US Bitcoin spot ETFs bleed $168 million amid market chaos, Ether ETFs gain

Key Takeaways

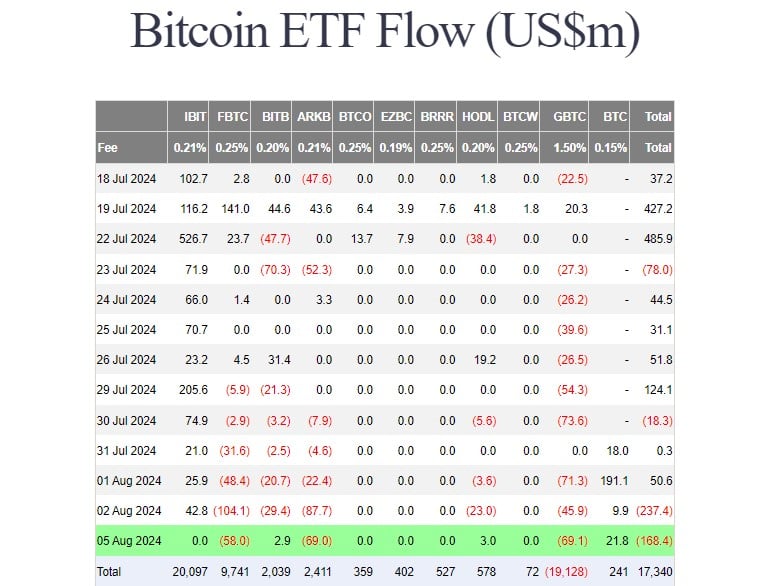

- Grayscale and Fidelity Bitcoin funds each saw around $69 million in withdrawals on Monday.

- Ethereum ETFs logged nearly $49 million in net inflows, contrasting with Bitcoin’s heavy outflows.

Share this article

Investors pulled $168 million from the group of nine US spot Bitcoin exchange-traded funds (ETFs) on Monday, bringing the total net outflows for two consecutive days to $405 million, according to data from Farside Investors. Meanwhile, spot Ethereum ETFs collectively logged nearly $49 million in net inflows.

Grayscale’s Bitcoin ETF (GBTC) and Fidelity’s Bitcoin fund (FBTC) dominated daily outflows as traders withdrew around $69 million from each fund.

In contrast, Grayscale’s Bitcoin Mini Trust (BTC), the low-cost version of GBTC, took in almost $29 million, becoming the ETF with the most daily outflows. Two ETFs that also posted gains today were Bitwise’s Bitcoin ETF (BITB) and Valkyrie’s Bitcoin fund (BRRR), attracting approximately $6 million.

Other Bitcoin funds, including BlackRock’s iShares Bitcoin Trust (IBIT), reported zero flows.

Bitcoin and Ethereum ETFs hit $6 billion in trading volume

According to data from Coinglass, US Bitcoin and Ethereum ETFs recorded nearly $6 billion in trading volume on Monday. Spot Bitcoin ETFs accounted for over $5 billion of the total volume, with IBIT and FBTC being the dominants.

Spot Ether ETFs, led by Grayscale’s Ethereum ETF and BlackRock’s iShares Ethereum Trust (ETHA), contributed around $715 million to total trading volume.

Bloomberg ETF analyst Eric Balchunas called the high trading volume “crazy volume during a market rout is generally a pretty reliable measure of fear.” He added that deep liquidity on bad days is valued by traders and institutions, indicating long-term benefits for ETFs.

Bitcoin ETFs have traded about $2.5b so far, a lot for 10:45am, but not too crazy (full history below). If you bitcoin bull you actually DONT want to see crazy volume today as ETF volume on bad days is a pretty reliable measure of fear. On flip, deep liquidity on bad days is part… pic.twitter.com/TOQRjyriqp

— Eric Balchunas (@EricBalchunas) August 5, 2024

Farside’s data shows that BlackRock’s ETHA captured $47 million in net inflows on August 5, followed by VanEck’s and Fidelity’s Ethereum ETFs.

These two funds captured almost $33 million in inflows. Bitwise’s Ethereum fund and Grayscale’s Ethereum Mini Trust also reported gains on Monday.

The Grayscale Ethereum Trust (ETHE) suffered nearly $47 million in net outflows, the lowest since it was converted to an ETF. More than $2.1 billion was taken from the fund in ten trading days.

Investors still hold around 234 million ETHE shares. With the recent crypto market downturn, those shares are now valued at around $4.7 billion, as updated by Grayscale.

The crypto crash kicked off on August 4 following news of Jump Trading moving large amounts of Ether to exchanges. This led to a sharp price correction across crypto markets, with Bitcoin briefly dipping below $50,000 at the start of US trading hours on August 5. Ethereum followed suit, losing over 20% of its value in a day.

At the time of reporting, both Bitcoin and Ethereum prices have covered slightly. BTC is currently trading at around $54,000 while Ethereum is up 6% to over $2,400, CoinGecko’s data shows.

Share this article

Go to Source

Author: Vivian Nguyen