Bitcoin UTXOs echoing March 2020 ‘black swan’ crash — New research

BTC price performance may be weathering a storm not seen since COVID-19 sparked a 60% drawdown three-and-a-half years ago.

Bitcoin (BTC) is recovering from a “black swan” event last rivaled by the March 2020 COVID-19 crash, data suggests.

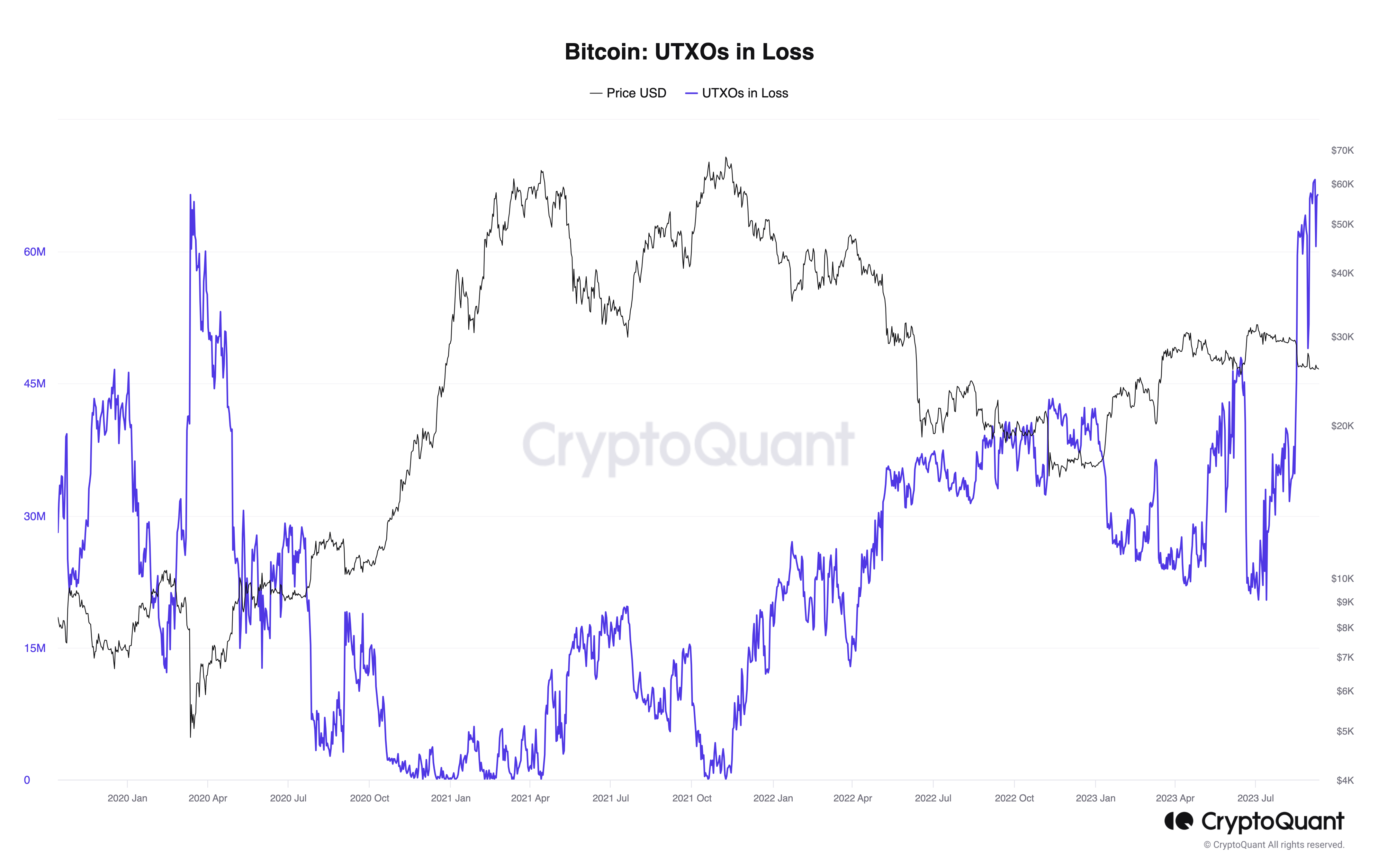

In one of its Quicktake posts on Sep. 7, on-chain analytics platform CryptoQuant revealed a major spike in loss-making unspent transaction outputs (UTXOs).

