DOT price targets new highs and investors expect the ongoing Polkadot parachain auctions to send the price on a trajectory that mirrors Kusama’s 2020 breakout.

This week a number of contenders are set to participate in Polkadot's first parachain auctions and this process tends to place buy pressure on DOT, while also giving aspiring blockchain projects a chance to show why they offer the most competitive solutions to the different demands that exist in the crypto sector.

The ongoing Polkadot parachain auctions follow the success of similar auctions on its sister network Kusama, where projects like Moonriver (MOVR) and Karura successfully secure a parachain slot for the next year.

The Kusama parachain auctions began during a downturn in the wider crypto market and played a role in helping KSM recover from a low of $148.85 on July 19 to its current price near $457 as the tokens pledged to auctions were pulled from circulation.

Here’s a look at some of the parachain auctions currently underway on the Polkadot network and similar to the Kusama auctions, DOT could receive a boost as an increasing number of tokens are removed from the circulating supply.

Acala (ACA) is a layer-one smart contract platform billed as the decentralized finance (DeF) and liquidity hub of Polkadot. The protocol is Ethereum (ETH) compatible and has built-in liquidity and ready-made financial applications including a trustless exchange, decentralized stablecoin (aUSD), and DOT Liquid Staking (LDOT).

Acala is the sister network of the Karura (KAR) DeFi protocol which operates on the Kusama network and offers many of the same functionalities.

Given that DeFi has emerged as one of the foundational sectors of the cryptocurrency ecosystem, having a large, established DeFi protocol that can attract liquidity and offer token holders some yield is a must-have for every network.

Moonbeam (GLMR) is a fully Ethereum compatible smart contract platform designed to simplify the process for multi-chain projects to launch on the Polkadot network.

Moonbeam’s sister network on Kusama is Moonriver, which offered the highest reward rating of all parachains launched on the Kusama network.

Simplifying the process of a cross-chain migration to Polkadot is an important issue to address in the current market because high fees on Ethereum is still one of the main reaons why investors and developers have shifted to lower-cost alternatives like Polygon, Fantom and Avalanche.

If Moonbeam can help simplify that process for interested projects, it has the potential to help boost the overall strength and activity on Polkadot.

Astar (ASTR) is a protocol focused on the creation of a scalable and interoperable infrastructure for Web3.0 through the creation of a multi-virtual machine supporting platform that connects compatible layer-one protocols with the Polkadot network.

Astar is also capable of acting as a scalable smart contract platform that helps the Polkadot relay chain which is not able to support smart contracts.

Parallel Finance (PARA) is a DeFi lending protocol and automated money market (AMM) that supports both Polkadot and Kusama-based assets and also enables token holders the ability to put their assets to work by earning interest.

The protocol aims to offer higher liquidity, yield and capital efficiency for the Polkadot ecosystem and users will eventually be able to lend, stake and borrow assets from any of the supported networks.

Related: DeFi protocol Acala raises $400M in crowdloans during first Polkadot parachain auction

The ongoing parachain auctions for Polkadot are likely to put positive pressure on the price of DOT because users are buying tokens to contribute to crowdloans and this effectively removes the tokens from circulation for two years.

As seen in the chart below, the introduction of crowdloans on Kusama in June 2021 resulted in a spike in token price while the price action for DOT was more muted.

Now the opposite is occurring as the price of DOT is seen outperforming the price of KSM beginning in mid-September just as excitement for the Polkadot parachain auctions began to increase.

With eleven sets of parachain auctions set to run weekly between Nov. 11 2021 and March 10, 2022, there is a strong possibility that the price of DOT will continue to increase as long as demand for parachain access continues.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph.com. Every investment and trading move involves risk, you should conduct your own research when making a decision.

