Billionaire Jack Dorsey foresees a future where bitcoin could supplant the U.S. dollar as the dominant global currency. He envisions a scenario where bitcoin’s value could soar to $1 million by 2030. Highlighting the cryptocurrency’s decentralized nature, Dorsey underscores its potential to democratize financial systems and reduce reliance on traditional banking institutions. Jack Dorsey Anticipates […]

Billionaire Jack Dorsey foresees a future where bitcoin could supplant the U.S. dollar as the dominant global currency. He envisions a scenario where bitcoin’s value could soar to $1 million by 2030. Highlighting the cryptocurrency’s decentralized nature, Dorsey underscores its potential to democratize financial systems and reduce reliance on traditional banking institutions. Jack Dorsey Anticipates […] Block Inc. has announced its strategy of regularly purchasing bitcoin for its corporate balance sheet via dollar-cost averaging (DCA). The company plans to allocate 10% of its monthly gross profit from bitcoin products towards investments in the cryptocurrency. “We view bitcoin as an instrument of global economic empowerment; it is a way for individuals around […]

Block Inc. has announced its strategy of regularly purchasing bitcoin for its corporate balance sheet via dollar-cost averaging (DCA). The company plans to allocate 10% of its monthly gross profit from bitcoin products towards investments in the cryptocurrency. “We view bitcoin as an instrument of global economic empowerment; it is a way for individuals around […]

Jack Dorsey’s fintech conglomerate Block is now investing 10% of its gross profit from Bitcoin products directly into BTC itself. In a new announcement, the firm notes that it is making a strategic investment in the top crypto asset “following numerous positive developments both within the company and in the broader market.” “In April, Block […]

The post Jack Dorsey-Led Block Announces Plan To Invest 10% of Its Gross Profit From Bitcoin Products Directly Into BTC appeared first on The Daily Hodl.

According to the 501(c)(3) public charity Opensats, a nonprofit focused on supporting Bitcoin-related initiatives and efforts that contribute to Bitcoin’s success, Jack Dorsey’s philanthropic endeavor #startsmall has contributed $21 million to the organization. Bitcoin Development Nonprofit Opensats Receives $21M From Dorsey’s #Startsmall On May 3, Opensats disclosed receiving a $21 million contribution from Jack Dorsey’s […]

According to the 501(c)(3) public charity Opensats, a nonprofit focused on supporting Bitcoin-related initiatives and efforts that contribute to Bitcoin’s success, Jack Dorsey’s philanthropic endeavor #startsmall has contributed $21 million to the organization. Bitcoin Development Nonprofit Opensats Receives $21M From Dorsey’s #Startsmall On May 3, Opensats disclosed receiving a $21 million contribution from Jack Dorsey’s […]

Block, Inc. co-founder Jack Dorsey told shareholders its Bitcoin-buying plan during an earnings call, saying its an “investment in a future where economic empowerment is the norm.”

Twitter co-founder Jack Dorsey said his fintech firm Block, Inc. will flip 10% of its gross profit made off its Bitcoin products into buying Bitcoin (BTC) every month.

“Going forward, each month we will be investing 10% of our gross profit from Bitcoin products into Bitcoin purchases,” Dorsey wrote in a May 2 shareholder letter inclusive of its better-than-expected first-quarter results.

“We were one of the first public companies to put Bitcoin on our balance sheet,” he added. Block bought $220 million worth of BTC across Q4 2020 and Q1 2021.

Jack Dorsey's Block will allocate 10% of its Bitcoin product profits to monthly BTC purchases as part of its commitment to the flagship crypto.

The post Jack Dorsey’s Block doubles down on Bitcoin, commits 10% of product profit to monthly BTC purchases appeared first on Crypto Briefing.

Block’s first-quarter 2024 results beat Wall Street analyst estimates on earnings and revenue which saw its share price surge after the bell.

Fintech firm Block’s first-quarter results have beat Wall Street analyst revenue and earnings expectations which saw its shares jump after-hours.

On May 2, Block, Inc. posted its Q1 2024 results showing revenues of $5.96 billion — beating estimates from analytic firm Zacks by 3.54%.

Block’s earnings per share was $0.85 — up from Zack’s $0.62 per share estimate. Its Q1 gross profits reached $2.09 billion, up 22% from the year-ago quarter.

