AI financial tools: A smart way to manage money or a risky experiment?

AI is transforming the world of finance, but is it ready for the retail sector? Experts weigh in.

The ever-evolving financial sector has been seemingly attracting cutting-edge technology over the last few years, with blockchain technology and digital currencies trying to help traditional finance evolve for over a decade. Now, artificial intelligence (AI) is bringing in new tools.

AI tools like ChatGPT and Bing Chat have shown an impressive capability to help boost efficiency, to the point 7,800 jobs at IBM are at risk of being replaced by AI within years, according to the company’s CEO. This technology manages to boost efficiency by being able to churn through colossal data sets in little time and bring in valuable insights that humans would take hours or days to recover.

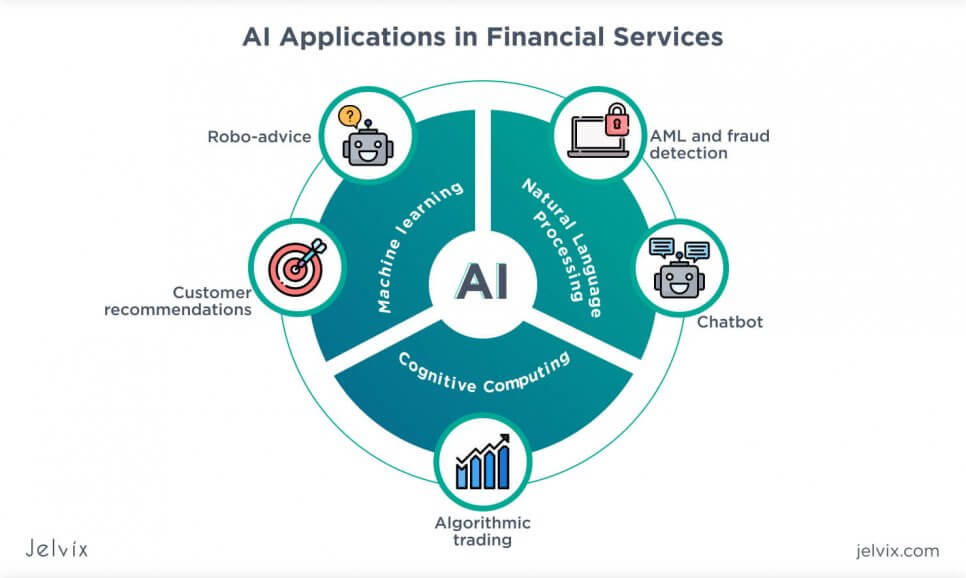

Machine learning, a subset of AI that helps computer systems learn from data and improve in a system that mimics human decision-making, has been in use for years by several high-profile financial institutions that are harnessing the power of AI.

In its 2022 annual report, trading platform Robinhood noted its machine learning models are “highly advanced and contribute to multiple capabilities across our business.”

Earlier this month, major cryptocurrency exchange Crypto.com announced the launch of “Amy,” a generative AI user assistant built to inform users about the crypto industry. Similarly, Binance launched an AI-powered nonfungible token (NFT) generator that minted over 10,000 tokens in less than three hours.

While these developments are exciting, AI-powered tools may not yet be ready for a retail audience, as they cannot fully support an individual during financially challenging times. On top of that, algorithmic bias is a legitimate concern that has been raised by various experts, as AI may unintentionally favor or disadvantage potential ideas based on bias carried from its model.

AI’s effects on the retail finance sector

Some basic AI financial tools are already being used in the retail finance sector, including the above-mentioned AI-powered NFT generator Binance launched and Crypto.com’s Amy chatbot.

Other tools meant to scrape financial social media for sentiment indicators and trends have also been launched, as have tools made to simplify analyses of financial reports.

Speaking to Cointelegraph, Robert Quartly-Janeiro, chief strategy officer of cryptocurrency exchange Bitrue, said that new AI tools are “part of the future far beyond” its current uses. He added that businesses will use these tools if they save money, although customers “prefer to deal with humans, be it in-branch, online or on the phone.”

Recent: ‘Moral responsibility’: Can blockchain really improve trust in AI?

Asked about the potential for AI to transform the retail finance sector in the next few years, Quartly-Janeiro said he “hopes it doesn’t,” aside from creating “fairer lending decisions, more open-mindedness on consumer credit to increase access to finance, and better risk management parameters.”

He added that consumers and the billions of decisions they make “drive economies and their growth,” cautioning:

“If you replace humans on a large scale with a machine that doesn’t buy, sell, invest, lend, borrow, then you have a serious problem on your hands; temporary profitability isn’t worth the risk of mass employment displacement.”

Chris Ainsworth, CEO of investment service Pave Finance, which uses AI to monitor market conditions and personalize portfolios, told Cointelegraph he does not believe AI financial tools are currently ready to be used in the retail sector without oversight.

According to him, current AI tools can “deviate from their intent fairly quickly,” and it will “take much longer than people think to fully deploy AI without oversight.” Ainsworth added that oversight is needed to “ensure models are adjusting properly, given volatility, correlations and the dynamics of markets changing quickly.”

He said that, in the future, AI tools will help drive down costs for the retail finance sector, although without proper oversight AI-driven models will not account for markets that can be driven by human emotion.

