New data from the decentralized prediction market Polymarket reveals that Donald Trump is leading Kamala Harris in polls after Robert Kennedy Jr. suspended his presidential campaign. According to the crypto casino, which lets users bet on the outcome of anything, Trump now has a 51% chance to win the 2024 presidential election while Harris – […]

The post RFK Jr.’s Campaign Suspension Gives Donald Trump a Lead Over Kamala Harris: Polymarket appeared first on The Daily Hodl.

Recently, Dr. Tedros Adhanom Ghebreyesus, the Director-General of the World Health Organization (WHO), officially declared that the Mpox outbreak, commonly known as monkeypox, is now a public health emergency of international concern. Following this announcement, Polymarket users have started placing bets on whether Mpox will be categorized as a pandemic in 2024. Polymarket Bettors Give […]

Recently, Dr. Tedros Adhanom Ghebreyesus, the Director-General of the World Health Organization (WHO), officially declared that the Mpox outbreak, commonly known as monkeypox, is now a public health emergency of international concern. Following this announcement, Polymarket users have started placing bets on whether Mpox will be categorized as a pandemic in 2024. Polymarket Bettors Give […]

This week’s Crypto Biz explores Tether’s profit record, bank-linked crypto trading in the United Arab Emirates, Polymarket’s growth amid US elections, and Coinbase custodian arm.

Stablecoins continue to meet the significant global demand, specially in emerging economies. According to a new analysis from BVNK and the Centre for Economics and Business Research, businesses and consumers in 17 countries are willing to pay an average premium of 4.7% to access stablecoins pegged to the US dollar. The figure rises to 30% in Argentina.

By 2027, these countries are expected to spend $25.4 billion in premiums alone for stablecoin access. The report also sheds light on the inefficiencies of current cross-border payment systems, currently trapping $11.6 billion in working capital due to settlement delays. Stablecoins are expected to facilitate $2.8 trillion in cross-border payments by the end of this year.

Circle’s USD Coin (USDC) stablecoin reportedly saw a surge in trading volume in July, spurred by compliance with new European regulations. Meanwhile, Tether’s USDT (USDT) still holds a large chunk of stablecoins’ market share, with 70% of their $164 billion global market capitalization.

Somalia has shut down crypto-friendly messaging app Telegram and gambling site 1XBet, while cryptocurrency investments aren’t banned.

The Federal Republic of Somalia is the latest country to ban cryptocurrency-friendly messaging app Telegram, alongside TikTok social media app and the online-betting site 1XBet.

Somalia’s Ministry of Communications and Technology (MOCT) officially announced on Aug. 20 that the government is shutting down Telegram, TikTok and 1XBet.

On Sunday, MOCT Minister Jama Hassan Khalif held a meeting on telecommunications and internet security in social media with the National Communications Agency and major Somali telecom firms. The minister said that the government of Somalia is “working to preserve the culture of Somali society,” as telecom and internet devices have “affected lifestyles and increased bad habits.”

The announcement by MOCT reads:

“It was considered important to shut down TikTok, Telegram and 1XBet gambling equipment, which had an impact on Somali youth, causing some of them to die.”

According to online reports, Somalia’s move to ban TikTok, Telegram and 1XBet also aims to limit the spread of indecent content and propaganda.

“The minister of communications orders internet companies to stop the aforementioned applications, which terrorists and immoral groups use to spread constant horrific images and misinformation to the public,” Khalif reportedly said. He added that Telegram and other applications were ordered to suspend their operations in Somalia by Aug. 24. “Anyone who does not follow this order will face clear and appropriate legal measures,” the official reportedly stated.

The Ministry of Telecommunications and Technology announces the ban of #TikTok, #Telegram and online betting platform of 1Xbet, a move to counter and prevent indecent activities & contents, and extremism propaganda.#Somalia pic.twitter.com/dphcpuH18a

— SNTV News (@sntvnews1) August 20, 2023

It’s not immediately clear whether Somalia’s decision to ban Telegram and other platforms have any implications for the country’s cryptocurrency adoption. In a similar way to many countries in Africa, investing in cryptocurrencies like Bitcoin (BTC) is not banned in Somalia. In the meantime, many global jurisdictions often argue that crypto is associated with terrorism financing risks.

