Bitcoin ready to revert a two-week downtrend: but there’s a catch

Share this article

URL Copied

Bitcoin (BTC) spiked past $70,000 today and broke its two-week downtrend. Trader Rekt Capital highlights, however, that this already happened recently, and a daily close above the resistance must occur to confirm this breakout.

Bitcoin broke its two-week downtrend today

However, we have seen upside wicks beyond this downtrend before

Which is why a Daily Close later today is needed to confirm this breakout$BTC #Crypto #Bitcoin pic.twitter.com/0jjg7TeebA

— Rekt Capital (@rektcapital) June 3, 2024

The trader shared on X that this downtrend started near the $71,500 price level, and it’s not something out of the ordinary in Bitcoin’s post-halving periods. It consists of rejections at gradually lower prices, forming lower highs. The daily close above $68,000 is then imperative so that BTC can start picking momentum back again.

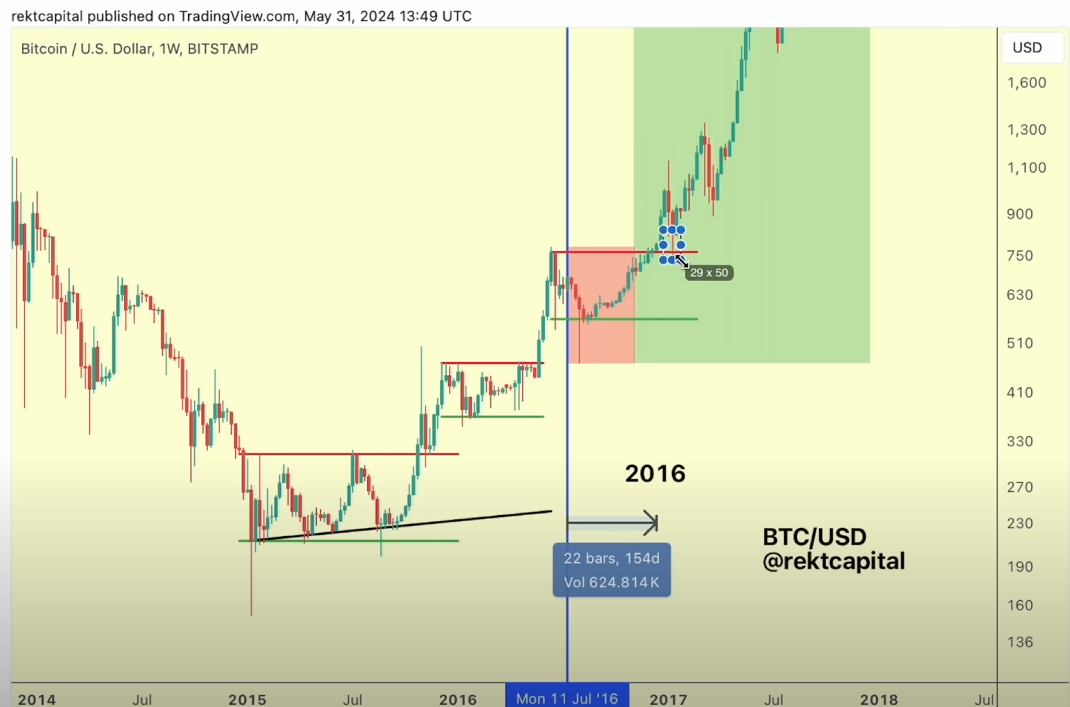

Moreover, Rekt Capital frequently emphasizes that Bitcoin has two phases left in the current bull cycle: the re-accumulation phase and the parabolic upward movement phase. In a video published on June 2nd, the trader compares the current cycle with the 2016 halving, as both cycles registered multiple accumulation periods.

Notably, the current re-accumulation period might take 150 to 160 days to end, starting on April 15th. “We do see lots of cross-similarities between 2016 and 2024: the re-accumulation ranges here [2016] are very similar to what was seen in 2024, and the post-halving danger zone is very similar to what we saw,” added Rekt Capital.

Consequently, if history repeats itself, Bitcoin might consolidate between $68,000 and $71,500 up until September before the upward parabolic movement phase starts. This means that even with a daily close today above resistance, history says BTC won’t start a strong bullish movement in the short term.

Share this article

URL Copied

The information on or accessed through this website is obtained from independent sources we believe to be accurate and reliable, but Decentral Media, Inc. makes no representation or warranty as to the timeliness, completeness, or accuracy of any information on or accessed through this website. Decentral Media, Inc. is not an investment advisor. We do not give personalized investment advice or other financial advice. The information on this website is subject to change without notice. Some or all of the information on this website may become outdated, or it may be or become incomplete or inaccurate. We may, but are not obligated to, update any outdated, incomplete, or inaccurate information.

Crypto Briefing may augment articles with AI-generated content created by Crypto Briefing’s own proprietary AI platform. We use AI as a tool to deliver fast, valuable and actionable information without losing the insight – and oversight – of experienced crypto natives. All AI augmented content is carefully reviewed, including for factural accuracy, by our editors and writers, and always draws from multiple primary and secondary sources when available to create our stories and articles.

You should never make an investment decision on an ICO, IEO, or other investment based on the information on this website, and you should never interpret or otherwise rely on any of the information on this website as investment advice. We strongly recommend that you consult a licensed investment advisor or other qualified financial professional if you are seeking investment advice on an ICO, IEO, or other investment. We do not accept compensation in any form for analyzing or reporting on any ICO, IEO, cryptocurrency, currency, tokenized sales, securities, or commodities.

Go to Source

Author: Gino Matos