AnubisDAO’s 13.5K ETH rug pull money washes away on Tornado Cash

After almost two years, the stolen 13,556 ETH, which was worth nearly $60 million, amounted to almost 26.2 million at the time of writing.

Nearly two years after the dog-inspired decentralized finance (DeFi) project — AnubisDAO — was rug-pulled for almost $60 million in Ether (ETH), the stolen funds were siphoned away using Tornado Cash.

In October 2021, AnubisDAO raised 13,556 ETH from crypto investors owing to the predated Dogecoin (DOGE) trend. However, roughly 20 hours into the investment, the funds were sent to a different address — resulting in an instant loss for the investors.

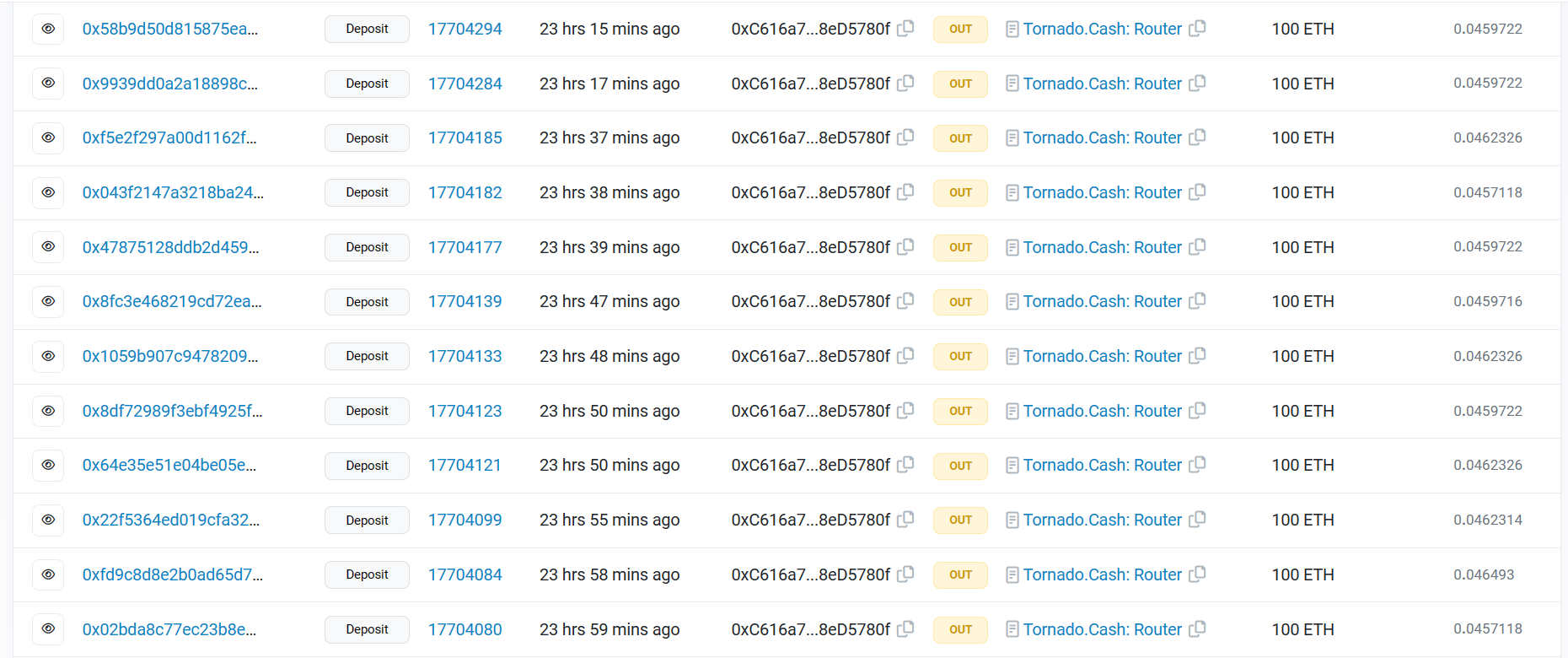

Between July 15 and 16, the illicit funds were moved via Tornado Cash, a decentralized protocol that allows private transactions. The person in possession of the 13,556 ETH divided and moved the funds via 100 ETH per transaction, as shown in the screenshot below.

The information was brought forward by blockchain investigator PeckShield, back when 13,556 ETH was worth roughly $60 million. After almost two years, the stolen funds amounted to almost 26.2 million at the time of writing.

It seems the rugged @AnubisDAO funds are being washed via @TornadoCash https://t.co/DPoZ1ifSNX https://t.co/LvDSUsL6tS pic.twitter.com/mKfSdTE6D9

— PeckShieldAlert (@PeckShieldAlert) July 16, 2023

As the duped investors see their funds being siphoned away into the abyss, a few remain optimistic about a highly unlikely scenario of getting a refund once the bear market recovers. As a result, investors are advised to do thorough research about a project and its founders before making any investment.

Related: Crypto scams are down 77% — but this exploit is making a huge comeback

Losses from the Multichain exploit forced lending protocol Geist Finance to shut down permanently. The latest post confirms the team does not plan to reopen lending and borrowing on Geist.

1/2 After confirmation from Multichain that the funds will not be recovered, we are announcing that Geist will not reopen. Because Chainlink oracles are tracking the value of real USDC, USDT, WBTC or ETH, they are not aware of the real value of Multichain assets.

— Geist Finance (@GeistFinance) July 14, 2023

A related technical complication makes it “impossible” for Geist Finance to reenable lending as doing so would result in bad debt for holders of non-Multichain coins such as Magic Internet Money (MIM) or Fantom (FTM).

Magazine: Experts want to give AI human ‘souls’ so they don’t kill us all

Go to Source

Author: Arijit Sarkar