BlackRock debuts new spot Bitcoin ETF in Canada

Key Takeaways

- BlackRock has launched the iShares Bitcoin ETF on Cboe Canada.

- The newly listed fund joins other iShares ETFs already trading on the exchange.

Share this article

BlackRock Canada, the Canadian arm of the global investment management firm, announced Monday the launch of its iShares Bitcoin ETF on Cboe Canada. The fund, trading under the tickers IBIT (Canadian dollars) and IBIT.U (U.S. dollars), is designed to offer Canadian investors a regulated and accessible means of gaining exposure to the world’s largest digital asset.

BlackRock’s new Bitcoin ETF adopts a funds-of-funds approach, meaning that it invests substantially or all of its assets in the US-listed iShares Bitcoin Trust ETF, which in turn invests in and holds long-term Bitcoin. Investors can buy shares of the ETF through standard brokerage accounts.

“The launch of the iShares Bitcoin ETF in Canada underscores BlackRock’s commitment to innovation and providing clients access to an expanding world of investments,” said Helen Hayes, Head of iShares Canada, BlackRock.

“The iShares Fund provides Canadian investors with a convenient and cost-effective way to gain exposure to Bitcoin and helps remove the operational and custody complexities of holding bitcoin directly,” she added.

The Bitcoin ETF joins seven other iShares products already trading on Cboe Canada. The exchange handles approximately 15% of all trading volume in Canadian listed securities. It’s also a go-to platform for ETFs from Canada’s largest issuers, Canadian Depositary Receipts, and various growth companies.

“Cboe has a history of bringing many first-of-their-kind products to market, including spot crypto ETFs in the United States, and we’re thrilled to continue our leadership in innovation by listing BlackRock Canada’s IBIT ETF on Cboe Canada,” said Rob Marrocco, Global Head of ETF Listings at Cboe.

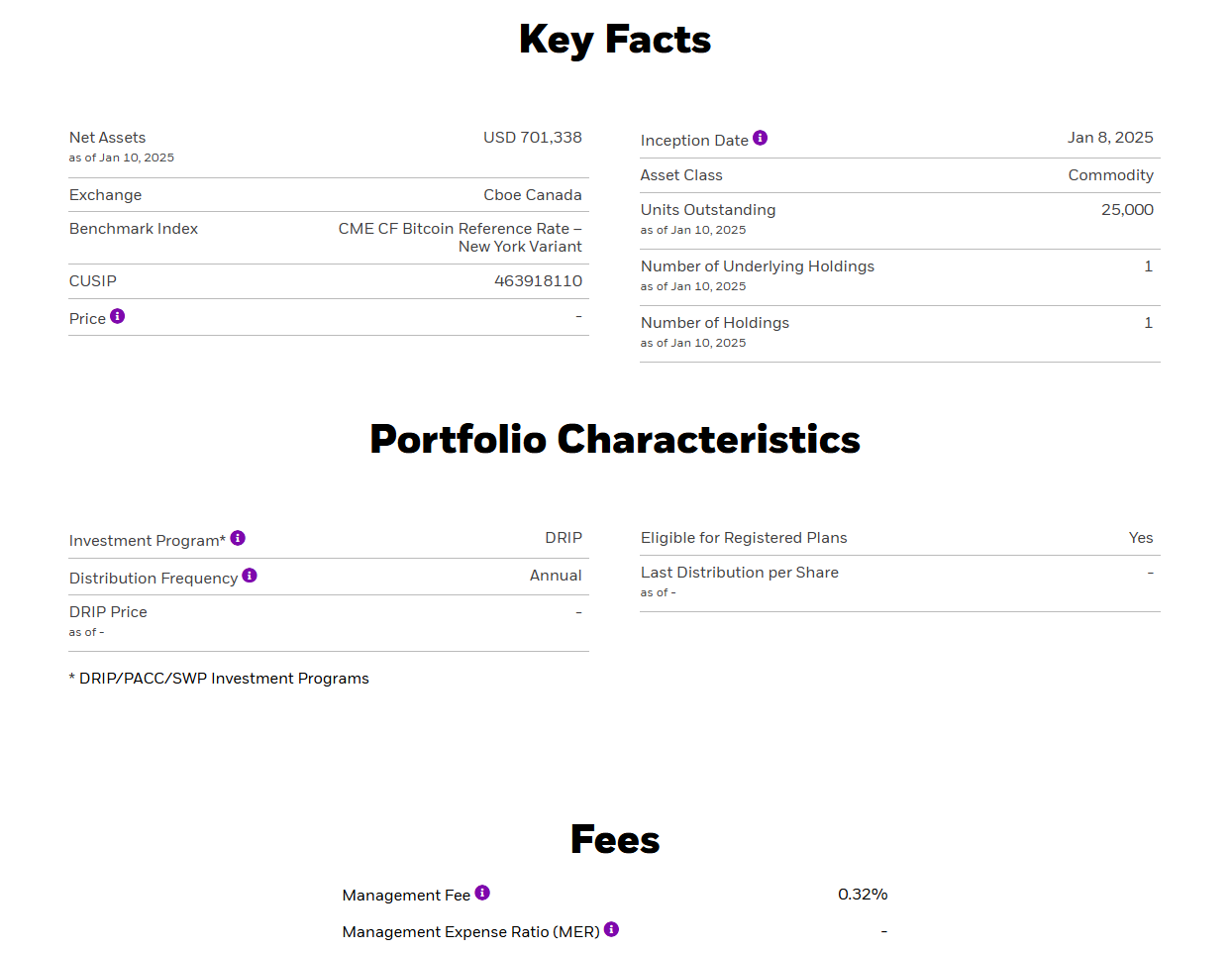

As of January 10, the Canada-listed iShares Bitcoin ETF had net assets of around $701,338, with 25,000 units outstanding. BlackRock charges a management fee of 0.32%.

Share this article

Go to Source

Author: Vivian Nguyen