Ledn achieved a record $690M in crypto loans during Q1, reflecting a broader market recovery and solidifying its industry leadership.

The post Ledn’s institutional loans reach $584 million in Q1 appeared first on Crypto Briefing.

Celsius users with funds held in its custody program have finally begun to withdraw funds, but users report delays due to a backlog of requests.

Some Celsius customers have reported being able to withdraw funds from the bankrupt crypto firm for the first time, some 263 days after the lender froze withdrawals in the lead-up to its bankruptcy filing.

According to numerous social media posts, as of Mar. 2, certain customers who held funds in Celsius’ Custody accounts have been overjoyed that they were finally able to withdraw their funds from the lender.

Glad to be one of the few to get their money back in almost one piece. Hoping everyone else will receive theirs in due time

— richieroyce.eth (@Richie_Royce) March 2, 2023

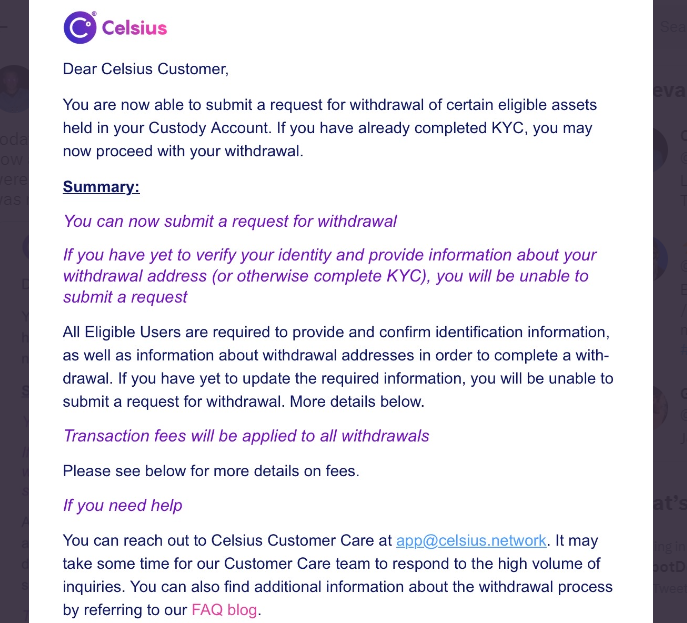

Customers report they received an email a few weeks ago listing those who were eligible to remove their funds, before receiving another on Mar. 2 noting withdrawals could be processed.

While some users who whitelisted wallets ahead of their withdrawal attempt received their funds within minutes, others pointed to large delays.

A backlog of withdrawal attempts seems to have built up, however, with some claiming that withdrawal requests are being converted into support tickets which could take some days to process, as a result of “too many requests and not enough staff.”

On Jan. 31, Celsius published details on who was eligible to withdraw, with customers who had only ever held funds in custody accounts able to currently withdraw 94% of their original funds.

The custody accounts were only available to United States residents. The withdrawals are restricted to these customers much to the disappointment of customers with funds in other accounts offered by Celsius.

Related: Wrapped Bitcoin supply drops to negative after 11,500 wBTC burn linked to Celsius

Custody account holders may yet be able to get back the other 6%, pending future court hearings.

Customers who had transferred funds from the earn or borrow programs to a custody account are apparently able to withdraw 72.5% of their funds at this point in time, up to a maximum of $7,575.

The lender had first announced they would be freezing withdrawals on Jun. 13, 2022, citing “extreme market conditions,” before filing for bankruptcy on Jul. 13.

The bankrupt lender is set to hold auctions for its assets in January, while it's been given the green light to return some customer funds.

Bankrupt crypto lender Celsius Network has attracted 30 potential bidders over its various assets including its retail platform and mining business.

According to a company presentation filed on Dec. 20, more than 125 parties were contacted since September, with 30 potential bidders executing non-disclosure agreements — a legal contract used to protect sensitive information about a company or the bidding terms — typically required during negotiations.

Celsius said that so far, it has received multiple bids proposing a variety of potential transaction and business structures to acquire its assets — such as migrating Celsius customers to the acquirer’s platform along with a haircut of their assets — among other structures.

The lending platform also revealed it had received a number of single asset bids.

With the bidding deadline reached on Dec. 12, the auction for Celsius' various assets is now set for Jan. 10, 2023, after being pushed back from the original date of Dec. 15, according to earlier documents filed by Celsius.

The latest presentation notes that as of Nov. 25 the company held coins valued at approximately $2.6 billion, but after this is combined with the value of its non-coin assets they are still $1.2 billion short of being able to pay off all debts.

Its ongoing mining operations have been successful however, with Celsius claiming that it has generated positive operating cash flow every month this year as it continues to deploy more mining rigs.

Related: BlockFi files motion to return frozen crypto to wallet users

In related news, on Dec. 20 bankruptcy judge Martin Glenn has just granted a motion previously filed by Celsius on Sep. 1, allowing them to reopen withdrawals for a minority of their customers.

The assets eligible to be withdrawn are those that were only ever held in the Custody Program and for amounts less than $7,575 which were transferred from Earn or Borrow Programs into the Custody program within 90 days of its filing for bankruptcy on Jul. 13.

The order also applies to "ineligible Withhold Assets," with assets included in this definition to be determined following meetings between Celsius, the Withhold Ad Hoc Group and the Celsius Official Committee of Unsecured Creditors.