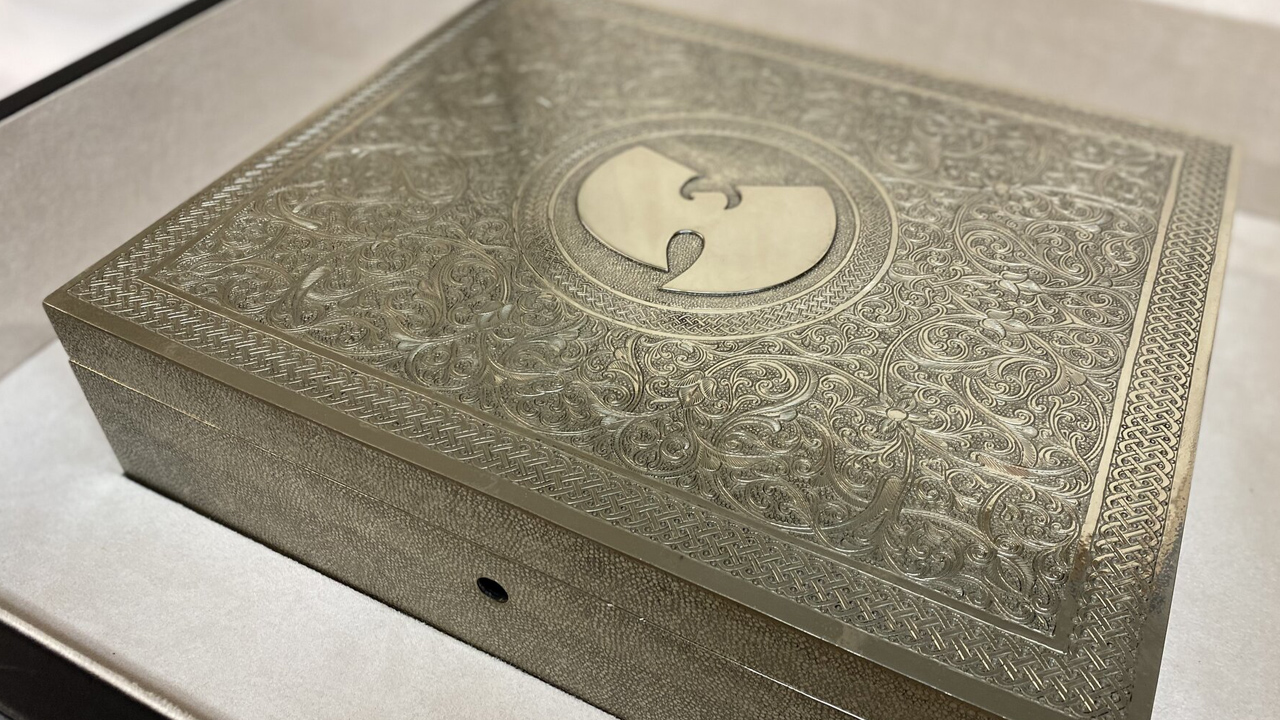

After fighting in court since 2015, the former hedge fund manager Martin Shkreli was sentenced to seven years in prison for conspiring to commit securities fraud and he was forced to pay $7.4 million in fines. One of Shkreli’s prized possessions, an unreleased Wu-Tang Clan album, was seized by the U.S. Marshals and sold for […]

After fighting in court since 2015, the former hedge fund manager Martin Shkreli was sentenced to seven years in prison for conspiring to commit securities fraud and he was forced to pay $7.4 million in fines. One of Shkreli’s prized possessions, an unreleased Wu-Tang Clan album, was seized by the U.S. Marshals and sold for […]

Participants piled $7 million into a dutch auction to win one of 50 Golden Tokens granting ownership to unminted NFTs from artist Tyler Hobbs.

Nonfungible token (NFT) investors have poured $7 million into a dutch auction that sold 50 tokens conferring ownership over digital artworks that will not be minted until December.

Tyler Hobbs, the artist behind the popular NFT series Fidenza, will launch 100 one-a-kind digital artworks in his latest collection Incomplete Control at the New York City-based Bright Moments gallery from Dec. 9 to Dec. 13.

On Oct. 22, Hobbs’ fans contributed 1,800 ETH (worth more than $7 million) in exchange for 50 of 100 “Golden Tokens” that grant its holder ownership rights to one of the artworks slated to be minted during the event. Each of the tokens features a number between one and 50 that corresponds to a specific artwork from the collection.

The Golden Tokens were sold via a dutch auction hosted by Mirror Protocol that lasted just 90 minutes. The tokens were initially priced at 500 ETH each, with the price scheduled to decline by non-linear intervals every 5 minutes until reaching a floor of 5 ETH. All 50 tokens were sold at prices of between 30 Ether (roughly $120,000) and 80 Ether ($320,000) each.

Nonfungible token (NFT) investors have piled $7 million into a dutch auction that sold 50 tokens allowing buyers to mint digital artworks they have not seen.

did a thing today

— p.mirror.xyz (@patrickxrivera) October 22, 2021

congrats @tylerxhobbs and @brtmoments on raising ~1,800 ETH for NFT tickets redeemable for IRL mints

also s/o the entire @viamirror team across protocol, product, design, data, growth, etc. for shipping a dutch auction protocol + UI in a week pic.twitter.com/nfSxhmPlM6

The remaining Golden Tokens will be randomly distributed to 50 of the wallets that currently hold artworks from Hobbs’ previous series Fidenza or the CryptoCitizens NFT project on Nov. 5. Individuals who receive the tokens will be entitled to purchase an Incomplete Control NFT at for 15 ETH a 50% discount compared to the auction’s final clearing price.

