Alliance Resource Partners (ARLP), a coal mining company in the U.S., recently disclosed its use of underutilized electricity loads for bitcoin mining. Cary Marshall, the company’s CFO, revealed that ARLP concluded the first quarter of 2024 with an approximate total of 425 bitcoins. Marshall also stated that during the first quarter, ARLP mined 61 bitcoins […]

Alliance Resource Partners (ARLP), a coal mining company in the U.S., recently disclosed its use of underutilized electricity loads for bitcoin mining. Cary Marshall, the company’s CFO, revealed that ARLP concluded the first quarter of 2024 with an approximate total of 425 bitcoins. Marshall also stated that during the first quarter, ARLP mined 61 bitcoins […]

CryptoQuant CEO Ki Young Ji said that despite a drop in Bitcoin mining revenues since the halving, Bitcoin miners haven’t shown any signs of capitulation.

Bitcoin (BTC) miners show no signs of “capitulation” despite their revenue falling to 14-month lows following the halving event in April.

In an April 30 post to X, CryptoQuant CEO Ki Young Ju said that following a drop in revenue to levels post having, Bitcoin miners now face two options, capitulation or await growth in the price of Bitcoin to cover their costs.

Citing the 365-day Puell Multiple chart — a metric that estimates the level of sell pressure from miners — Ju said miners show no signs of capitulation “for now.”

This week, the Nasdaq-listed bitcoin miner Iris Energy Limited announced it has boosted its hashrate to 9 exahash per second (EH/s) and aims to reach 10 EH/s in the coming month. This development follows the network’s fourth halving and occurs amid a period when Bitcoin’s hashprice has significantly declined, exerting intense pressure on BTC mining […]

This week, the Nasdaq-listed bitcoin miner Iris Energy Limited announced it has boosted its hashrate to 9 exahash per second (EH/s) and aims to reach 10 EH/s in the coming month. This development follows the network’s fourth halving and occurs amid a period when Bitcoin’s hashprice has significantly declined, exerting intense pressure on BTC mining […] While bitcoin mining has become increasingly difficult and block rewards have dropped from 6.25 bitcoins to 3.125 bitcoins, a solo miner discovered block 841,286. Bitcoin’s Harsh Mining Climate Yields Treasure for One Solo Entity Mining bitcoin (BTC) has become significantly challenging, with the network’s difficulty reaching an all-time high of 88.10 trillion. This complexity, coupled […]

While bitcoin mining has become increasingly difficult and block rewards have dropped from 6.25 bitcoins to 3.125 bitcoins, a solo miner discovered block 841,286. Bitcoin’s Harsh Mining Climate Yields Treasure for One Solo Entity Mining bitcoin (BTC) has become significantly challenging, with the network’s difficulty reaching an all-time high of 88.10 trillion. This complexity, coupled […] JPMorgan Chase CEO Jamie Dimon has reiterated his critical stance on bitcoin, labeling it a fraud and dismissing its potential as a legitimate currency. Former FTX CEO Sam Bankman-Fried has agreed to a settlement that involves cooperating with legal actions against celebrities linked to FTX’s collapse. U.S. analysts are evaluating the impact of the proposed […]

JPMorgan Chase CEO Jamie Dimon has reiterated his critical stance on bitcoin, labeling it a fraud and dismissing its potential as a legitimate currency. Former FTX CEO Sam Bankman-Fried has agreed to a settlement that involves cooperating with legal actions against celebrities linked to FTX’s collapse. U.S. analysts are evaluating the impact of the proposed […] Marathon Digital plans to increase its 2024 hash rate target for Bitcoin mining from 35-37 EH/s to 50 EH/s, thanks to expanded capacity from recent acquisitions, aiming to more than double its mining operations without the need to raise additional capital. The company’s growth includes purchasing a 200 megawatt Bitcoin mining center and two additional […]

Marathon Digital plans to increase its 2024 hash rate target for Bitcoin mining from 35-37 EH/s to 50 EH/s, thanks to expanded capacity from recent acquisitions, aiming to more than double its mining operations without the need to raise additional capital. The company’s growth includes purchasing a 200 megawatt Bitcoin mining center and two additional […] The renowned ‘epic satoshi’ from the fourth halving block, also known as Sat # 1,968,750,000,000,000, fetched a price of 33.3 bitcoins, valued at just over $2.13 million on Thursday afternoon Eastern Standard Time. This satoshi, the smallest denomination of BTC, was sold for an astonishing 338 billion percent more than the typical value of a […]

The renowned ‘epic satoshi’ from the fourth halving block, also known as Sat # 1,968,750,000,000,000, fetched a price of 33.3 bitcoins, valued at just over $2.13 million on Thursday afternoon Eastern Standard Time. This satoshi, the smallest denomination of BTC, was sold for an astonishing 338 billion percent more than the typical value of a […] On Tuesday, Jack Dorsey, the founder of Block, took to X to announce that the company is “building a mining rig.” Dorsey also shared a blog post authored by Block’s lead for mining hardware products, Naoise Irwin. The post revealed enhancements in the chip design, upgrading from the initially planned 5-nanometer (nm) process to an […]

On Tuesday, Jack Dorsey, the founder of Block, took to X to announce that the company is “building a mining rig.” Dorsey also shared a blog post authored by Block’s lead for mining hardware products, Naoise Irwin. The post revealed enhancements in the chip design, upgrading from the initially planned 5-nanometer (nm) process to an […]

The Block — then Square — CEO initially suggested the idea of a collaborative approach to decentralize Bitcoin mining in October 2021.

Payments firm Block, formerly known as Square, has announced plans to develop a Bitcoin (BTC) mining system in response to challenges faced by mining operators.

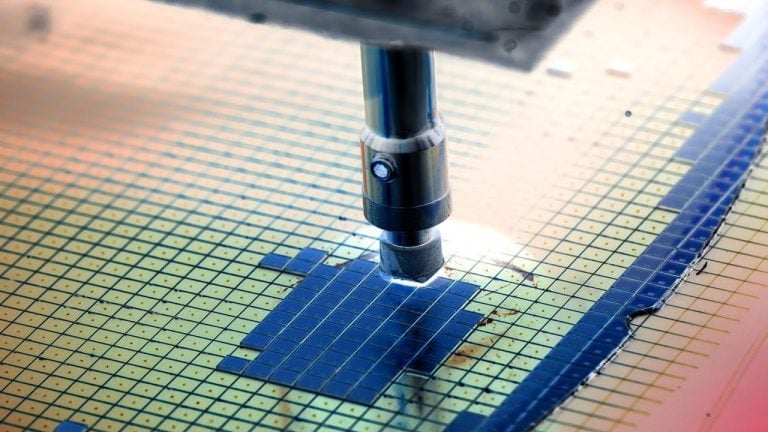

In an April 23 blog post, Block said it had completed development of a three-nanometer chip used for BTC mining, which led to the firm announcing a “full Bitcoin mining system.” Block — then Square — CEO Jack Dorsey suggested a collaborative approach to decentralize Bitcoin mining in October 2021.

“We’ve spent a significant amount of time talking to a wide variety of bitcoin miners to identify the challenges faced by mining operators,” said Block. “Building on these insights and pursuant to our goal of supporting mining decentralization, we plan to offer both a standalone mining chip as well as a full mining system of our own design.”