BlackRock Bitcoin ETF logs $318 million net inflows despite BTC price dip

Key Takeaways

- BlackRock’s Bitcoin ETF attracted $318 million in net inflows despite a 4% Bitcoin price drop.

- IBIT’s recent growth contributes to US spot Bitcoin ETFs surpassing 1 million Bitcoin in holdings.

Share this article

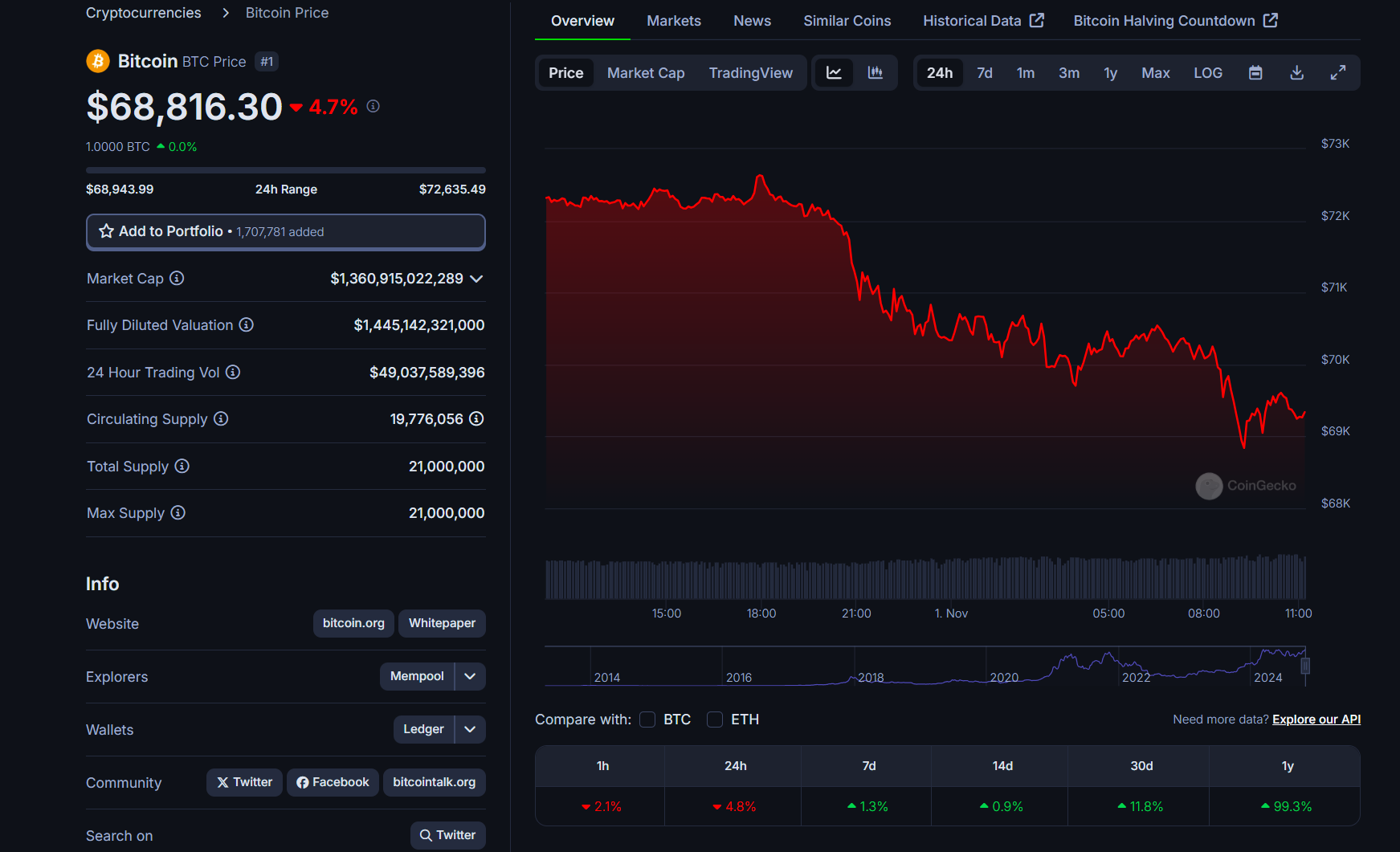

BlackRock’s spot Bitcoin ETF, the IBIT fund, continues to be a preferred option for financial investors. The fund attracted around $318 million in net inflows on Oct. 31 despite Bitcoin’s price falling 4% to $68,800.

