BlackRock, WisdomTree Bitcoin ETFs dominate daily inflows

Key Takeaways

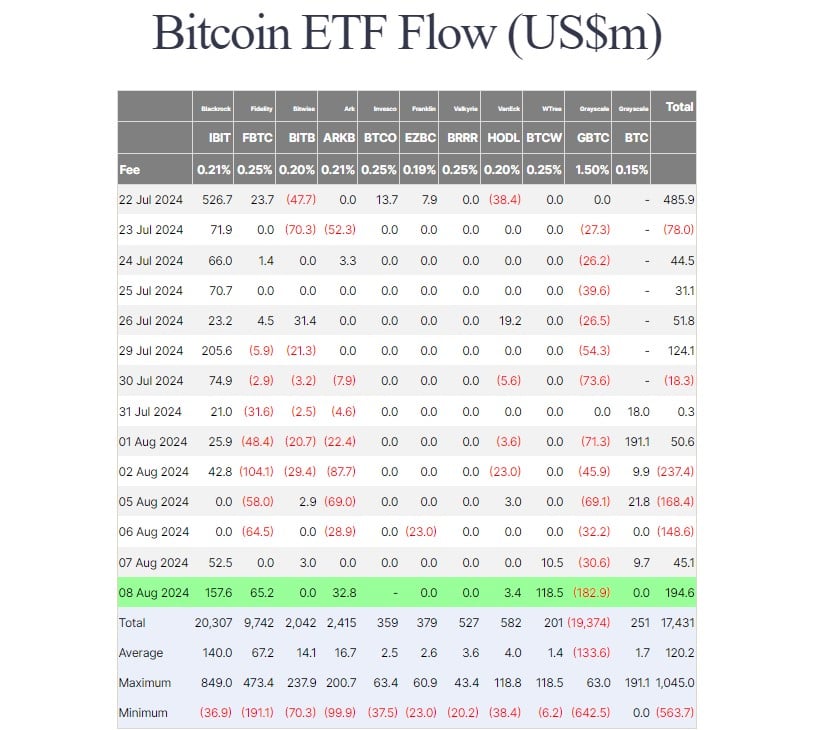

- BlackRock’s IBIT led the pack, attracting over $157 million in net capital.

- WisdomTree’s BTCW had a historic day with over $118 million, its largest inflow since its trading debut.

Share this article

BlackRock’s iShares Bitcoin Trust (IBIT) solidified its market leadership on August 8, attracting over $157 million in net capital, according to data from Farside Investors. But the day’s standout performer was WisdomTree’s Bitcoin fund (BTCW), which experienced its largest single-day inflow since launch at over $118 million.

Since its January debut, BTCW has struggled to compete with other Bitcoin ETFs, with net capital never surpassing $20 million until Thursday’s surge. The fund’s total inflows now stand at $201 million, though this remains relatively small compared to its competitors.

In addition to IBIT and BTCW, Bitcoin ETFs launched by Fidelity, ARK Invest/21Shares, and VanEck also reported inflows. Other ETFs, excluding Invesco’s BTCO, saw zero flows.

Strong inflows into IBIT and BTCW efficiently offset the massive capital drained from the Grayscale Bitcoin ETF (GBTC). On Thursday, investors withdrew approximately $183 million from the fund, the largest since early April.

Overall, US spot Bitcoin exchange-traded funds (ETFs) collectively attracted around $194 million in new investments on Thursday, extending their inflow streak after bleeding over $300 million earlier this week.

Share this article

Go to Source

Author: Vivian Nguyen