Hobbs describes his Incomplete Control series as exploring themes of imperfection, and how the digital sphere is able to transcend many of the imperfections present in the physical world. Hobbs’ website states:

“The forces of chaos and entropy give the natural world a certain warmth, and there are patterns and lessons there that we can use. I like to introduce these elements into the digital world, and Incomplete Control continues that work.”

Related: 17% of addresses snapped up 80% of all Ethereum NFTs since April

Hobbs’ previous NFT series Fidenza comprises a curated drop of 999 NFTs that comprise unique generative artworks created using the purchaser’s transaction hash as a data input. The collection was sold for more than 37,000 ETH (roughly $400,000) and is being showcased on the generative NFT platform, Art Blocks.

During September, Solana-based NFT project SolBlocks came under fire from Hobbs for using Fidenza’s open-sourced code to generate images for commercial purposes without Hobbs authorization. Hobbs has since rejected SolBlocks’ offer to share profits from their sales with him.

Mojito previously helped develop Sotheby’s new digital NFT marketplace platform, Metaverse.

NFT development studio Mojito announced Friday that they have raised $20M in seed funding from a number of investors, including internationally known auction house Sotheby's.

According to an announcement published in Forbes, Sotheby’s auction house in partnership with Future Perfect Ventures, Creative Artists Agency and NEA’s Connect Ventures, contributed to the round at Mojito’s estimated value of $100 Million.

The Delaware-based start-up indicated that it will use this new injection of capital to grow and develop its engineering teams, make a better version of its current NFT platform, and further develop its NFT trading and investment platforms.

The NFT market has seen its total monthly sales drop from early September, though numbers have held at between $1.8 and $2.1 Billion for the last month according to nonfungible.com. The NFT market’s total monthly sales hit an all-time high of $3.7 Billion on Sept. 4 after a steady rise in late July. $31 million of the current total NFT market sales comes from the sale of art-based assets.

Digital art marketplaces such as OpenSea achieved prominence during this timeas well, reportedly hosting 98 percent of the market’s transactions through August of 2021.

Art dealers and museums have taken notice, and are beginning to follow suit as they follow the money apparent in this new market. Both Sotheby’s and Christie’s auction houses have had a number of successful NFT auctions in the past year. Christie’s was the first of the two to host a global auction of an NFT.

Mojito previously aided Sotheby’s in the development of its new digital NFT marketplace, known as Metaverse.

Businessman and TV personality Kevin O’Leary, a one-time vocal opponent to cryptocurrency-based investments, recently stated his belief that the NFT market would become bigger than Bitcoin during an interview on the Pomp podcast.

The “Coinbase effect” has just been observed for two of three tokens freshly listed on the exchange’s Pro platform.

Leading U.S. cryptocurrency exchange Coinbase has announced three new listings on its Pro exchange, predictably causing the tokens’ prices to pump.

On Oct. 19, Coinbase Pro announced new listings in ARPA Chain (ARPA), Bounce (AUCTION), and Perpetual Protocol (PERP). It confirmed that trading will become available on or after 21.00 PT on Oct. 19, provided ample liquidity enters the market. The three tokens will be each paired with USD, EUR, and USDT.

While AUCTION and ARPA rallied during the hours leading up to the announcement’s publication to each gain roughly 25% in the past 24 hours, the news appears to have stirred little interest among PERP traders.

After seeing a slight initial climb at the time of the announcement, PERP has lost 5% in the past 24 hours to last trade hands for roughly $17. PERP is currently down 30.7% from its Aug. 30 all-time high of $24.40, according to CoinGecko.

ARPA Chain, which enables privacy-focused smart contracts and off-chain transactions began to see momentum roughly 9 hours before the official announcement was published. According to CoinGecko, ARPA is up 25% over the past 24 hours and is roughly 8% of its Oct. 13 all-time high.

AUCTION, the native token of decentralized auction protocol Bounce, also surged at the time of the announcement, climbing 23% from roughly $33 to $40 in the past 24 hours.

