Cryptocurrency exchange Kraken has launched a new regulated derivatives trading platform in Bermuda after obtaining a Class F Digital Business License from the Bermuda Monetary Authority. This platform offers over 200 contracts, including perpetual and fixed-maturity futures, and aims to provide a secure and reliable trading experience. The move highlights Bermuda’s supportive regulatory environment and […]

Cryptocurrency exchange Kraken has launched a new regulated derivatives trading platform in Bermuda after obtaining a Class F Digital Business License from the Bermuda Monetary Authority. This platform offers over 200 contracts, including perpetual and fixed-maturity futures, and aims to provide a secure and reliable trading experience. The move highlights Bermuda’s supportive regulatory environment and […]

The crypto exchange is expanding its offerings in Bermuda as the US SEC goes after it on its home turf.

Cryptocurrency exchange Kraken has opened a derivatives trading platform in Bermuda, having received a license from the Bermuda Monetary Authority (BMA).

Bermuda is becoming an attractive locale for regulating cryptocurrency activities. Kraken follows Coinbase International and HashKey Global to the island.

The BMA indicates that Payward Digital Solutions (Kraken’s legal name) received a Class F Digital Business License on July 30, enabling it to provide wallet services, operate as a digital asset derivative exchange provider and operate as a digital asset lending or digital asset repurchase transactions service provider, among other things.

The Financial Services Regulatory Authority (FSRA) of the Abu Dhabi Global Market (ADGM) and the Bermuda Monetary Authority (BMA) have signed a digital assets Memorandum of Understanding (MOU). This MOU establishes a framework for collaboration between the two regulatory authorities to support the creation and effective supervision of digital assets entities across their jurisdictions. It […]

The Financial Services Regulatory Authority (FSRA) of the Abu Dhabi Global Market (ADGM) and the Bermuda Monetary Authority (BMA) have signed a digital assets Memorandum of Understanding (MOU). This MOU establishes a framework for collaboration between the two regulatory authorities to support the creation and effective supervision of digital assets entities across their jurisdictions. It […]

The recent regulatory approval for Coinbase’s international subsidiary comes within a month of getting the NFA nod to offer crypto derivatives services to institutional clients in eligible U.S. states.

Coinbase International Exchange, a class F license holder from the Bermuda Monetary Authority (BMA), announced it has received additional regulatory approval, allowing the platform to offer perpetual futures trading to non-United States retail customers.

Launched in May 2023, Coinbase International already offered crypto derivates services to institutional clients. With the latest regulatory approval, the crypto platform will provide eligible customers access to regulated perpetual futures contracts on the Coinbase Advanced platform in the coming weeks. The exchange said perpetual futures accounts are maintained by Coinbase Bermuda and regulated by the BMA.

The crypto exchange claimed in its announcement that nearly 75% of crypto trading volume comes from the derivatives market, and the recent regulatory approval would help retail traders access the crypto derivatives market primarily dominated by the institutions.

The crypto platform also noted that Coinbase does not engage in market-making. It said the liquidity on the exchanges is provided by established, independent liquidity providers who have undergone thorough compliance reviews.

Coinbase claimed its platform would prove the right gateway for retail traders to access the derivatives market securely and competently. Only non-U.S. consumers in a few countries can use Coinbase International Exchange, and customers are tested to evaluate their eligibility for the product before they can open a Coinbase Advanced trading account.

Related: Legal scholars file amicus brief in support of Coinbase

The recent approval for Coinbase International to offer perpetual futures to retail customers comes just a month after the platform received approval from the National Futures Association (NFA) to offer investments in crypto futures to eligible institutional clients in the United States.

Coinbase has continued to make strides outside the U.S. despite facing a regulatory battle with the Securities and Exchange Commission over its services. The regulator filed a lawsuit against Coinbase in early June, alleging that the exchange violated local securities laws by selling unregistered securities.

