DEX trading volume rises 15.7% in Q2, CEX activity drops

Key Takeaways

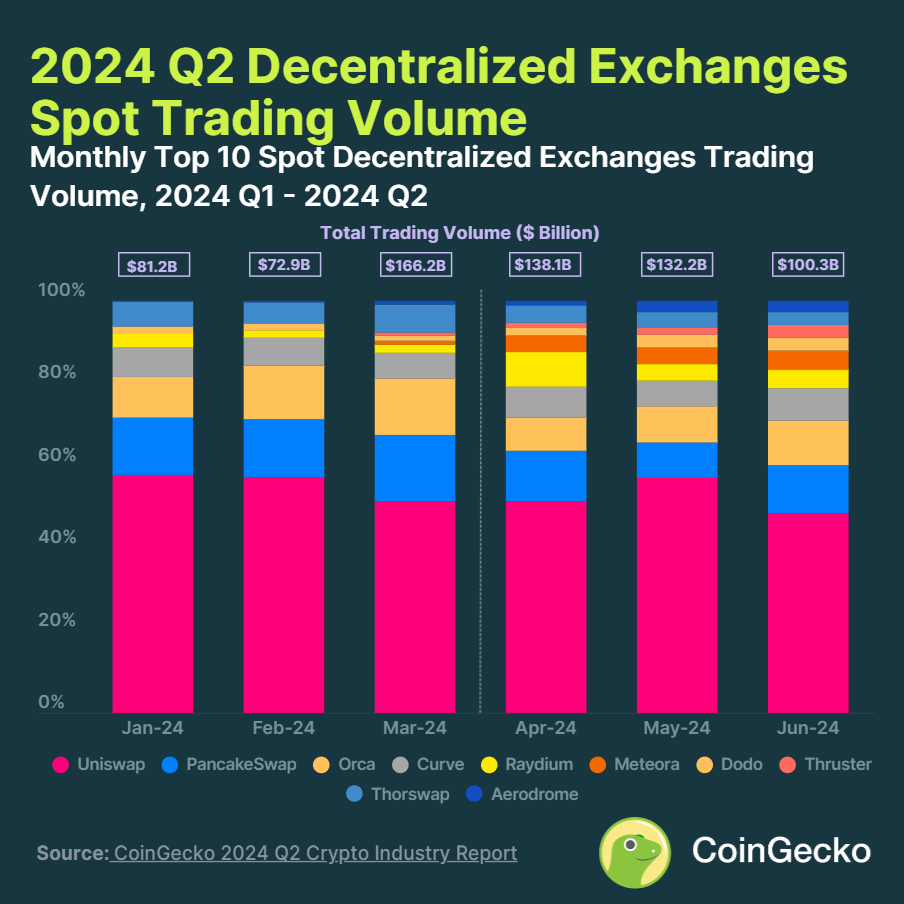

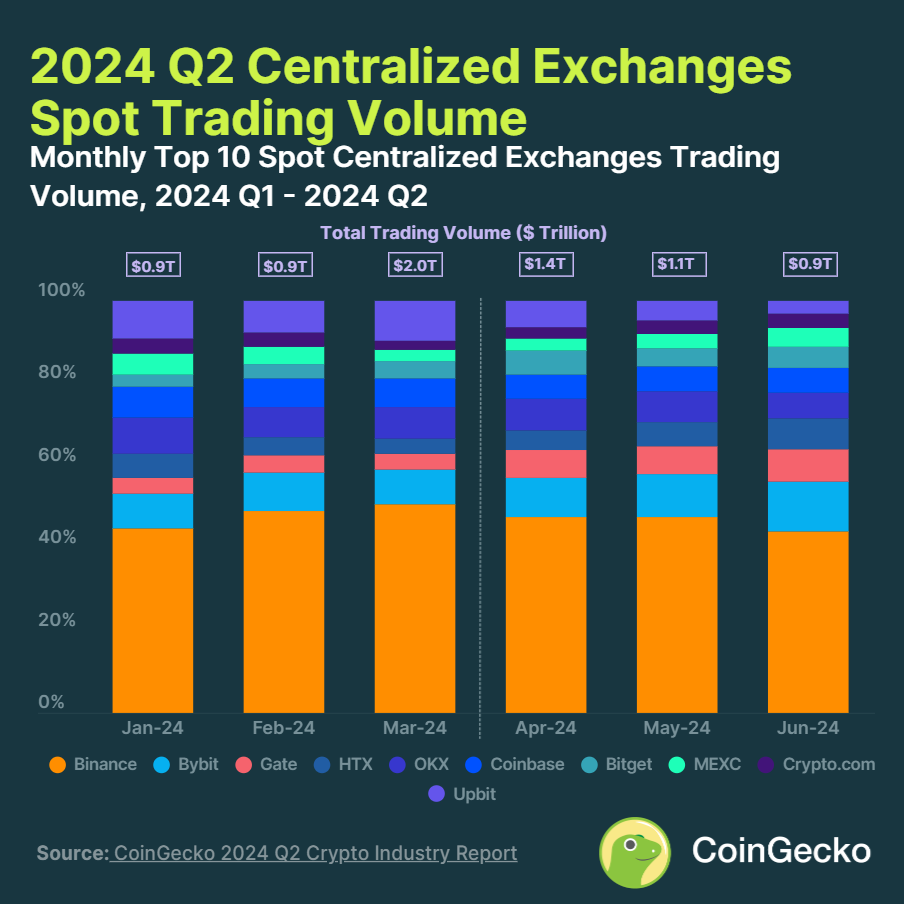

- DEX trading volume grew 15.7% in Q2 2024, while CEX volume dropped 12.2%.

- Uniswap maintained 48% DEX market share, while Binance held 45% of CEX market.

Share this article

Decentralized exchanges (DEXs) saw a 15.7% quarter-on-quarter increase in spot trading volume, reaching $370.7 billion in Q2 2024. This growth contrasts with centralized exchanges (CEXs), which experienced a 12.2% decline, recording $3.4 trillion in volume.

Uniswap maintained its dominance with a 48% market share among DEXs. Newcomers Thruster and Aerodrome made significant gains, with Thruster’s volume rising 464.4% to $6 billion and Aerodrome growing 297.4% to $5.9 billion.

“This shift can be attributed to the inherent advantages of DEXs, including privacy, complete transparency, and self-custody. In contrast, CEXs face challenges such as KYC requirements, high fees, and collapse risks,” Tristan Frizza, founder of decentralized exchange Zeta Markets, shared with Crypto Briefing.

Frizza added that despite nearly 80% of trades still occurring on centralized exchanges, the barriers that have historically held decentralized finance (DeFi) back, such as challenging onboarding and performance issues, are being lowered.

Therefore, as the DeFi ecosystem matures, DEXs are improving in terms of liquidity and user experience, making decentralized trading more appealing to a broader audience.

“Solana, for instance, supports over 33% of the total daily DEX volume across all blockchains due to its unmatched speed and cost-effectiveness. This makes it an ideal environment for both retail and institutional users.”

Tristan also highlights the developments related to DEX for perpetual contracts trading, mentioning the launch of a layer-2 blockchain on Solana dedicated to Zeta Markets, called Zeta X.

“We aim to combine the convenience and speed of a CEX with the core benefits of DeFi—transparency, self-custody, governance participation, and on-chain rewards. This will help lead the shift from CeFi to DeFi.”

In the CEX space, Binance retained its top position with a 45% market share despite volume declines. Bybit surged to second place, increasing its market share to 12.6% in June.

Only four of the top 10 CEXs saw volume increases, with Gate leading at 51.1% growth ($85.2 billion), followed by Bitget at 15.4% ($24.7 billion), and HTX at 13.7% ($25.5 billion).

The DEX growth was attributed to meme coin surges and numerous airdrops, while CEX performance aligned with overall crypto market trends.

Share this article

Go to Source

Author: Gino Matos