022 to make it one of the few countries in compliance with the extension of the Travel Rule to crypto.

Crypto asset businesses in the United Kingdom will be required to comply with Financial Action Task Force (FATF) Anti-Money Laundering and Counter-Terrorist Financing rules, known collectively as the Travel Rule, beginning Sept. 1, a statement from the Financial Conduct Authority (FCA) reiterated Aug. 17. This will bring the U.K. into conformity with FATF standards set in 2019.

The Travel Rule requires virtual asset service providers (VASPs) to share customer information when making transfers to help identify suspicious transactions. The U.K. passed legislation to begin enforcing the Travel Rule in July 2022.

Related: PayPal UK to halt Bitcoin purchases until early 2024

U.K. crypto businesses will be expected to implement the Travel Rule fully by Sept. 1 when sending or receiving crypto assets in the U.K. or jurisdictions that have already implemented the rule. Businesses will be responsible for compliance when using third-party vendors as well.

The Travel Rule is designed to bring greater transparency to cryptoasset transfers, making it harder for criminals to use #crypto for illegal activity.https://t.co/kmB6rgMn5e

— Financial Conduct Authority (@TheFCA) August 17, 2023

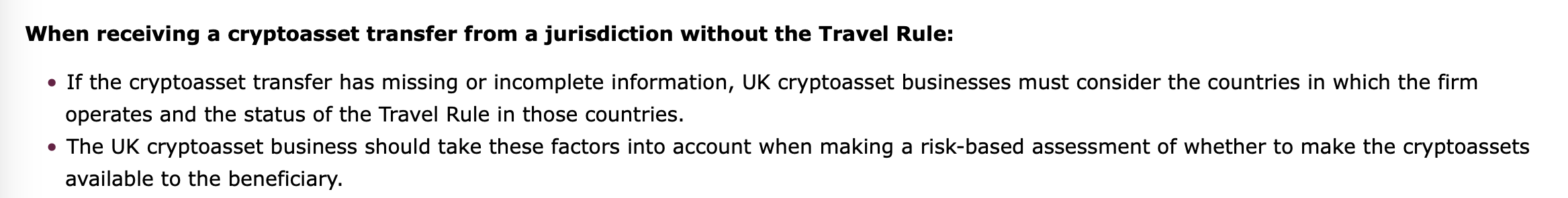

When transacting with VASPs in jurisdictions that have not implemented the Travel Rule, the originating U.K. business must take steps to determine if the recipient is capable of receiving the required information in any way and to collect and store the information in any case. When a U.K. crypto business is the recipient of a transfer, it will be required to use discretion:

The FATF, an intergovernmental task force established by the G7 in 1989, created the Travel Rule in 2012 for traditional financial institutions and extended the rule to VASPs in 2019. It has reported limited progress with its implementation, saying in June that less than half of the countries it had surveyed had taken any steps to implement the rule. A survey conducted in 2022 found that 29 of 98 countries had passed legislation on the rule, but only 11 were enforcing it.

Crypto asset businesses in the U.K. are facing a growing number of regulatory requirements. New FCA marketing standards come into force in October. The FCA published a consultative paper on comprehensive crypto regulation in February.

Magazine: Should we ban ransomware payments? It’s an attractive but dangerous idea

Go to Source

Author: Derek Andersen