Collect this article as an NFT to preserve this moment in history and show your support for independent journalism in the crypto space.

The Coinbase CEO has a lot of faith in Congress in making a “clear rule book” for crypto firms to follow. But the SEC? Not so much.

United States-founded cryptocurrency exchange Coinbase has no plans to move its operations out of the U.S., CEO Brian Armstrong told investors in an Q1 earnings call.

On May 5, Armstrong assured shareholders the firm is “100% committed” to the U.S. market over the long term despite regulatory uncertainty in the U.S.

“So let me be clear, we're 100% committed to the U.S. I founded this company in the United States because I saw that rule of law prevails here. That's really important, and I'm actually really optimistic on the U.S. getting this right.”

The “optimism” alluded to by Armstrong comes from his confidence in Congress soon passing a clear set of rules for crypto firms to follow:

“When I go visit DC, there is strong bipartisan support for Congress to come in and create new legislation that would create a clear rule book in the U.S. and I think it's really important for America to get this right.”

However, Armstrong’s comments weren’t entirely “optimistic.”

The chief executive is concerned about the unpredictable enforcement action of the Securities Exchange Commission, which comes in light of the firm being served with a Wells Notice by the securities regulator in late March:

“Despite our ongoing engagement with the commission, they have not been as clear about what their specific concerns are with Coinbase as we might like, and so I have to refrain from speculating too much.”

“It's especially difficult to predict the timeline of any potential SEC litigation that we might face,” Armstrong added.

The troubles led Coinbase to file an action in a U.S. federal court seeking to compel the SEC to answer a petition that has been pending since July.

Today, to provide greater transparency in our long-standing engagement with the SEC, we are sharing our response to the Wells notice we received last month. https://t.co/aquuWmxmRM

— Coinbase ️ (@coinbase) April 27, 2023

The back and forth comes as Coinbase launched Coinbase International Exchange (CIE) on May 2, which prompted many pundits to believe that Coinbase was looking for an escape route from the U.S.

The exchange is open to customers in 30 countries worldwide, including Singapore, Hong Kong, El Salvador, Philippines, Thailand and Bermuda — where CIE is now licensed from.

Today Coinbase launched Coinbase International Exchange @CoinbaseIntExch and will begin by offering BTC & ETH perpetual futures settled in USDC with up to 5x leverage to institutional clients in eligible jurisdictions outside of the U.S.https://t.co/OzhbgJlZ2K

— Coinbase ️ (@coinbase) May 2, 2023

Related: SEC has 10 days to respond to Coinbase complaint: Legal exec

Armstrong said the European Union is “in front” in terms of regulatory progress with its Markets in Crypto Assets (MiCA) legislation set to enter into effect in mid-2024 or early 2025:

“They've adopted comprehensive crypto legislation called MiCA, creates a single clear rule book for the entire region. It's pretty powerful.”

“I just got back from a trip from the U.K. and D.C. Both of those, both have draft bills in the works that are working on things like around stable coins and market structure Singapore, Hong Kong, Australia, Brazil, all are essentially following in this direction,” Armstrong added.

The CEO’s remarks come as Coinbase managed to increase its revenue 22% and slashed its net income loss over $475 million to $79 million in Q1.

Our Q1'23 financial results are in and our letter to shareholders can be found on the Investor Relations website at https://t.co/8ovHEtPRgf pic.twitter.com/4iWAPGZNMh

— Coinbase ️ (@coinbase) May 4, 2023

Magazine: Crypto regulation: Does SEC Chair Gary Gensler have the final say?

Coinbase, the San Francisco-based cryptocurrency exchange, recently announced the launch of a new service called Coinbase International Exchange. The new platform will enable institutional users outside of the United States to trade bitcoin and ethereum perpetual futures. The company stated in a tweet that the service will begin by offering perpetual futures settled in USDC […]

Coinbase, the San Francisco-based cryptocurrency exchange, recently announced the launch of a new service called Coinbase International Exchange. The new platform will enable institutional users outside of the United States to trade bitcoin and ethereum perpetual futures. The company stated in a tweet that the service will begin by offering perpetual futures settled in USDC […]

The Coinbase International Exchange will roll out trading by listing Bitcoin and Ether perpetual futures.

