One of the investors who called and profited off the subprime mortgage collapse of 2008 says crypto is currently one of three major themes driving today’s narrative – but he still isn’t a fan of it. In a new interview on Bloomberg Television, Steve Eisman of Neuberger Berman says that artificial intelligence (AI), infrastructure, and […]

The post ‘Big Short’ Investor Steve Eisman Says Crypto One of Three ‘Great Themes of Our Time’ – Here’s What He Means appeared first on The Daily Hodl.

Famed “Big Short” investor Michael Burry tweeted Thursday, telling his 1.4 million followers, “I was wrong to say sell.” The tweet follows Burry’s warning for months that the U.S. was headed for an “extended multi-year recession” and his decision to dump all of his stocks but one in August 2022. Burry: ‘I Was Wrong to […]

Famed “Big Short” investor Michael Burry tweeted Thursday, telling his 1.4 million followers, “I was wrong to say sell.” The tweet follows Burry’s warning for months that the U.S. was headed for an “extended multi-year recession” and his decision to dump all of his stocks but one in August 2022. Burry: ‘I Was Wrong to […] Hedge fund manager Michael Burry, famed for forecasting the 2008 financial crisis, says inflation has peaked in the U.S. but there will be another inflation spike. He expects the U.S. economy to be in a recession “by any definition.” Michael Burry’s 2023 Economic Predictions Famous investor and founder of investment firm Scion Asset Management, Michael […]

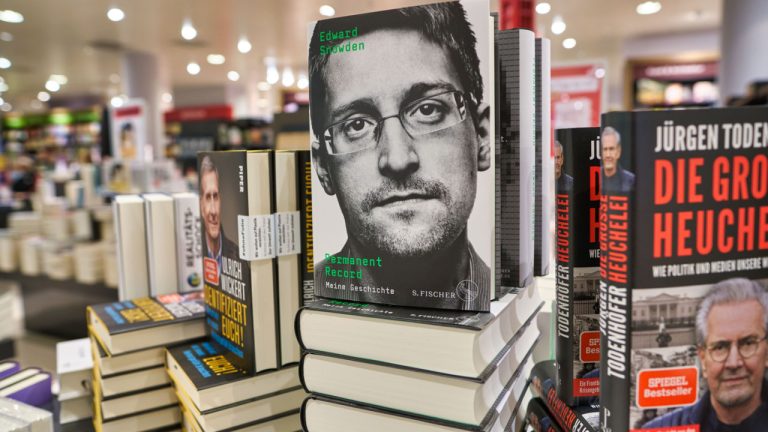

Hedge fund manager Michael Burry, famed for forecasting the 2008 financial crisis, says inflation has peaked in the U.S. but there will be another inflation spike. He expects the U.S. economy to be in a recession “by any definition.” Michael Burry’s 2023 Economic Predictions Famous investor and founder of investment firm Scion Asset Management, Michael […] Ahead of the holidays and new year, the former U.S. National Security Agency (NSA) contractor known to the world as a staunch privacy advocate and whistleblower, Edward Snowden, has offered to step up as the new CEO of Twitter after current “Chief Twit” Elon Musk has said he is stepping down. In other news from […]

Ahead of the holidays and new year, the former U.S. National Security Agency (NSA) contractor known to the world as a staunch privacy advocate and whistleblower, Edward Snowden, has offered to step up as the new CEO of Twitter after current “Chief Twit” Elon Musk has said he is stepping down. In other news from […]

No let-up in risk assets means Bitcoin faces more selling pressure, but hope remains that a key moving average could soon see a challenge.

Bitcoin (BTC) returned under $20,000 on June 29 as analysts stayed hopeful of a trip higher.

Data from Cointelegraph Markets Pro and TradingView followed BTC/USD as it crossed below the $20,000 mark for the first time in nearly a week in Asian trading hours.

The weakness followed rangebound behavior near $21,000, this characterizing a market still in tune with moves in global equities.

The S&P 500 had finished its previous session down 2%, while the Nasdaq Composite Index lost 3%. On the day, Hong Kong’s Hang Seng was likewise 2.1% lower, while China’s Shanghai Composite Index traded down 1.4%.

With few bullish cues coming from macro, Bitcoin thus had little stopping it from revisiting the lower end of a range in place for several weeks.

“Bitcoin is giving that correction, was anticipating a potential low at $20.3K,” Cointelegraph contributor Michaël van de Poppe wrote in part of his latest Bitcoin-focused Twitter update.

“We get $20.1K as that's the second important one… Would like to see it hold here and see additional confirmation on LTF. If it doesn't, $19.3-19.5K next for support.”

Zooming out, other sources were still optimistic about the potential for an assault on resistance further up.

For on-chain analytics resource Material Indicators, this could still come in the form of challenging the 200-week moving average, a key bear market support level, which had begun to function as resistance in June.

Trend Precognition is flashing a pretty strong Long signal on the #BTC Weekly chart. Signal won't print until the W candle closes, but indicates that we could see a run at the 200 WMA this week. Happy to test the lows first. For me, sub $17.5k invalidates. #NFA pic.twitter.com/hvs1as44qG

— Material Indicators (@MI_Algos) June 28, 2022

Focusing on macro, commentators argued that with little certainty about economic strength available, risk assets such as crypto would continue to suffer on longer timeframes.

Related: 3 charts showing this Bitcoin price drop is unlike summer 2021

The mood followed a prediction from Big Short investor Michael J. Burry that the U.S. Federal Reserve would abandon its inflation-busting quantitative tightening (QT) policy in 2022 and return to more accommodative conditions.

“Deflationary pulses from this- -> disinflation in CPI later this year --> Fed reverses itself on rates and QT --> Cycles,” part of a tweet published June 27 reads.

Only a clear boon for risk assets would therefore cut Bitcoin and altcoins some slack, popular Twitter account TXMC Trades responded, this perspective echoing views of various commentators including former BitMEX CEO, Arthur Hayes.

Despite the dreams of decouploors, #Bitcoin is unlikely to grow in a sustained way unless the economy also shows significant improvement, as they are undeniably linked.

— TXMC (@TXMCtrades) June 28, 2022

With regional data slipping toward contraction, the near term path remains unattractive. https://t.co/qpuPsYm07P pic.twitter.com/WT3TjKHiKD

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph.com. Every investment and trading move involves risk, you should conduct your own research when making a decision.

Hedge fund manager Michael Burry, famed for forecasting the 2008 financial crisis, has warned of a looming consumer recession and more earnings trouble. He cited falling U.S. personal savings and record-setting revolving credit card debt despite trillions of dollars in stimulus money. Michael Burry’s Recession Warning Famous investor and founder of investment firm Scion Asset […]

Hedge fund manager Michael Burry, famed for forecasting the 2008 financial crisis, has warned of a looming consumer recession and more earnings trouble. He cited falling U.S. personal savings and record-setting revolving credit card debt despite trillions of dollars in stimulus money. Michael Burry’s Recession Warning Famous investor and founder of investment firm Scion Asset […]