Bitcoin veterans account for 40% of profit-taking despite low trading volume

Share this article

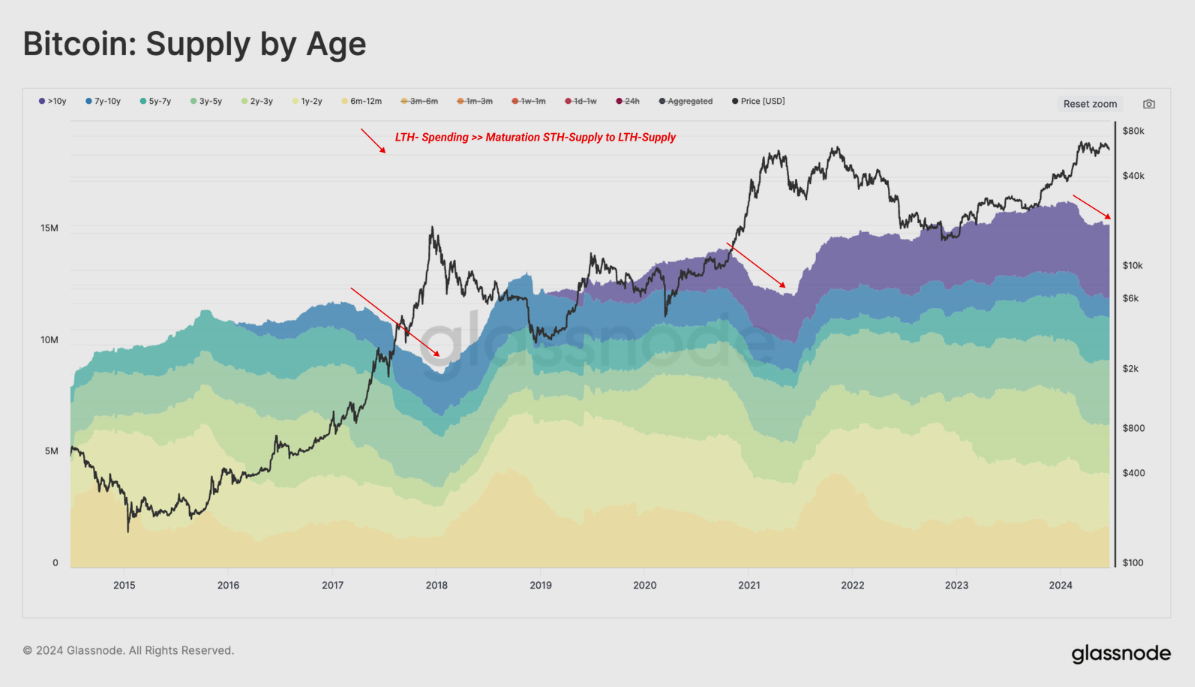

Bitcoin (BTC) long-term holders (LTHs) are the investors with the most profit-taking and less trading activity in crypto currently, according to the latest “The Week On-chain” report by Glassnode. Despite their daily on-chain volume of 4% to 8%, the LTH represents up to 40% of the profit-taking movements.

“Whilst there are occasional bursts of spending activity for each cohort, the frequency of high-spending days increases dramatically during the euphoria phase of a bull market,” the report points out. “This highlights the relatively consistent behavior pattern of long-term investors taking profits during periods of rapid price appreciation.”

This behavior underscores the substantial impact of long-term holders on market liquidity and price stability. During periods of market euphoria, LTHs’ selling activity tends to increase, aligning with substantial price appreciations and contributing to the cyclical nature of the market.

Notably, Glassnode analysts highlighted that the current BTC price is below the cost basis of both the holders from one week to one month (1w-1m holders) and one month to three months (1m-3m holders), which are $68,500 and $66,400, respectively.

Therefore, if the price stays below those levels for too long, history suggests that investor confidence will deteriorate and result in deeper corrections.

Moreover, when the cost basis of the 1w-1m holders falls below the 1m-3m cost basis, the structure formed by this movement signals “a diminishing momentum in the demand side,” ending up on net capital outflows from Bitcoin.

The image below shows that this outflow movement happened five times in the bull cycles witnessed in 2017 and 2021, and is currently in its fourth instance in the current cycle.

Additionally, the current consolidation phase near Bitcoin’s previous all-time high aligns with the “equilibrium to euphoria boundary,” where the price tends to appreciate quickly followed by the LTH increasing their distribution pressure.

Share this article

Go to Source

Author: Gino Matos