As the cryptocurrency industry faces regulatory challenges in the United States, public crypto exchange Coinbase is moving forward with a global derivatives platform.

On May 2, Coinbase announced the launch of the Coinbase International Exchange (CIE), a new institutional platform designed for crypto derivatives trading.

The CIE will start trading by listing Bitcoin (BTC) and Ether (ETH) perpetual futures later this week. All trading on the CIE will be settled in Coinbase-backed stablecoin USD Coin (USDC), requiring no fiat on-ramps.

Coinbase stressed that direct access trading on CIE is available to institutional clients via application programming interface in eligible, non-U.S. jurisdictions. “These products are not available to retail customers at this time,” Coinbase added.

According to the announcement, the new international crypto platform is launched with support of regulators in Bermuda. As previously reported, Coinbase obtained a license from the Bermuda Monetary Authority (BMA) by mid-April 2023. The Class F License allowed Coinbase to operate a digital asset exchange and a digital asset derivatives exchange provider as well as operate activities like token sales and issuance.

Coinbase noted that Bermuda’s regulatory environment is known for a “high level of transparency, compliance and cooperation.”

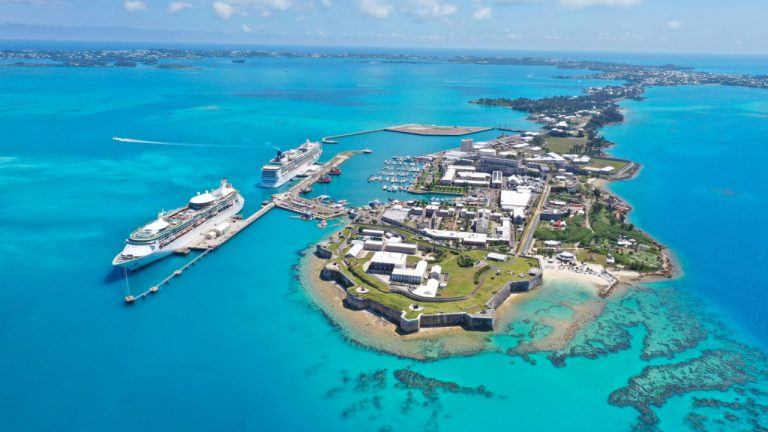

Bermuda is a self-governing British overseas territory with a parliamentary government. Similarly to the United Kingdom — where cryptocurrencies are currently legal — Bermuda has been friendly to crypto, growing increasingly bullish on the crypto industry recently.

In late April, Miami International Holdings, the operator of the Bermuda Stock Exchange, purchased remnants of the collapsed FTX crypto exchange. The company bought FTX’s futures and options exchange, and clearinghouse LedgerX for $50 million.

Previously, Bermudan Premier and Finance Minister Edward Burt declared that the government remains open to crypto despite industry failures like FTX. Last year, local authorities also stated that Bermuda would keep its crypto hub ambitions despite the industry facing a massive bear market in 2022.

Related: ARK Invest spends Int’l Workers’ Day buying $8M in Coinbase shares

The news comes amid major U.S. investment bank Citigroup downgrading Coinbase shares to neutral or high risk from buy or high risk with a $65 price target, down from $80. According to Citigroup analyst Peter Christiansen, regulatory unpredictability in the broader cryptocurrency sector is a looming threat to Coinbase.

Citi’s remarks came amid Coinbase shares already plummeting for several weeks. Over the past month, Coinbase shares plummeted more than 20%, dropping from a high of nearly $72 in April to $50 on Monday, May 1.

