Bitcoin bulls keep pressure on $28K while calls for BTC price dip grow

Bitcoin is being treated with suspicion on short timeframes, with repeated pushes into resistance met with rejection.

Bitcoin (BTC) eased volatility into Oct. 6 as BTC price downside preparations returned.

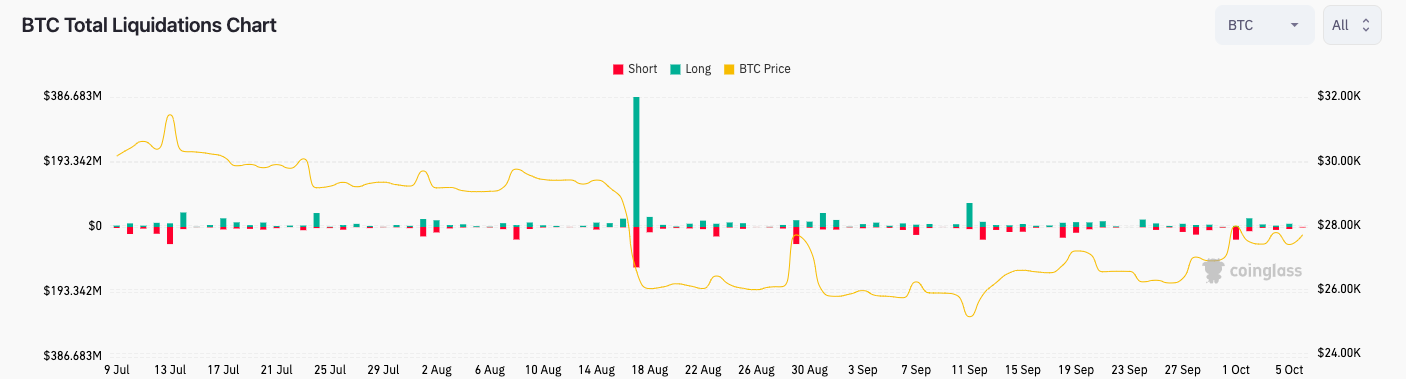

Bitcoin keeps liquidations limited amid long, short “squeeze”

Data from Cointelegraph Markets Pro and TradingView covered a flatter 24 hours for BTC/USD after a failed retest of $28,000.

After lingering in a narrow range around 1.5% lower, the largest cryptocurrency was again pushing toward the $28,000 mark ahead of the Wall Street open, yet fielded fresh concerns from market participants over potential losses to come.

I remain just in my long from $26,000 for now, but will be closing that and entering a short if we lose $27,200 support below us. Alerts are set and i am on standby pic.twitter.com/mcS9Zcp5zN

— Crypto Tony (@CryptoTony__) October 6, 2023

Popular trader Daan Crypto Trades eyed an ongoing tussle between two key moving averages (MAs) on one-day timeframes.

“Whether the Daily 200MA (Purple) or the Daily 200EMA (Blue) gives in first, will likely determine the trend for the rest of October if I had to guess,” he wrote alongside a chart in an X post on Oct. 4.

“$27K & $28K. The battle continues.”

Daan Crypto Trades subsequently flagged increasing open interest (OI) across exchanges, this apt to cause a squeeze of shorts followed by longs, respectively.

“This has usually been a short squeeze (up) into long squeeze (back down). We saw this yesterday again. Good to keep an eye on this region,” he suggested.

#Bitcoin Open Interest hit the 8.7-9.1B region again where we’ve recently seen a lot of squeezes occur.

This has usually been a short squeeze (up) into long squeeze (back down).

We saw this yesterday again.

Good to keep an eye on this region. pic.twitter.com/yojcBHSGzk

— Daan Crypto Trades (@DaanCrypto) October 6, 2023

Data from monitoring resource CoinGlass showed negligible liquidations across both long and short BTC positions through Oct. 6.

Lack of lower BTC price levels “surprise”

