Bitcoin retreats from $72,000 ahead of US CPI report

Share this article

URL Copied

Bitcoin’s (BTC) price has shown volatility ahead of tomorrow’s US Consumer Price Index (CPI) report. According to CoinGecko’s data, after surging past $72,000 earlier this week, Bitcoin retraced below $68,500 on Tuesday. BTC is trading at around $68,800 at press time, down 4% in the last 24 hours.

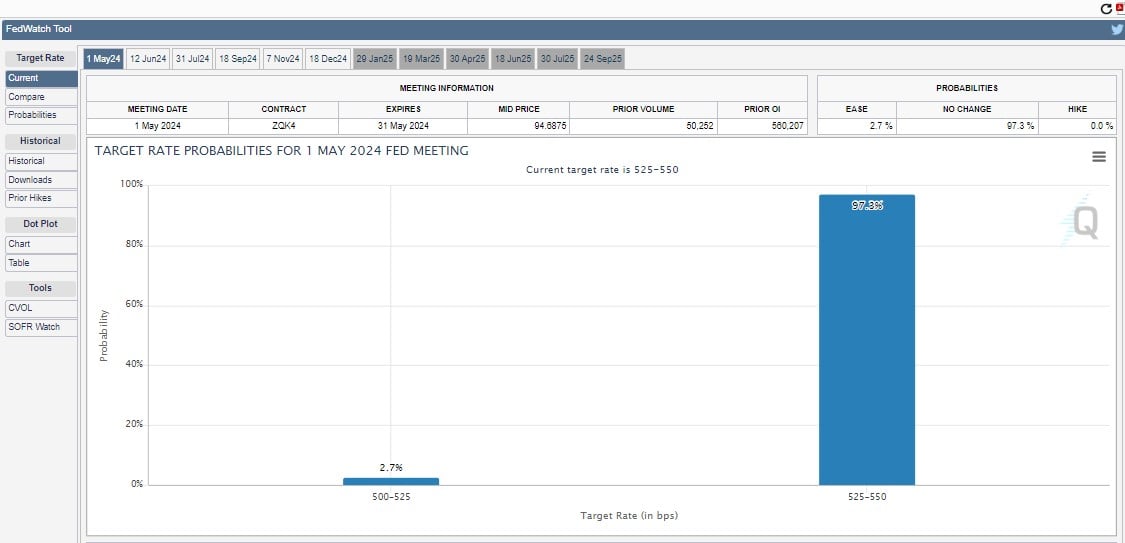

The CPI report, due Wednesday, is expected to considerably impact the Federal Reserve’s policy, especially regarding interest rates. Last month’s CPI inflation was reported at 3.2%, with core CPI at 3.8%. Projections for the upcoming data estimate a CPI of 3.5% and a core CPI of 3.7%.

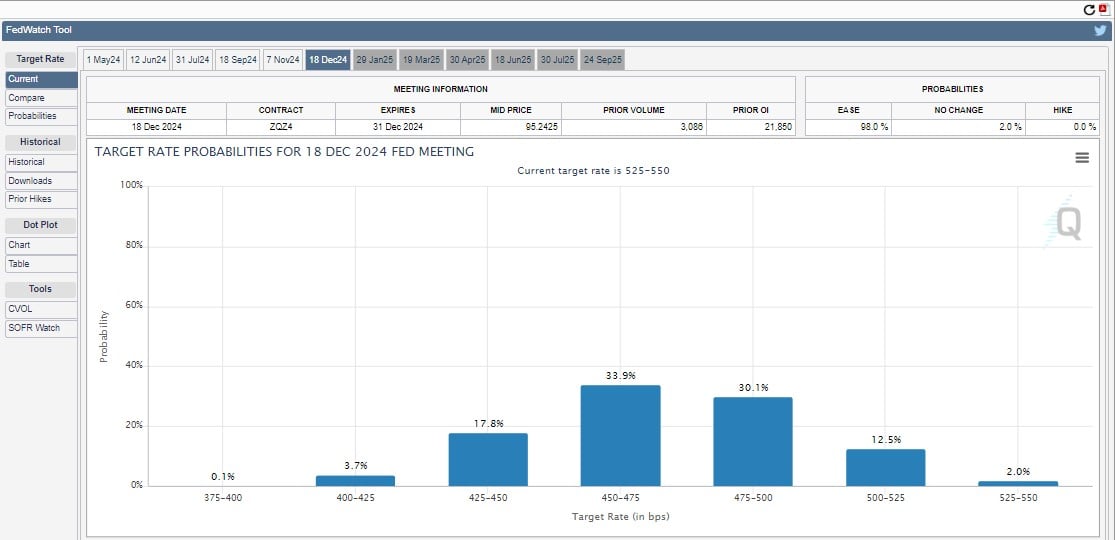

Estimates from the CME FedWatch Tool suggest a 97.3% likelihood that the Fed will hold interest rates between 525-550 basis points at the next FOMC meeting in May, with only a 2.7% chance of a rate decrease.

