BlackRock Bitcoin ETF attracts $205 million inflows amid market stagnation

Key Takeaways

- BlackRock’s iShares Bitcoin Trust recorded $205 million in net inflows on Monday.

Share this article

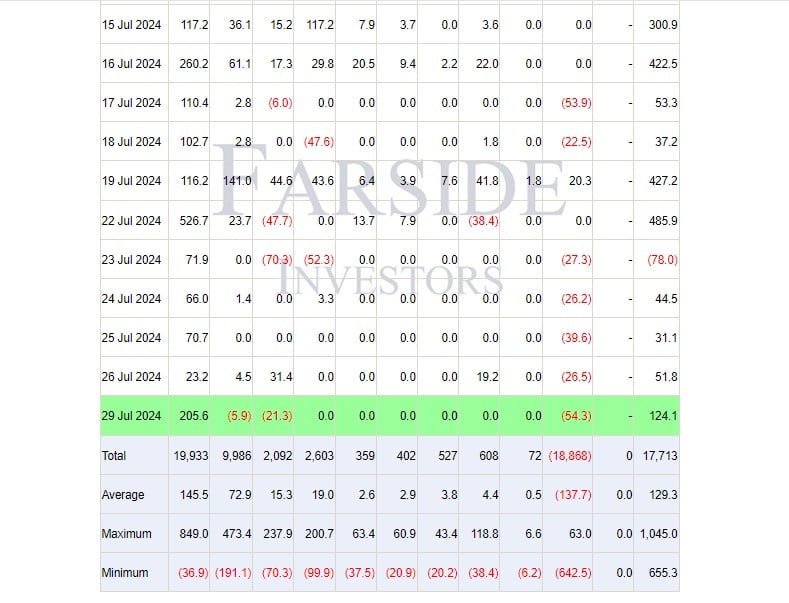

BlackRock’s iShares Bitcoin Trust (IBIT) outperformed its ETF peers on Monday, attracting around $205 million in net inflows while the rest of the market reported either losses or zero net flows, data from Farside Investors shows.

US spot Bitcoin ETFs collectively attracted approximately $124 million in net inflows on Monday, with BlackRock’s IBIT accounting for the entire gain.

In contrast, Grayscale’s GBTC, Bitwise’s BITB, and Fidelity’s FBTC experienced net outflows of $54 million, $21 million, and $6 million, respectively. Other competing funds reported zero inflows.

The Bitcoin ETF market will soon welcome Grayscale’s Bitcoin Mini Trust (BTC), a newly approved mini version of the Grayscale Bitcoin Trust. The spin-off offers a competitive edge with a management fee of 0.15%, significantly lower than the 1.5% charged by GBTC.

Starting July 31, Grayscale will transfer 10% of GBTC’s holdings to the Mini Trust, with GBTC shareholders receiving proportional shares in the new fund. With the new BTC fund, Grayscale aims to provide investors with a lower-cost option to gain exposure to Bitcoin through Grayscale’s investment products.

BTC’s lower fees will position it as a strong competitor in the Bitcoin ETF market. Grayscale’s GBTC, once a dominant player, has lost its edge since being converted to an ETF. As of July 29, GBTC’s assets under management (AUM) were $18.1 billion, outpaced by BlackRock’s IBIT with almost $23 billion in AUM.

Share this article

Go to Source

Author: Vivian Nguyen