US Credit Card Debt Soars To $1,140,000,000,000 As Bank of America CEO Issues Warning on ‘Depleting’ American Consumer

Americans are holding more household debt than ever before as one of the biggest banks in the country warns of a weakening US consumer.

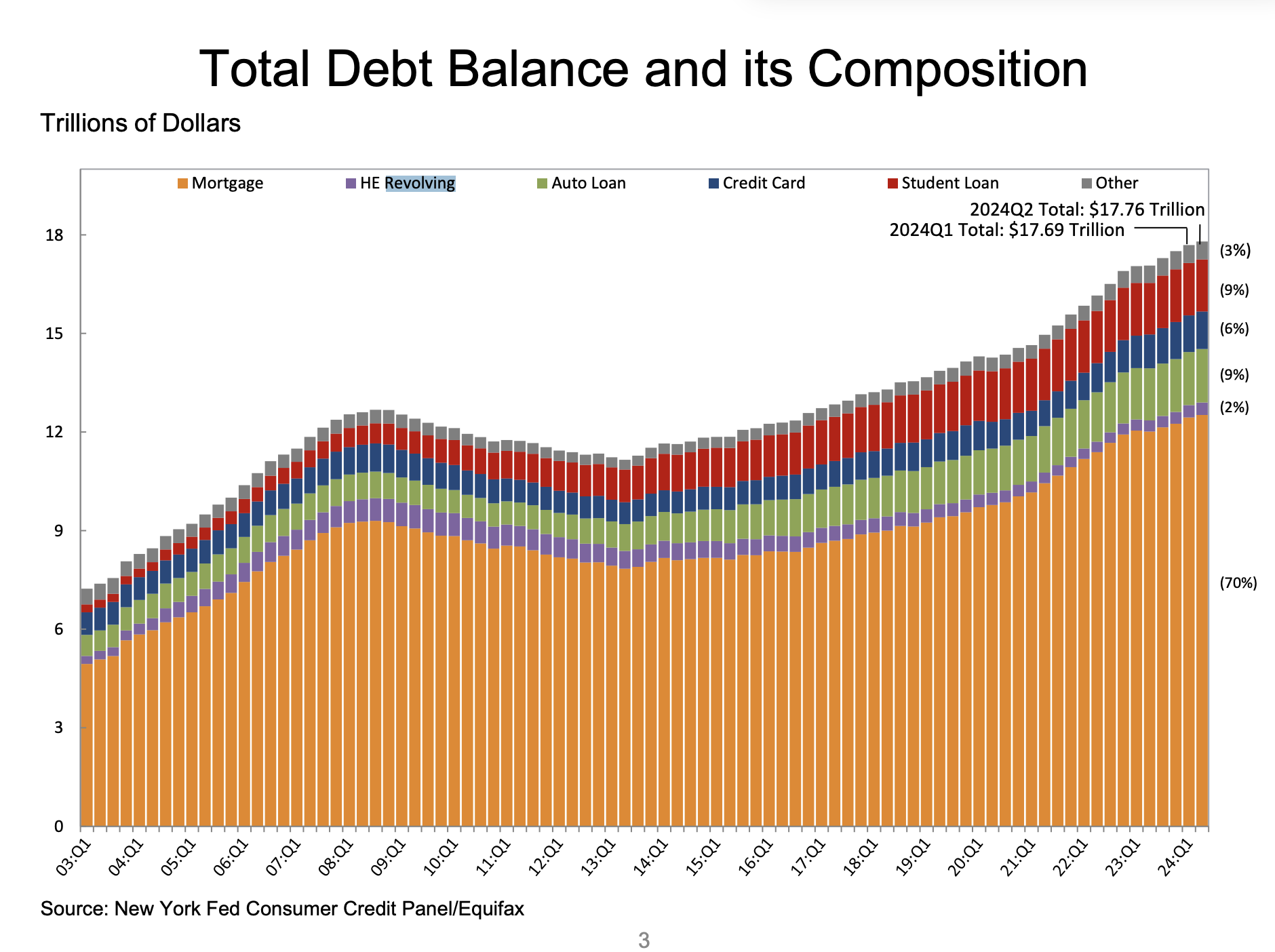

According to a report from the New York Fed, US credit card debt just hit $1.14 trillion.

On the whole, Americans have more student loan, mortgage, credit card and home equity revolving debt right now than at any time in history.

Says the Fed,

“Aggregate household debt balances increased by $109 billion in the second quarter of 2024, a 0.6% rise from 2024Q1. Balances now stand at $17.80 trillion and have increased by $3.7 trillion since the end of 2019, just before the pandemic recession.”

The Fed also reports that delinquency transition rates for credit cards, auto loans, and mortgages increased slightly in the second quarter, and that about 4.9% of consumers had a third-party collection account on their credit.

Consumers also appear to be experiencing a slow-down amid the higher debt loads.

In a new interview with FOX Business, Bank of America CEO John Moynihan says that the bank’s consumer base is currently spending at half the rate they were last year, a sign of a “depleting” consumer.

“Well, in our consumer base of 60 million customers spending every week, what you’re seeing is they’re spending at a rate of growth of this year over last year, for July and August so far, about 3%. That is half the rate it was last year at this time. And so the consumer has slowed down. They have money in their accounts, but they’re depleting a little bit. They’re employed, they’re earning money, but if you look at- they’ve really slowed down.

So the Fed is in a position they have to be careful that they don’t slow down too much. Right now, where they are spending at is consistent where they spent in ’17, ’18,’19, a lower inflation, a more normal growth economy.”

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

The post US Credit Card Debt Soars To $1,140,000,000,000 As Bank of America CEO Issues Warning on ‘Depleting’ American Consumer appeared first on The Daily Hodl.

Go to Source

Author: Alex Richardson