Crypto policy gains momentum as pro-crypto candidates sweep Congress

Key Takeaways

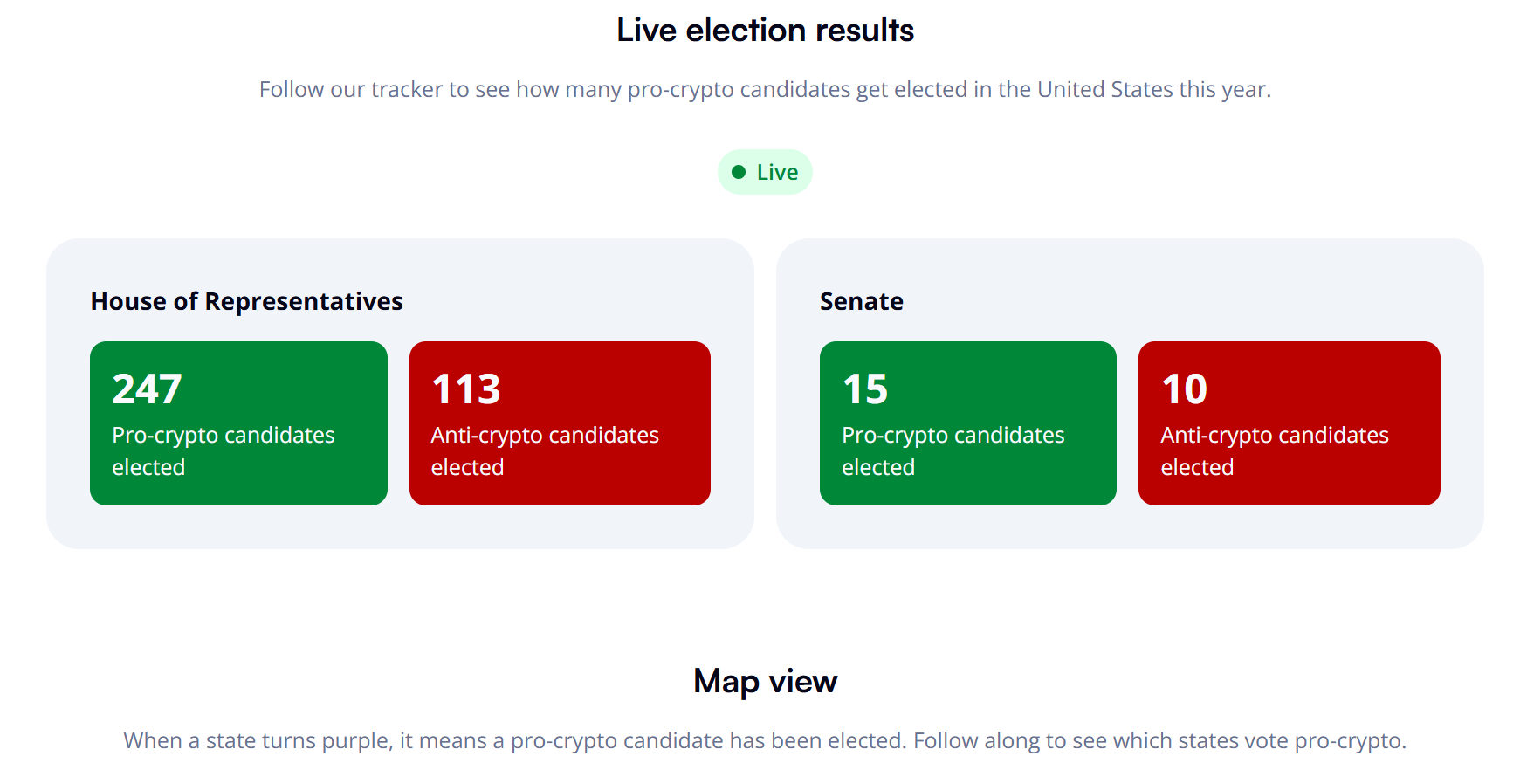

- Pro-crypto candidates have secured a majority in the US Congress with 247 representatives.

- The crypto industry contributed $206 million to election campaigns, primarily supporting Fairshake.

Share this article

Crypto policy takes center stage during the US elections as approximately 69% of newly elected officials support digital assets, according to updated data from Coinbase’s Stand With Crypto (SWC) website.

The election results show that 247 supporters of crypto won House seats, compared to 113 opponents, at press time. Meanwhile, in the Senate, pro-crypto candidates won 15 seats versus 10 for anti-crypto candidates.

Pro-crypto officials have been elected in most states nationwide; only New Mexico, Alaska, Hawaii, Vermont, and Maine remain without a supportive candidate, data shows.

Around $206 million was donated by the crypto industry to election campaigns, including $204 million to Fairshake, a pro-crypto superPAC, and nearly $3 million to SWC.

In the Ohio Senate race, Bernie Moreno defeated incumbent Democrat Sherrod Brown with 50.2% of the vote (2.8 million) to Brown’s 46.4% (2.5 million). Fairshake spent $40 million to support Moreno’s campaign, with backing from Coinbase, Ripple Labs and Andreessen Horowitz’s founders.

The race for several other key Senate seats remains competitive. Tim Sheehy leads Jon Tester by 247,000 votes to 205,000.

Meanwhile, Bob Casey and Dave McCormick are battling it out in Pennsylvania with 3.2 million votes each. The Wisconsin race is tied with approximately 1.6 million votes between Tammy Baldwin and Eric Hovde.

However, in Massachusetts, crypto advocates were dealt a setback when Democratic Senator Elizabeth Warren defeated Republican John Deaton, a known crypto supporter.

The election of numerous pro-crypto candidates could lead to major changes in how crypto assets are regulated in the US. With a growing number of lawmakers supporting the industry, the country appears ready to implement more favorable regulations that could foster innovation and investment in digital assets.

Share this article

Go to Source

Author: Vivian Nguyen