As previously reported, Coinbase planned to set up a global crypto exchange as of mid-March 2022. The first reports on Coinbase’s upcoming international crypto platform came just a few days before the exchange officially announced that it received a Wells notice from the United States Securities and Exchange Commission. In response, Coinbase filed a motion against the SEC on April 25, asking the regulator to clarify industry regulations.

Magazine: Crypto regulation — Does SEC Chair Gary Gensler have the final say?

It's reported the U.S.-based crypto exchange is planning to quickly launch a derivatives exchange based in the island nation.

United States-based cryptocurrency exchange Coinbase has received a license to operate in Bermuda and it's reportedly set to launch a derivatives exchange based there as soon as next week.

According to an April 19 blog post, Coinbase revealed it had "received our regulatory license to operate from the Bermuda Monetary Authority" — the nation's financial regulator.

The license, a Class F License under the Digital Asset Business Act, allows Coinbase to conduct a range of activities such as token sales and issuance, and operate as both a digital asset exchange and as a digital asset derivatives exchange provider according to the Bermuda regulator.

An April 19 report from Forbes citing "a person close to the company" claimed Coinbase is planning to launch a derivatives exchange in Bermuda as soon as next week.

Related: Coinbase’s Base network gets OpenZeppelin security integration

The latest development is an update to Coinbase's "go broad and go deep" campaign that sees it seeking to "establish regulated entities and local operations."

It also shed light on its progress in Brazil, Canada, Singapore, Europe and the United Arab Emirates, adding:

"As we have said previously, our approach globally will be consistent with our approach in the United States: we will work with governments and regulators in different markets, and will always aim to be the most trusted and compliant crypto company in any market."

Asia Express: Bitcoin glory on Chinese TikTok, 30M mainland users, Justin Sun saga

Bermuda's Edward Burt reportedly met with U.S. lawmakers and government officials this week in Washington, D.C. to discuss common standards for digital assets.

The dramatic collapse of crypto exchange FTX last November is not moving Bermuda away from receiving crypto companies, according to the head of the British island territory’s government during an interview with Bloomberg News.

“The future of finance is digital,” said the premier and finance minister Edward David Burt, who believes there are still considerable benefits to be gained from digital assets and blockchain technology.

Bermuda is a self-governing territory with a parliamentary government and was one of the first places to implement a regulatory framework for digital assets. The territory is just 915 miles away from The Bahamas, where the now-bankrupted FTX once operated.

Burt reportedly faced intense political pressure before FTX's failure, as the exchange chose The Bahamas instead of Bermuda for its headquarters. According to him, the latest events in the crypto industry had a minimal impact on the territory thanks to its regulations. “I think that approach has been vindicated,” Burt said, adding that regulations in Bermuda are clear and won't change for any company.

Today, GBBC had the pleasure of hosting @BermudaPremier in Washington, D.C. as he shared how government, private sector, and regulators are working together to create clear, smart regulation around #blockchain & #digitalassets pic.twitter.com/ABYEUMrRaJ

— Global Blockchain Business Council (GBBC) (@GBBCouncil) March 31, 2023

According to Bloomberg, Burt met with U.S. lawmakers and government officials this week in Washington, D.C. to discuss common standards for digital assets, along with topics related to its finance and insurance sectors. He believes that regulators around the world "must work together" to provide clarity for emergent technologies.

Since 2022, Bermuda's government has pushed forward its ambitious plans to become a cryptocurrency hub. The island, known for its natural beauty and attractive taxation policies, has been actively expanding its crypto sector since 2017, Cointelegraph reported. According to Burt, 17 licensed crypto firms are currently operating in Bermuda.

Among the latest crypto developments in the territory, Jewel Bank released in December Bermuda's first stablecoin powered by the Polygon blockchain, focusing on enabling real-time settlements using a stablecoin with a one-to-one peg to the United States dollar.

Magazine: Best and worst countries for crypto taxes — plus crypto tax tips