Bitcoin on-chain metrics remain robust during July’s rebound: Bitfinex

Key Takeaways

- BTC price recovered 29% since July 5, reaching a 38-day high of $68,560.

- ETF inflows totaled $1.2 billion last week, signaling renewed investor interest.

Share this article

Bitcoin (BTC) reached a 38-day high of $68,560 last week, marking a 29% recovery since July 5th, and the latest edition of the “Bitfinex Alpha” reports that on-chain metrics for BTC are strong.

BTC recorded its first sequence of five consecutive green daily closes since early March, indicating a robust momentum shift. The market has absorbed the sell-off from the German government, which liquidated over 48,000 BTC.

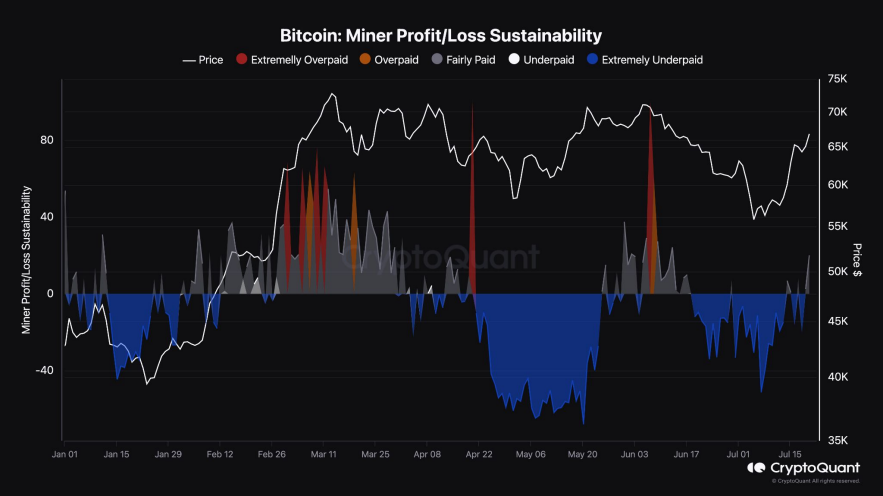

Moreover, miner selling pressure, typically high after halvings, has decreased. The Miner Sustainability metric shows miners have returned to profitability for the first time in a month. The Miner Position Index has reached equilibrium, suggesting other forces now play a more substantial role in BTC price determination.

Notably, spot Bitcoin exchange-traded funds (ETF) outflows have become the main downward pressure on price. However, last week saw almost $1.2 billion in total inflows, with the average inflow cost basis at $58,200.

Moreover, the Cumulative Volume Delta metric indicates more aggressive buying pressure over the past couple of weeks, marking the first net-buy-side aggression since March.

Bitcoin Exchange Reserve has rapidly decreased, suggesting large investors are buying the dips and moving assets off exchanges. This behavior points to accumulation and a potential supply squeeze.

On the investors’ side, the Short-Term Holder Realized Price has moved up alongside the BTC price, indicating dip-buying. The Long-Term Holder Realized Price has moved past $20,000 for only the second time in history, reflecting net accumulation by long-term holders for the first time since the 2022 bear market.

Share this article

Go to Source

Author: Gino Matos