The MOCT did not immediately respond to Cointelegraph’s request for comment. This article will be updated pending new information.

Related: Telegram Wallet bot enables in-app payments in Bitcoin, USDT and TON

The news comes just a few days after Iraq’s telecom ministry lifted the ban on Telegram in mid-August. The authority banned the messaging app in early August, citing personal data and security concerns.

In April, Telegram was temporarily suspended across Brazil as authorities were investigating neo-Nazi groups that were reported to use the messaging platform to incite school attacks. Telegram was reportedly fined roughly $186 million for not complying with an investigation into neo-Nazi activities on the platform.

Collect this article as an NFT to preserve this moment in history and show your support for independent journalism in the crypto space.

Balaji Srinivasan has predicted Bitcoin will reach $1 million within 90 days as a consequence of hyperinflation in the United States.

Former Coinbase chief technology officer Balaji Srinivasan has made a millionaire bet on Bitcoin's (BTC) price over the next 90 days, predicting the cryptocurrency price will reach $1 million by June 17.

The wager was initiated on March 17, when pseudonymous Twitter user James Medlock offered to bet anyone $1 million that the United States would not experience hyperinflation. A few hours later, the former Coinbase CTO accepted the bet.

Sir, I believe we have ourselves a deal https://t.co/9JYaLNo9Eq

— James Medlock (@jdcmedlock) March 18, 2023

Under the proposed terms, if Bitcoin's price fails to reach $1 million by June 17, Medlock will win $1 million worth of the dollar-pegged stablecoin USD Coin (USDC) and the 1 BTC. The same way, if Bitcoin is worth at least $1 million by the date, then Balaji can keep the 1 BTC and the $1 million in USDC. Srinivasan explained in the thread:

“You buy 1 BTC. I will send $1M USD. This is ~40:1 odds as 1 BTC is worth ~$26k. The term is 90 days.”

Related: Banking crisis: What does it mean for crypto?

As per the thread, other Twitter users helped set up a smart contract with the betting terms. Srinivasan also disclosed that he would move another $1 million in USDC for another wager on the same topic:

"I am moving $2M into USDC for the bet. I will do it with Medlock and one other person, sufficient to prove the point. See my next tweet. Everyone else should just go buy Bitcoin, as it'll be much cheaper for you than locking one up for 90 days."

Medlock and Srinivasan made the wager based on their different views of the U.S. economy's future amid ongoing uncertainty regarding the country's banking system.

Srinivasan argues that there's an impending crisis that will lead to the deflation of the U.S. dollar, and thus, to a hyperinflation scenario that would take the BTC price to $1 million. Medlock, on the other hand, is bearish about upcoming hyperinflation in the country.

Meanwhile, Bitcoin's price has reached $27,387 at the time of writing, with its market capitalization adding over $194 billion year-to-date to a 66% growth in 2023, outperforming Wall Street bank stocks amid fears of a global banking crisis.

Also, for the first time in a year, BTC's price has shifted away from United States stocks, rising about 65% compared to the S&P 500's 2.5% gains and the Nasdaq's 15% decline, Cointelegraph reported.

The rehabilitation center estimates that about 1% of cryptocurrency traders will develop an "extreme" addiction to crypto trading.

A luxury rehabilitation center in Spain has recently added services aimed at treating a relatively new kind of addiction — crypto trading.

The center, called “The Balance,” is a Switzerland-founded wellness center, with its main facility located on the Spanish island of Mallorca along with representations in Spain, London and Switzerland.

While it has been known to treat addiction ailments such as alcohol, drugs and behavioral health — it has now recently begun offering services aimed at combatting crypto trading addiction, according to a report from the BBC.

