Kraken to delist USDT and non-MiCA-compliant stablecoins in the EEA by March 31

Key Takeaways

- Kraken will delist USDT and several other stablecoins in the EEA due to MiCAR regulations by March 31, 2025.

- Delisting process begins in February 2025 with full halt of spot trading on March 24, 2025.

Share this article

Kraken will delist Tether (USDT) and four other stablecoins in the European Economic Area (EEA) as the crypto exchange prepares for upcoming regulatory changes under the Markets in Crypto-Assets (MiCA) regulation. The delisting will occur in phases, concluding with automatic conversion of remaining holdings by March 31, 2025.

In addition to USDT, other affected stablecoins are PayPal USD (PYUSD), Euro Tether (EURT), TrueUSD (TUSD), and TerraUSD (USDT).

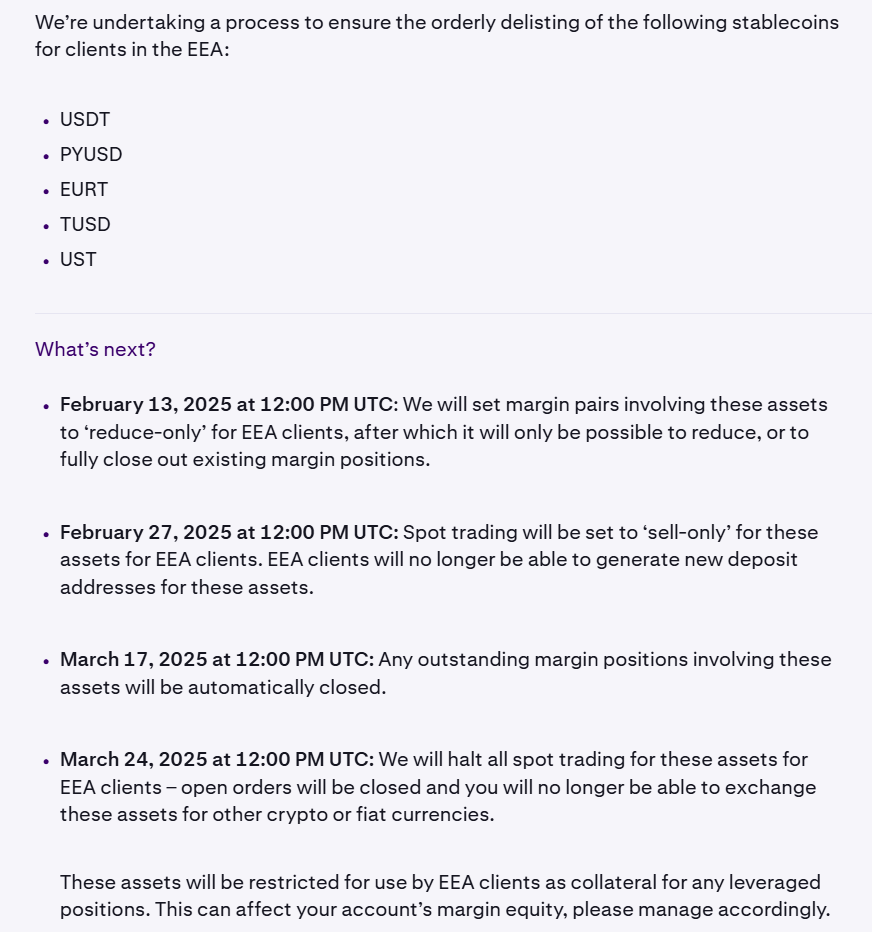

The delisting process will begin on February 13, 2025, when margin pairs involving these assets will be set to “reduce-only” for EEA clients. By February 27, spot trading will be restricted to “sell-only” mode, and new deposit addresses will no longer be generated for affected assets.

On March 17, any outstanding margin positions involving these assets will be automatically closed. All spot trading for these stablecoins will halt for EEA clients on March 24, with all open orders being closed.

After March 31, 2025, all remaining EEA client holdings in these assets will be automatically converted to an equivalent stablecoin. The exchange noted that affected assets deposited to existing addresses after the deadline will only be available for withdrawal.

The exchange, which operates Virtual Asset Service Provider services across Germany, Spain, Italy, the Netherlands, Belgium, Ireland, France and Poland, said last May it was considering delisting USDT in the EU to comply with stricter stablecoin requirements under MiCA regulations.

Kraken’s decision comes amid increasing regulatory scrutiny of stablecoins in Europe. Several major exchanges have taken proactive steps to remain compliant and provide long-term services in Europe.

Crypto.com said Wednesday it would delist USDT along with nine other tokens in Europe as of January 31, 2025, in compliance with the new regulation. The exchange will suspend buying and stop deposits, but will allow withdrawals until March 31, 2025.

Users are advised to convert affected tokens to MiCA-compliant assets by the end of the first quarter or they will be auto-converted to a compliant asset.

Share this article

Go to Source

Author: Vivian Nguyen