Ahmed Ismail, CEO and founder of AI-powered crypto liquidity aggregator Fluid, told Cointelegraph that AI tools are “mature enough to assess and manage risk, detect and prevent fraud, make effective credit and trading decisions, offer round-the-clock interaction and communication services, automate recurrent processes and reduce the scope of human error.”

Ismail added there’s nevertheless always a chance to improve, especially when it comes to preventing cyberattacks and safeguarding private data. Per his words, AI will play a transformative role in shaping the retail finance industry and will “shift paradigms” in trading, personalized banking, underwriting, financial advisory and more.

According to Ismail, numbers suggest that more than half of financial organizations with over 5,000 employees have already adopted AI, citing Bank of America’s chatbot Erica and Capital One’s natural language SMS text-based bank assistant Eno as examples.

While so many financial institutions are bringing AI tools to a retail audience, there are numerous challenges to overcome on several fronts. While concerns surrounding the technology abound, privacy and regulatory concerns are also worth considering.

Avoiding hiccups when implementing AI in finance

Bitrue’s Quartly-Janeiro said that financial institutions implementing retail-focused AI solutions also have to consider the implementation, adoption and cost benefits of their decisions, with the risks being “far more complicated,” as once they hand control of a function to AI, it isn’t clear how they’ll reclaim it.

He noted J. Robert Oppenheimer who, after perfecting the atomic bomb during the Manhattan Project, became a prominent proponent of banning nuclear weapons. Numerous high-profile individuals, including Tesla’s Elon Musk and Apple’s Steve Wozniak, have asked for a pause in the development of AI technology.

Fluid’s Ismail pointed to a different challenge — the “presence of human bias in data used to train AI,” which he said may lead to “embedded bias in AI algorithms.”

“These biases may lead to the exclusion of specific customer segments, inefficient operations or process mechanisms and a lack of trust in the technology.”

To Ismail, the predictive models used in making the technology work must also be “free from modeling pitfalls as realistically possible,” while cybersecurity and data privacy issues “should also be seriously considered.” AI-powered financial service solutions could “fall prey to data poisoning attacks, input attacks or model extraction or inversion attacks.”

He concluded, “The fast transformation of such a large market — as financial services and advisory are — to AI-based providers may affect the system’s stability by making it vulnerable to a single point of failure.”

Maya Mikhailov, founder of AI app tool Savvi AI, told Cointelegraph that when implementing AI, financial institutions must consider data security and privacy and follow applicable local data collection and storage laws.

Mikhailov added it’s also essential they have “transparency and audibility for the models that they are deploying,” as regulators will not accept them not knowing how their model works in case their AI programs end up violating lending or other local laws.

Their reputation may also be tied to the accuracy of the results provided by the AI tool, meaning they must be diligent and stop the program from hallucinating and giving customers inaccurate or harmful advice.

Taking all of this into account, it isn’t clear whether major financial institutions will have retail-ready AI tools in the near future. Smaller projects are likely going to be launching these tools as they can, as they don’t have to worry about reputational risk.

Is AI going to replace human financial advisers?

The jury is still out on whether these retail-ready AI tools will be able to outperform the market, suggest different strategies based on an individual’s profile, or replace human financial advisers.

To Mikhailov, retail AI-based financial tools may end up replacing human advisers at the “lower end of the market” to offer more “mainstream advisory tools to larger audiences.”

“A smartly deployed AI program will augment human, financial advisers with tools they can use to quickly and efficiently provide the strongest recommendations for their client’s portfolios.”

Fluid’s Ismail noted that there are “conflicting opinions among industry experts and analysts on whether AI will ever fully replace human advisers. AI’s advantages of AI over human-led services are evident.”

He added that AI can manage financial matters in real-time and offer “a more tax-efficient advisory service,” stating, “AI-powered decisions are also expected to be more immune to faults than those taken by human advisers. Commission expectations will not drive these AI-powered decisions and be free of biases towards or against a specific customer segment.”

Pave Finance’s Ainsworth said that human financial advisers may end up being replaced but added that such a possibility is “likely much further out than people think,” as by then, AI “will need to account for human emotion, which will be difficult.”

Caleb Silver, editor-in-chief at financial education portal Investopedia, told Cointelegraph that AI may “never be able to replace the personal touch that financial planning and advice requires for some clients who have complicated financial needs.”

He said that clients aren’t just looking for portfolio allocation and investment strategies but want “holistic financial planning and advice that is customized for them, and that requires a level of multidimensional thinking and execution that software alone isn’t yet capable of providing.”

Recent: How crypto funds shape the development of the digital asset market

Even if AI never replaces human advisers, it may still help democratize access to financial knowledge and services and aid crypto’s ethos of banking the unbanked. Ainsworth said:

“AI will help drive down costs and make investing more accessible. The key will be to make sure people are educated and have guardrails to support their investment decisions.”

While recent developments in the world of AI show just how fast the technology is growing, a human touch is still missing in AI interactions. Despite the advances, AI systems are unable to comprehend an individual’s unique circumstances through a simple chat interface or provide emotional support when red candles take over.

Human advisers, on the other hand, are able to provide this type of support and don’t raise privacy concerns the way AI systems do.

Nevertheless, AI is here to stay, and the market will likely determine whether financial tools using the technology are retail-ready.

Go to Source

Author: Francisco Rodrigues