The Feb. 5 report revealed that one of the center’s clients reached out so that he could “wean off crypto” after reportedly pouring in $200,000 worth of crypto trades each week.

The treatment involves a four week stay — which comprises of therapy, massages and yoga. The bill can be upwards of $75,000.

In another part of the world, Castle Craig Hospital — a Scottish-based addiction rehabilitation clinic treating high-adrenaline crypto traders since 2018 — has seen over 100 clients come in with “dangerous” cryptocurrency problems.

In Asia, Diamond Rehabilitation — a Thailand-based wellness center operating since 2019 — has also added services dedicated to cryptocurrency addiction rehab and treatment.

The organization said it approaches rehab through the use of Cognitive Behavioral Therapy (CBT), Motivational Interviewing (MI) and Psychodynamic Theory (PT) as part of its comprehensive, multi-stage approach to help traders overcome their addiction.

Related: How to control stress and depression in a crypto winter

It is believed that the euphoric highs and crushing lows of the fast-paced, 24/7 cryptocurrency trading arena have brought in real demand for rehabilitation centers to offer services for trading addicts.

An article by Family Addiction Specialist estimates about 1% cryptocurrency traders will develop a severe pathological addiction, while 10% will experience other problems beyond that of a financial loss.

Data from cryptocurrency payments platform TripleA estimates that over 420 million people have traded cryptocurrencies. This could mean that at least 4.2 million people may be suitable for such services.

Symptoms of this addiction according to Family Addiction Specialist, includes constantly checking the prices online — particularly in the middle of the night.

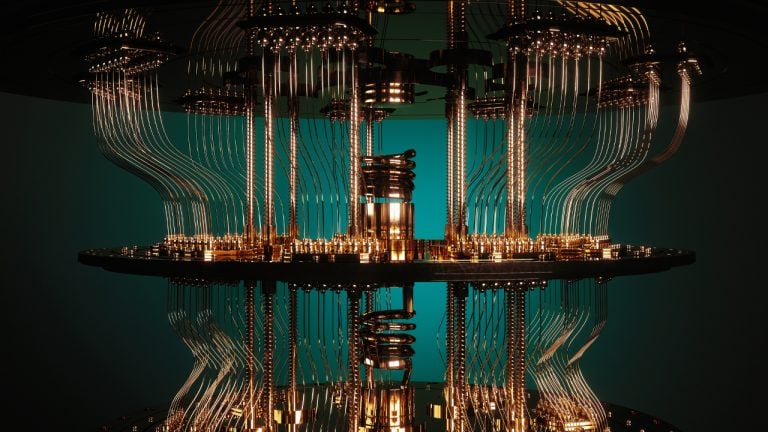

According to reports circulating on the web, 24 Chinese researchers have reportedly succeeded in breaking RSA encryption using a quantum computer. This would be a significant achievement, as RSA encryption is widely used in current security practices. However, a number of experts, computer scientists, and cryptographers do not believe the researchers have made a significant […]

According to reports circulating on the web, 24 Chinese researchers have reportedly succeeded in breaking RSA encryption using a quantum computer. This would be a significant achievement, as RSA encryption is widely used in current security practices. However, a number of experts, computer scientists, and cryptographers do not believe the researchers have made a significant […] The U.S. Commodity Futures Trading Commission (CFTC) has ordered a “decentralized” prediction market platform to shut down non-compliant markets and pay a fine of $1.4 million. “Polymarket had been operating an illegal unregistered or non-designated facility for event-based binary options online trading contracts, known as ‘event markets,'” said the derivatives regulator. CFTC Takes First Crypto […]

The U.S. Commodity Futures Trading Commission (CFTC) has ordered a “decentralized” prediction market platform to shut down non-compliant markets and pay a fine of $1.4 million. “Polymarket had been operating an illegal unregistered or non-designated facility for event-based binary options online trading contracts, known as ‘event markets,'” said the derivatives regulator. CFTC Takes First Crypto […]

DraftKings has partnered with the NFL Players Association to expand the offerings of its marketplace via gamified NFL player NFTs.