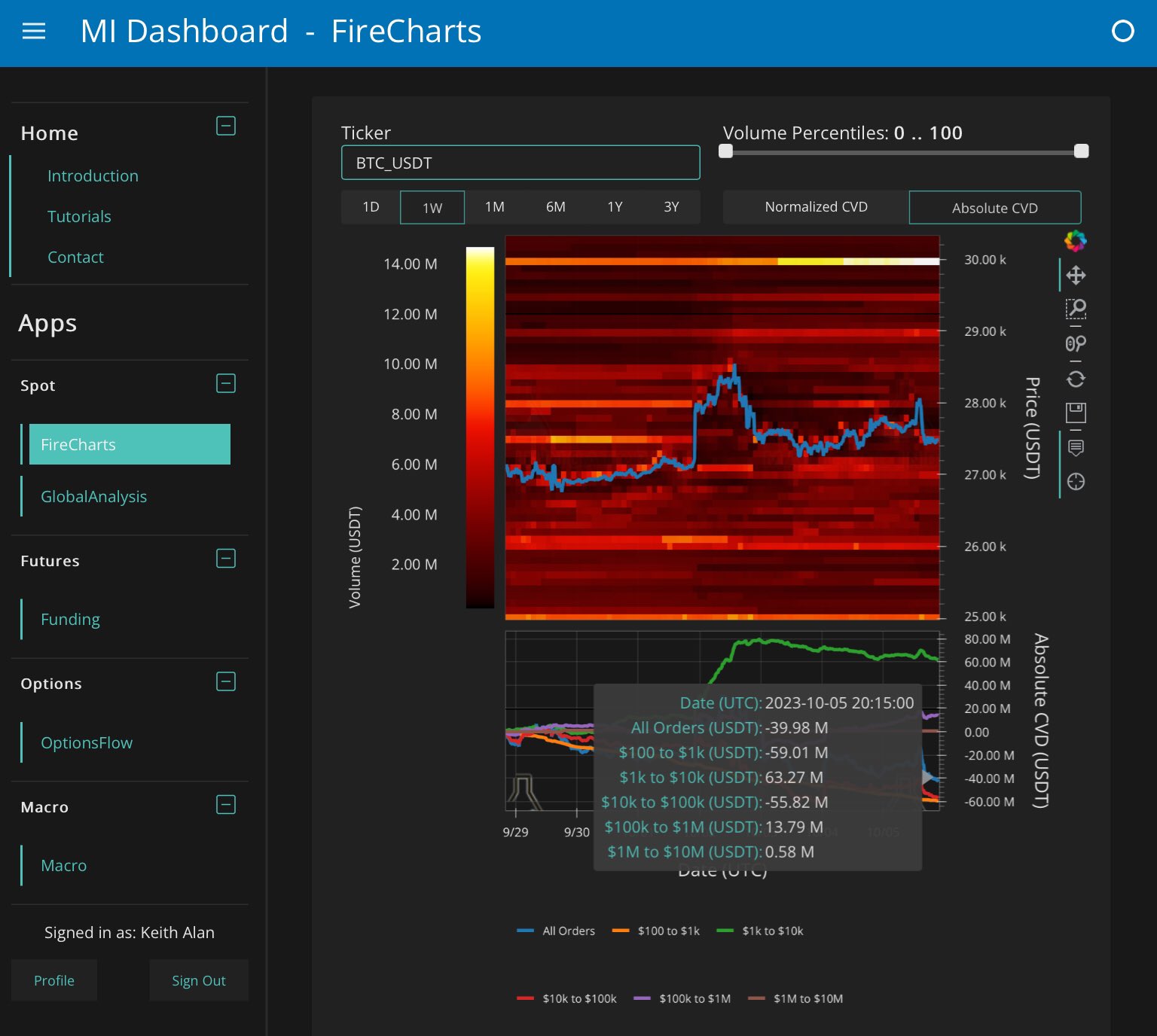

Monitoring resource Material Indicators meanwhile turned its attention to whale trading behavior over the course of the week.

Related: Bitcoin bull market awaits as US faces ‘bear steepener’ — Arthur Hayes

Dividing whales into volume-based cohorts, it showed different “classes” of whales making contradictory moves. Orders worth between $100,000 and $1 million — the class Material Indicators often says is the main driver of spot price action — have increased exposure, but failed to spark a broader uptrend.

“This week, purple bought aggressively and sold the local top. They then stared buying dips for a NET +$13.8M in market orders on @binance over the last 7 days,” it explained.

Data further showed other whales net selling to the tune of nearly $60 million over the same period.

“We could speculate whether or not that’s part of the FTX liquidation,” Material Indicators added, referencing the potential liquidation of assets from defunct exchange FTX.

“Doesn’t really matter who it is, but if there is any surprise, it’s not that price hasn’t gone higher…it’s that it didn’t go lower.”

On the topic of exchange-based setups, popular trading account Exitpump likewise spied a potential liquidity grab being prepared below $27,400.

“Price always likes to do multiple kisses into resistance block forming a top,” part of recent analysis summarized.

$BTC Possible run back to 28k. Good amount of bid liquidity below 27.4k on Binance spot orderbook.

Price always likes to do multiple kisses into resistance block forming a top. pic.twitter.com/ZvUVEeqULY

— exitpump (@exitpumpBTC) October 5, 2023

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Go to Source

Author: William Suberg