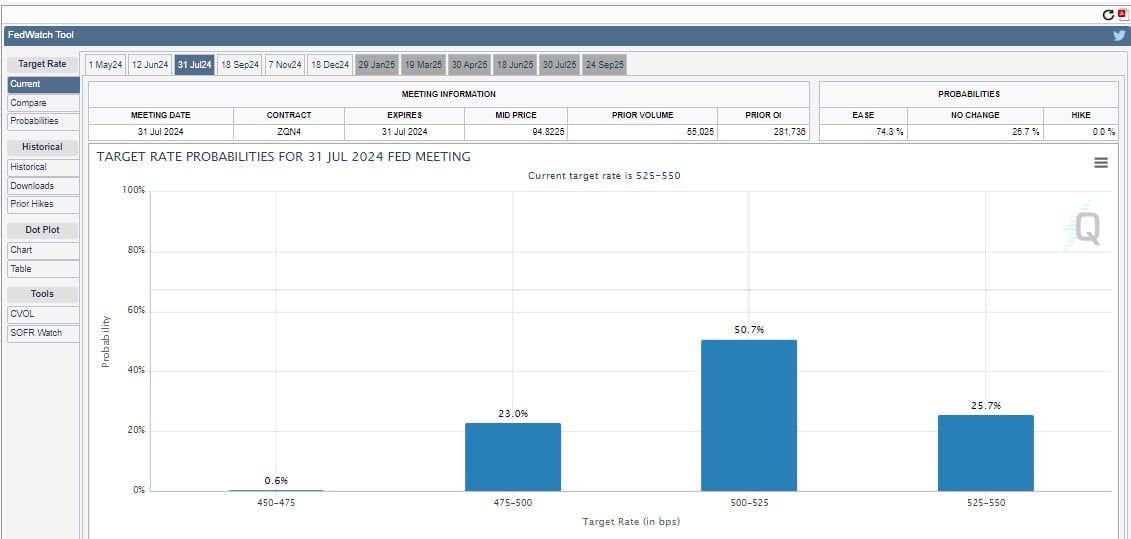

Despite the present uncertainty, the market is factoring in a high probability of rate cuts starting from July.

Economists polled by Reuters expect the headline CPI to rise by 3.4% year-over-year, representing a slight inflation reduction, moving closer to the Fed’s target.

Last week, Fed Chairman Jerome Powell stressed that the Fed would need more evidence that inflation is decreasing before cutting interest rates. Other Fed officials also showed a preference for a more cautious and stringent approach to easing monetary policy.

Bitcoin’s faltering momentum is rattling the crypto market, sending most altcoins into correction mode. Ethereum (ETH), after surging 8% on Monday, has shed those gains and is now down 4.5% over the last 24 hours, according to CoinGecko data.

However, not all coins are following suit. The Open Network (TON) and Fantom (FTM) defied the trend, each surging 8% today.

Share this article

URL Copied

The information on or accessed through this website is obtained from independent sources we believe to be accurate and reliable, but Decentral Media, Inc. makes no representation or warranty as to the timeliness, completeness, or accuracy of any information on or accessed through this website. Decentral Media, Inc. is not an investment advisor. We do not give personalized investment advice or other financial advice. The information on this website is subject to change without notice. Some or all of the information on this website may become outdated, or it may be or become incomplete or inaccurate. We may, but are not obligated to, update any outdated, incomplete, or inaccurate information.

Crypto Briefing may augment articles with AI-generated content created by Crypto Briefing’s own proprietary AI platform. We use AI as a tool to deliver fast, valuable and actionable information without losing the insight – and oversight – of experienced crypto natives. All AI augmented content is carefully reviewed, including for factural accuracy, by our editors and writers, and always draws from multiple primary and secondary sources when available to create our stories and articles.

You should never make an investment decision on an ICO, IEO, or other investment based on the information on this website, and you should never interpret or otherwise rely on any of the information on this website as investment advice. We strongly recommend that you consult a licensed investment advisor or other qualified financial professional if you are seeking investment advice on an ICO, IEO, or other investment. We do not accept compensation in any form for analyzing or reporting on any ICO, IEO, cryptocurrency, currency, tokenized sales, securities, or commodities.

Go to Source

Author: Vivian Nguyen