The Nation Football League Players Association, or NFLPA, in collaboration with sports betting operator DraftKings Inc., announced the launch of a gamified nonfungible token, or NFT, collection to drop on DraftKings Marketplace during the 2022-2023 NFL season. Starting next year, fans will be able to play NFT-based games featuring their favorite NFL Players, according to the company.

OneTeam, the official media business partner of the NFLPA, helped facilitate the deal with DraftKings, giving them the necessary licensing rights to use the name, image and likeness for active NFL players.

In a statement shared on the DraftKings website, Beth Beiriger, SVP of product operations for DraftKings Marketplace said, “The future of fandom is unfolding in front of us, and few organizations beyond DraftKings are as equipped to capitalize on the increasing intersection between sports and NFTs that will be cornerstones of engagement and entertainment within Web3.”

The DraftKings Marketplace went live this past August with its inaugural Tom Brady NFT collection in partnership with the NFT platform co-founded by Brady himself called Autograph. Besides NFTs, Brady further displayed his backing of crypto by giving a fan 1 BTC for his 600th touchdown pass.

Related: Rams player Odell Beckham Jr. will accept NFL salary in Bitcoin

The announcement suggested that DraftKings’ upcoming NFTs will enable customers to buy and sell collectibles via the Polygon network, and use them within games against other players. The goal of the DraftKings’ NFT experience is to “create authentic connections for avid fans,” according to Sean C. Sansiveri, General Counsel and Head of Business Affairs at NFL Players Inc., the marketing and licensing arm of the NFLPA.

Related: Pro sports leagues are no longer resisting NFTs: Dapper Labs

Last month the NFL also entered a collaboration with Ticketmaster to tie NFT collectibles to select game tickets when purchased, emphasizing the pro sports league’s broad adoption of blockchain technology.

Cryptocurrency and smart contracts are redefining the future of online betting. Esports, meanwhile, represent a growing market for gambling.

Cryptocurrency wallet Exodus has officially integrated with SportX, an online sports and crypto betting platform, giving users the ability to wager on esports games through smart contracts executed on the Polygon network.

The partnership, which was announced Tuesday, gives Exodus’ more than 1 million users access to SportX’s decentralized betting exchange where they can place bets on a wide range of sports and esports games using cryptocurrency. The minimum bet amount is $5, denominated in USD Coin (USDC), which can be sent directly to the Exodus wallet or exchanged from any of the 138 cryptocurrencies it supports. All markets created, traded and settled on SportX are facilitated by the Polygon network.

Currently, SportX is authorized for use in Canada, South America, most European countries excluding France and the Netherlands and throughout most of Asia.

Esports, which refers to multiplayer video games played competitively in front of spectators, has grown to become a billion-dollar industry, with mainstream developers such as Halo entering the market.

What a statement from Halo. Their re-entry into esports has been nothing short of incredible. Balanced maps, ranked play and a multi-million dollar tournament circuit out of the gate two weeks after release. Bravo @Halo.

— 100T Nadeshot (@Nadeshot) November 22, 2021

And congratulations @OpTic on the first

Although the relationship between cryptocurrency and esports is still nascent, industry observers have identified a “special connection” between the two domains. Both communities share similar demographics and employ technologies that transcend geographic locations. The financialization of gaming, also known as GameFi, is also expected to present new opportunities for the esports industry. (However, GameFi is not limited to the financialization of esports, but digital gaming more generally.)

Related: Coinbase partners with esports gaming organization competing in League of Legends

Crypto exchanges, meanwhile, continue to expand their footprint in the esports market, with the Sam Bankman-Fried-led FTX leading the way. In August, the derivatives exchange inked a seven-year deal with Dolphin Entertainment to create nonfungible tokens that target brands in several sectors, including esports. In June, FTX sealed a $210 million naming rights deal with esports giant TSM.