BlackRock reports second day of outflows since January debut

Key Takeaways

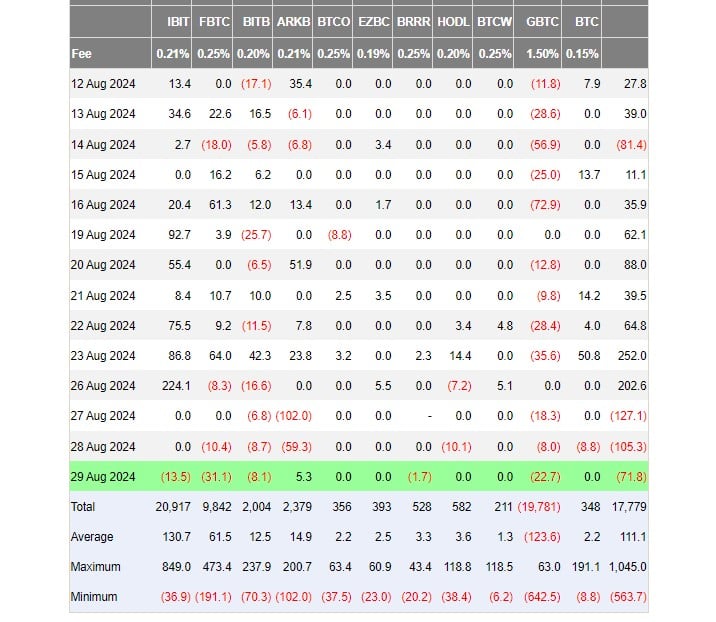

- The iShares Bitcoin Trust saw its second outflow since January, reporting $13.5 million withdrawn.

- US spot Bitcoin ETFs have experienced a three-day streak of net outflows.

Share this article

BlackRock’s spot Bitcoin exchange-traded fund (ETF), the iShares Bitcoin Trust, faced a setback on August 29, with investors pulling $13.5 million, data from Farside Investors shows. This marks the second day of outflows since the fund’s debut in January.

BlackRock’s iShares Bitcoin Trust, trading under the IBIT ticker, has seen consistent net capital almost every single day following its trading debut. As of August 29, IBIT drew almost $21 billion in net inflows, with its Bitcoin holdings exceeding 350,000 Bitcoin (BTC).

The fund experienced its first outflow on May 1, totaling about $37 million. On the same day, US spot Bitcoin ETFs saw their largest daily outflow, with approximately $564 million withdrawn.

So far this week, IBIT reported gains only on Monday, with $224 million in new investments. Thursday’s negative performance came after two days of zero flows.

ARK Invest/21Shares’ Bitcoin ETF was the only fund to report net inflows on Thursday, while competing Bitcoin ETFs managed by Fidelity, Bitwise, Valkyrie, and Grayscale, saw a cumulative net outflow of over $63 million.

Overall, the group of US spot Bitcoin ETFs ended yesterday with nearly $72 million in net outflows, extending its losing streak to three consecutive days.

Bitcoin fails to hold $61,000

The negative performance of US spot Bitcoin ETFs comes amid Bitcoin’s ongoing price stagnation.

Bitcoin’s recent attempt to reclaim a stable position above $61,000 faltered, with the price dropping back below $59,000 during Thursday’s US trading session, according to data from TradingView.

Despite a brief climb, Bitcoin was only marginally up by 0.6% over the past 24 hours. At press time, BTC is trading at around $59,000, down around 10% over the past month.

Meanwhile, Ether also struggled, recording a slight decline of 0.5% and barely maintaining above the $2,500 mark.

Share this article

Go to Source

Author: Vivian Nguyen