Bitcoin could bring ‘substantial change’ for many people disillusioned with current politics, says expert

Share this article

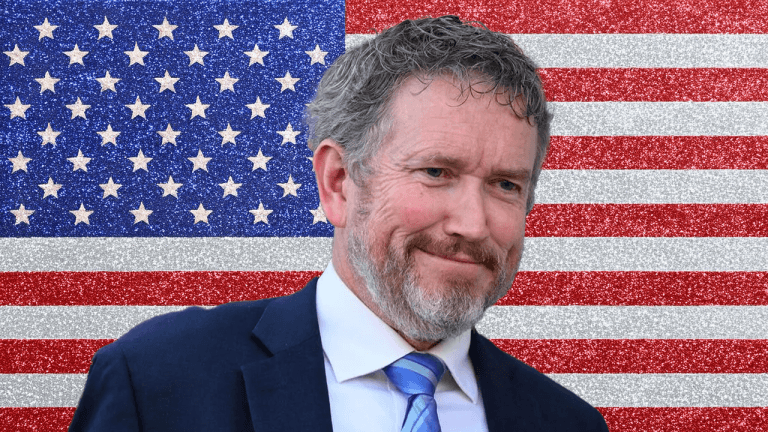

Bitcoin and the crypto industry have become major topics in this year’s US presidential election. For many people disillusioned with current politics, Bitcoin could bring substantial change, according to Raphael Zagury, Chief Investment Officer at Swan Bitcoin, a Bitcoin investment platform.

“It started with senators talking about bitcoin. Then we had more people talking about it. And now we have Trump coming in, and which was a surprise for most people, even for some of us who had been in Bitcoin for a long time, to hear him saying the positive things that he did,” stated Zagury at Market Domination Overtime hosted by Yahoo Finance journalist Julie Hyman on Sunday.

“For people that are very disillusioned with a lot of things that are happening in politics, this could be a very substantial change,” he added.

Initially, the idea of Bitcoin being discussed in presidential debates was considered improbable, according to Zagury. However, things have changed. Bitcoin discussions started with senators and have grown to include figures like Trump.

Trump’s positive stance on Bitcoin and the crypto industry has surprised many within the Bitcoin community, even long-time Bitcoin enthusiasts, the expert noted.

Zagury also believes the approval of spot Bitcoin exchange-traded funds (ETFs) in the US has been a critical development. He thinks that “all ETFs should be approved.”

“The bottom line of all of this is that we’re getting a lot of things that, you know, we’ve been looking for for a long time, which is getting more support, more clarity around…how you should hold Bitcoin, how you can wrap it,” he explained.

Zagury’s remarks came amid the anticipation of the spot Ethereum ETF launch in the US. On Friday, seven ETF issuers submitted their amended S-1 filings, setting the stage for a potential launch soon.

Bloomberg ETF analyst Eric Balchunas recently reiterated his prediction that July 2 would be the tentative date for the trading debut.

Recent S-1 filings have also sparked discussions about sponsor fee competition among firms, with BlackRock’s undisclosed fee being a particularly anticipated detail. Balchunas expects BlackRock’s fee to be below 0.30%.

According to the filing, Franklin Templeton will charge a 0.19% management fee, but it will waive the fee for the first $10 billion invested for six months. Meanwhile, VanEck will charge 0.20% in fees but will waive the fee for the first $1.5 billion invested.

In addition to fee disclosure, seed investment is a major highlight of the S-1 amendments.

Fidelity disclosed that FMR Capital invested $4.7 million by purchasing 125,000 shares at $37.99 per share on June 4.

BlackRock previously announced receiving $10 million in seed funding.

Invesco Galaxy and Grayscale also revealed seed investments of $100,000 each for their respective Ethereum ETFs.

Share this article

Go to Source

Author: Vivian Nguyen