On Wednesday, Block, the financial services firm, disclosed that merchants using Square can convert their daily sales into bitcoin through the Cash App. Block’s founder, Jack Dorsey, revealed this update on X, and as of today, merchants have the option to transfer between 1-10% of their Square-generated earnings into bitcoin, the leading crypto asset by […]

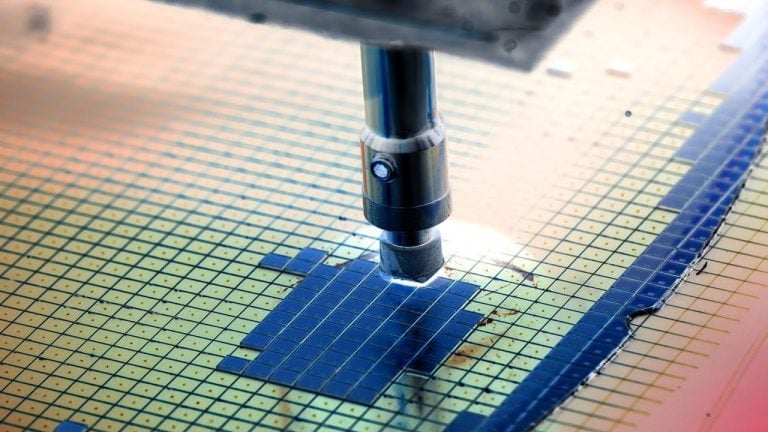

On Wednesday, Block, the financial services firm, disclosed that merchants using Square can convert their daily sales into bitcoin through the Cash App. Block’s founder, Jack Dorsey, revealed this update on X, and as of today, merchants have the option to transfer between 1-10% of their Square-generated earnings into bitcoin, the leading crypto asset by […] On Tuesday, Jack Dorsey, the founder of Block, took to X to announce that the company is “building a mining rig.” Dorsey also shared a blog post authored by Block’s lead for mining hardware products, Naoise Irwin. The post revealed enhancements in the chip design, upgrading from the initially planned 5-nanometer (nm) process to an […]

On Tuesday, Jack Dorsey, the founder of Block, took to X to announce that the company is “building a mining rig.” Dorsey also shared a blog post authored by Block’s lead for mining hardware products, Naoise Irwin. The post revealed enhancements in the chip design, upgrading from the initially planned 5-nanometer (nm) process to an […]

Marathon said the bug emanated from its experimental mining pool used to research ways to optimize operations.

Bitcoin mining firm Marathon Digital has confirmed it mined an invalid Bitcoin (BTC) block during an “experiment” aimed at optimizing the firm’s operations.

In a Sept. 27 post, Marathon said it utilizes a small percentage of the firm’s hashrate toward these experiments and stressed they weren’t trying to alter the network in any way:

“In no way was this experiment an attempt to alter Bitcoin Core in any way.” Marathon said, emphasizing that they corrected the error as soon as they noticed the invalid block.

We can confirm that Marathon did mine an invalid block. We utilize a small portion of our hash rate to experiment with our development pool and research potential methods to optimize our operations. The error was the result of an unanticipated bug that came from one of our…

— Marathon Digital Holdings (NASDAQ: MARA) (@MarathonDH) September 27, 2023

Marathon said the bug, which emanated from the firm’s internal development environment, wasn’t related to Marathon’s Bitcoin production pool or Bitcoin Core — the leading software used to connect to the Bitcoin network and run a node.

The incident occurred on Sept. 26 at 9:42 pm UTC on block 809478, according to mempool.space.

Several Bitcoin developers, along with BitMEX Research attributed the invalid block to a “transaction ordering issue.” Bitcoin developer “mononaut” believes Marathon mistake came from resorting the transactions in order of ascending absolute fees.

This is what MARA's invalid block at 809478 looks like:

— mononaut (@mononautical) September 27, 2023

- pink transactions no longer exist in the main chain

- blue transactions are invalid due to ordering (they spend an output from a transaction included later in the block) https://t.co/SJI1azOB5Z pic.twitter.com/5gY9TRA2eG

Bitcoin analyst Dylan LeClair suggested that Marathon should have conducted this experiment on a testnet before attempting it on Bitcoin’s mainnet.

In reflection, Marathon said Bitcoin “functioned exactly as designed” by excluding the invalid block:

“This incident, while unintended, underscores the robust security of the Bitcoin network, which rejected and rectified the anomaly.”

Related: Marathon Digital Q2 results miss revenue and earnings forecasts

Cointelegraph reached out to Marathon for comment but did not receive an immediate response.

Marathon’s (MARA) share price fell 2.91% to $8.01 during opening hours on Sept. 27, according to Google Finance.

Magazine: ‘Elegant and ass-backward’: Jameson Lopp’s first impression of Bitcoin