CryptoQuant: Bitcoin UTXOs in Loss “mirror” March 2020

Bitcoin may be worrying market participants with current BTC price weakness, but on-chain data paints an intriguing picture of activity “under the hood.”

UTXOs represent BTC left over after an on-chain transaction is executed. CryptoQuant’s UTXOs in Loss metric tracks when large numbers of these UTXOs are worth more than they were when the BTC was originally bought.

Currently, more of these are in loss compared to their original acquisition price than at any time since March 2020.

At the time, BTC/USD dropped 60% to its lowest levels since March 2019 — lows which were never seen again.

Considering the current data from UTXOs in Loss, CryptoQuant contributor Woominkyu ventured that, like March 2020, Bitcoin may be seeing, or already bouncing back from, a curveball selling event.

He summarized:

“Given that the current level of the ‘UTXOs in loss’ indicator mirrors that of the Black Swan event between March and April 2020 (due to the Coronavirus), those anticipating another Black Swan event might want to consider whether we are already in the midst of the event they are waiting for.”

In percentage terms, 38% of UTXOs were in loss at the end of August, a figure last seen in April 2020.

“When many UTXOs are in loss, investors might be more inclined to sell, hinting at market anxiety. Conversely, when most UTXOs are profitable, it suggests an optimistic outlook and a stronger holding sentiment among investors,” Woominkyu added.

Underwater Bitcoin speculators grow

Bitcoin meanwhile remains locked in a tight range amid a lack of overall BTC price trend.

Related: Bitcoin speculators now own the least BTC since $69K all-time highs

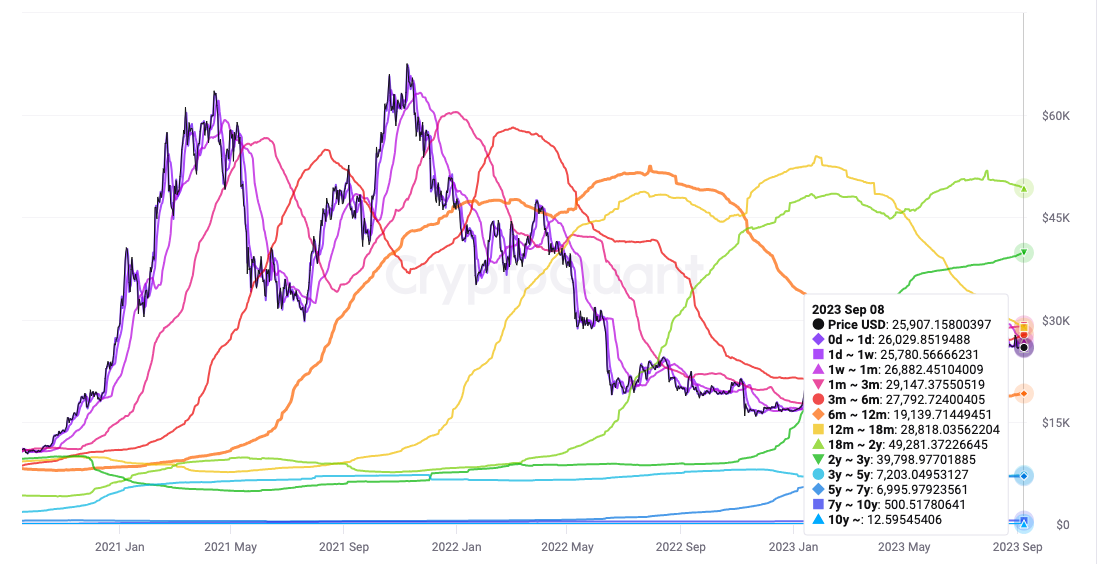

With neither a breakout nor breakdown willing to complete, cost basis data likewise shows current spot price caught between the acquisition prices of various investor cohorts.

This “Realized Price” — the price at which the supply last moved, divided by age group — shows that short-term holders fall into aggregate loss when BTC/USD is below around $27,000.

A full capitulation event, however, has yet to be recorded on-chain.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Go to Source

Author: William Suberg