Related: Regulatory and privacy concerns trail SEC’s threat to Coinbase

According to a Coin Metrics report published in June 2020, the impact of token listings on Coinbase Pro is significantly overstated. Concluding that new Coinbase markets typically posted average price movements of around -1% to +14% from ten days before until ten days after the listing announcement.

In April this year, Messari posted a contradictory report finding that the “Coinbase effect” results in new tokens gained roughly 90% on average after five days.

Following the competition, a replica of Carlsen's NFT trophy was auctioned off to a fan for 6.88 ETH.

For the first time in chess history, grandmaster Magnus Carlsen has been awarded a nonfungible token (NFT) trophy for winning an international chess tournament, Meltwater Champions Chess Tour (MCCT). The tournament minted a number of NFT trophies and collectibles to indefinitely preserve the game’s most defining moments.

Speaking to Cointelegraph, Carlsen shared his appreciation of the cryptocurrency ecosystem for supporting virtual chess tournaments. The chess champion cited MCCT’s recent partnership with FTX crypto exchange that allowed professional chess players to compete for a prize fund of 2.1825 Bitcoin (BTC) ($81,079).

“NFTs help the chess community celebrate great moments and possibly also reward those that have already invested so much time in growing the game. With Chess Champs, this is just getting started and I look forward to seeing it evolve,” Carlsen said.

Chess Champs minted two identical editions of the Champion’s Trophy NFT on the Ethereum blockchain, which were digitally signed by Carlsen after winning the tournament. The second NFT trophy was auctioned off at 6.88 ETH, approximately $24,700 at the time of purchase. According to a source, the bidding for the NFT trophy went up to 11 Ether (ETH) ($27,093) after the deadline. Carlsen said:

“It feels great to share the trophy with a passionate fan. It will be interesting to play a match with him and meeting him during the next season’s Champions Chess Tour Final.”

Collectibles also include NFTs dedicated to various chess pieces (such as pawn and bishop) on the blockchain.

Related: Valued at $4.3B, NFT platform Sorare to invest in women’s sports

As the NFT boom continues to bridge the gap between sports and digital entertainment, NFT marketplaces offer new ground for innovation.

Sorare, a marketplace for NFT trading cards, attained a $4.3 billion valuation after raising $680 million in Series B funding led by Japanese fintech giant SoftBank. As Cointelegraph reported, the company plans to use this funding to “significantly accelerate the development of women’s sports.”

Moreover, Sorare has also secured partnerships with La Liga soccer league and plans to onboard top-tier soccer teams as it diversifies its NFT-based portfolio offerings to other fantasy sports.

Three months after embracing crypto, Lloyds Auctions house reportedly sold a legendary rally car for $360,000 in Bitcoin.

Bitcoin (BTC) adoption is growing in the auction world, where privacy is a key concern. An anonymous buyer purchased a legendary rally car driven by iconic rally figures Colin McRae and Carlos Sainz, which was thought to be long-lost in an auction for half a million Australian dollars ($360,000) and reportedly used Bitcoin as a payment method.

Australian auction house Lloyds Auctions announced that the 1994 Subaru Prodrive 555 Group A World Rally Championship Car had been found in a barn, covered in dust, in the Victoria state of Australia.

The car was originally thought to be valued at 15,000–20,000 Australian dollars ($10,900–$14,500). But a six-month investigation from the International Classic Automobile Authentication and Rating System (ICAARS) revealed that “it may well be worth more than $1 million [$725,000].”

Lloyds said that the rally car, one of only 63 commissioned by Prodrive, had been sitting in the barn for 10 years, and the owner was unaware of the vehicle’s actual value. It only had three owners since its racing days, and its condition was untouched.

Touted as a “golden treasure” by an ICAARS inspector, the car went under the hammer on Sept. 26 and was auctioned for half a million Australian dollars. The winner was said to have paid the bid in Bitcoin.

Related: NFTs could mark a resurgence in art galleries

Lloyds announced in June that the Aussie auction house would start accepting crypto payments, enabling bidders to buy items auctioned on the platform with Bitcoin and other cryptocurrencies.

“As a longtime patron of Lloyds I had no hesitation and couldn’t believe how simple it was for me to pay with cryptocurrency,” a bidder then said, adding that the seller receives the payment in cash and “never know the difference.”

Beyond cryptocurrencies, nonfungible tokens (NFT) are also taking over the auction world by storm. Art galleries are adopting the new form of digital art as auctionable items. Sotheby’s auctioned Yuga Labs’ 101 Bored Ape Yacht Club NFT collection in September with a winning bid of $24.39 million.