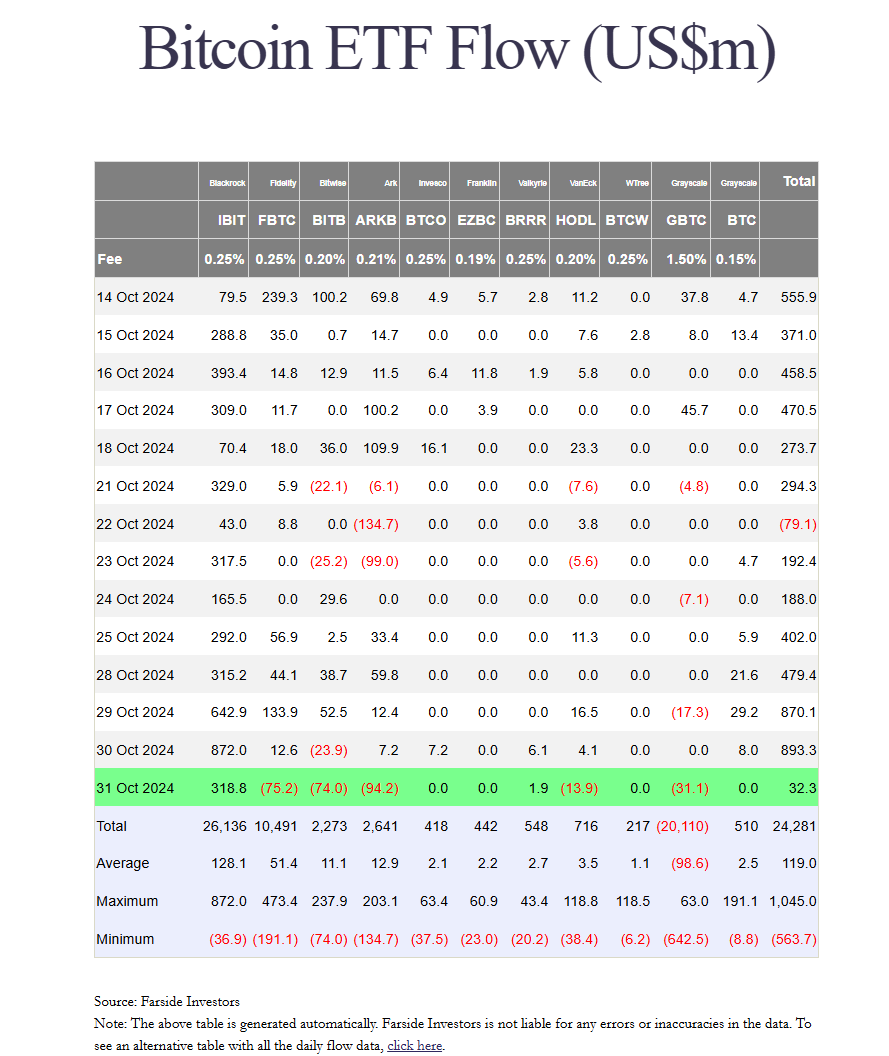

The inflow followed IBIT’s record-breaking performance of $875 million on Oct. 30, which exceeded its previous high of $849 million. The fund’s weekly inflows have now surpassed $2 billion, according to Farside Investors data.

Valkyrie’s BRRR fund also added nearly $2 million on Thursday. In contrast, other ETF providers faced significant redemptions.

Fidelity’s FBTC ended its two-week positive streak with over $75 million in net outflows. ARK Invest/21Shares, Bitwise, VanEck, and Grayscale ETFs collectively reported $213 million in outflows.

Despite the mixed performance across ETFs, IBIT’s massive influx efficiently helped the US spot Bitcoin ETF group maintain positive momentum, adding over $30 million in new investments. This marks the seventh consecutive day of net inflows for the sector.

IBIT has accumulated almost $30 billion in assets since its launch, with approximately half of that amount gathered in the past month. The combined holdings of US spot ETFs have now exceeded 1 million Bitcoin.

Bloomberg ETF analyst Eric Balchunas noted that IBIT has attracted more investment than any other ETF in the past week, surpassing established funds like VOO, IVV, and AGG, despite launching less than ten months ago.

$IBIT took in more cash than any other ETF in the world over the past week. This is out of 13,227 ETFs, which includes $VOO $IVV $AGG etc. It’s so hard to beat those veteran Cash Vacuum Cleaners, even for a week, especially for an infant ETF (3mo-1yr old) pic.twitter.com/S443lUXVQk

— Eric Balchunas (@EricBalchunas) October 31, 2024

Share this article

Go to Source

Author: Vivian Nguyen