HTX hacked again for $13.6M, 100K Koreans test CBDC, Binance 2.0: Asia Express

HTX hacked for $13.6M — the ecosystem’s fourth hack in recent months — 100K Koreans test out CBDC, and Binance is dead, long live Binance!

Our weekly roundup of news from East Asia curates the industrys most important developments.

HTX exchange hacked… again

In the fourth hack affecting the HTX (formerly Huobi Global) ecosystem in just two months, the exchange lost $13.6 million via a hot wallet hack that occurred on Nov. 22.

In its Nov. 23 announcement, the exchangepromisedto fully compensate for the losses caused by this attack and 100% guarantee the safety of user funds,” as well as restore services within 24 hours of the attack. The day prior, the HTX Eco Chain (HECO) bridge was exploited for $86.6 million. An investigation is ongoing.

In September, the HTX exchange was hacked for $7.9 million; this was followed by a $100 million hack against the Poloniex exchange, a related entity, in November. Justin Sun, the Chinese blockchain personality and de-facto owner of HTX (not to mention the owner of Poloniex, founder of Tron and CEO of BitTorrent etc),stated after the attack that “HTX Will Fully Compensate for HTXs hot wallet Losses. Deposits and Withdrawals Temporarily Suspended. All Funds in HTX Are Secure.” Sun previously also madeassurancesthat “all user assets are #SAFU” in the aftermath of the September hack against HTX.

Huobirebranded to HTXduring this years Singapore2049 event in September. Although its executives have repeatedly reassured that the exchange is doing well, the exchange ran into a number ofserious incidentsthis year, including analleged employee revolt.

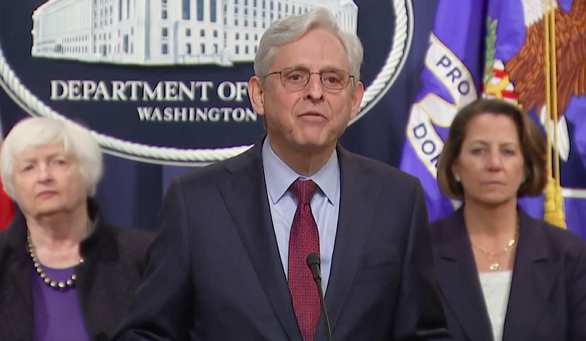

Binance pleads guilty, settles criminal charges for $4.3 billion

Crypto exchange Binance has agreed to plead guilty to violating the U.S. Bank Secrecy Act, knowingly failing to register as a money-transmitting business, and willfully violating the International Emergency Economic Powers Act. The exchange will pay $4.3 billion in penalties and forfeiture to the U.S. Justice Department.

According to the Nov. 21announcement, Changpeng Zhao, co-founder and CEO of Binance, has also pled guilty to one count of willfully violating the U.S. Bank Secrecy Act. Zhao has since entered his personal plea in the District Court for the Western District of Washington.

At the time, Zhao was granted a $175 million bond that allowed him to reside in Dubai pending his sentencing hearing on Feb. 24. However, the U.S. Department of Justice has since appealed that decision, asking to confine his residence to the U.S. pending the sentencing hearing due to Zhao allegedly possessing an “unacceptable risk of flight.”

In its indictment, the Department of Justice noted that, in a few noticeable incidents and despite reassurances, Binance facilitated over $1 billion in illicit transactions for Iranian users, the Russian marketplace Hyrdra and cryptocurrency mixer Bestmixer. and it solicited U.S. users without prior registration. Binance was also accused of deliberately masking such actions as “complying with U.S. law would stifle their efforts to grow Binance’s profits, market share, and trading volume.”

The same day, Zhao stepped down as the CEO of Binance. “I made mistakes, and I must take responsibility. This is best for our community, for Binance, and for myself,” he stated.

“Binance is no longer a baby. It is time for me to let it walk and run. I know Binance will continue to grow and excel with the deep bench it has.”

While Zhao still owns a majority in the exchange, he will be barred from being involved in the exchange’s everyday operations. Richard Teng, Binance’s global head of regional markets, was named the exchange’s new CEO. In his inaugural statement, Teng stated that the exchange’s fundamentals were “VERY strong” and that Binance is still “the world’s largest crypto exchange by volume.”

Blockchain analytics firm Nansen has noted that despite the guilty plea, it did not witness any “mass exodus of funds” after the incident. While the exchange witnessed nearly $965 million worth of withdrawals, its total holdings increased to $65 billion. On November 23, CZ’s X account was temporarily suspended after removing “Binance” from his profile name.

South Korea invites 100,000 people to test CBDC

The Bank of Korea, South Korea, and Central Bank will invite 100,000 Korean citizens to purchase goods with deposit tokens issued by commercial banks as part of its central bank digital currency (CBDC) pilot test. The first of such trials began in October.

According to local news reports on November 23, “participants will be restricted to using the currency solely for its designated purpose of payment. Other uses, including personal remittance, will not be permitted at this time.” Although the Bank of Korea has not yet decided to whether or not to implement a CBDC, further trials are expected, including an integration simulation system for carbon emissions trading on the Korea Exchange. It said:

“Recently, the rapid digitalization of the economy has led to a growing demand for a digital form of public currency. This demand is evident in the private sector, where new payment instruments such as stablecoins have been developed and are already widely used in certain sectors.”

Go to Source

Author: Zhiyuan Sun