On Dec. 1, 2022, an attorney for the U.S. Trustee submitted a written letter to Delaware bankruptcy court officials that seeks to establish an independent examiner to investigate the FTX Chapter 11 bankruptcy proceedings. The U.S. Trustee explained in the letter that FTX’s collapse was comparable to complex bankruptcy cases like Lehman’s, Washington Mutual Bank’s, […]

On Dec. 1, 2022, an attorney for the U.S. Trustee submitted a written letter to Delaware bankruptcy court officials that seeks to establish an independent examiner to investigate the FTX Chapter 11 bankruptcy proceedings. The U.S. Trustee explained in the letter that FTX’s collapse was comparable to complex bankruptcy cases like Lehman’s, Washington Mutual Bank’s, […]

Charts suggest BTC price will dip below $30,000, and derivatives data shows options traders becoming increasingly worried.

Bitcoin’s (BTC) current 20% drop over the past four days has put the price at its lowest level in nine months and while these movements might seem extraordinary, quite a number of large listed companies and commodities faced a similar correction. For example, natural gas futures corrected 15.5% in four days and nickel futures traded down 8% on May 9.

Other casualties of the correction include multiple $10 billion and higher market capitalization companies that are listed at U.S. stock exchanges. Bill.com (BILL) traded down 30%, while Cloudflare (NET) presented a 25.4% price correction. Dish Network (DISH) also faced a 25.1% drop and Ubiquiti's (UI) price declined by 20.4%.

Persistent weak economic data indicates that a recession is coming our way. At the same time, the U.S. Federal Reserve reverted its expansionary incentives and now aims to reduce its balance sheet by $1 trillion. On May 5, Germany also reported factory orders declining by 4.7% versus the previous month. The U.S. unit labor costs presented an 11.6% increase on the same day.

This bearish macroeconomic scenario can partially explain why Bitcoin and risk assets continue to correct but taking a closer look at how professional traders are positioned can also provide useful insight.

To understand whether the recent price action reflects top traders' sentiment, one should analyze Bitcoin's futures contracts premium, otherwise known as the "basis rate."

Unlike a perpetual contract, these fixed-calendar futures do not have a funding rate, so their price will differ vastly from regular spot exchanges. The three-month futures contract trades at a 5% or lower annualized premium whenever these pro traders flip bearish.

On the other hand, a neutral market should present a 5% to 12% basis rate, reflecting market participants' unwillingness to lock in Bitcoin for cheap until the trade settles.

The above data shows that Bitcoin's futures premium has been lower than 5% since April 6, indicating that futures market participants are reluctant to open leverage long positions.

Even with the above data, the recent 20% price correction was not enough to drive this metric below the 2% threshold, which should be interpreted as positive. Bulls certainly do not have a reason to celebrate, but there are no signs of panic selling from the viewpoint of futures markets.

To exclude externalities specific to the futures contracts, traders should also analyze the options markets. The most simple and effective metric is the 25% delta skew, which compares equivalent call (buy) and put (sell) options.

In short, the indicator will turn positive when "fear" is prevalent because the protective put options premium is higher than the call (bullish) options. On the other hand, a negative 25% skew indicates bullish markets. Lastly, readings between negative 8% and positive 8% are usually deemed neutral.

The above chart shows that Bitcoin option traders have been signaling "fear" since April 8 after BTC broke below $42,500. Unlike futures markets, options primary sentiment metric showed a worsening condition over the past four days as the 25% delta skew currently stands at 14.5%.

To put things in perspective, the last time this options market's "fear & greed" indicator touched 15% was on January 28, after Bitcoin price traded down 23.5% in four days.

Traders should also analyze margin markets. Borrowing crypto allows investors to leverage their trading position and potentially increase their returns. For example, a trader can borrow Tether (USDT) and use the proceeds to boost their Bitcoin exposure.

On the other hand, borrowing Bitcoin allows one to bet on its price decline. However, the balance between margin longs and shorts is not always matched.

Data shows that traders have been borrowing more Bitcoin recently, as the ratio declined from 24.5 on May 6 to the current 16.8. The higher the indicator, the more confident professional traders are with Bitcoin's price.

Despite some recent Bitcoin borrowing activity aimed at betting on the price downturn, margin traders remain mostly optimistic, according to the USDT/BTC lending ratio. Typically, numbers above five reflect bullishness and the recent 24.5 peak was the highest level in more than six months.

According to derivatives metrics, Bitcoin traders are afraid of a deepening correction as macroeconomic indicators deteriorate. However, investors also expect a potential crisis in traditional markets, so Bitcoin's 20% correction merely follows that of broader risk assets.

On a positive note, there are no signs of leverage short (negative) bets using margin or futures, meaning there is little conviction from sellers at current price levels.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph. Every investment and trading move involves risk. You should conduct your own research when making a decision.

Banking and financial services titan Goldman Sachs is making its first-ever loan grant to a borrower fully backed by leading digital asset by market cap Bitcoin (BTC). According to a recent report, a spokesperson from the bank said that Goldman Sachs was interested in the deal because of its structure and 24-hour risk management. This […]

The post Banking Giant Goldman Sachs Launching Its First-Ever Loan Collateralized by Bitcoin (BTC) appeared first on The Daily Hodl.

As buying a home is by itself a serious investment, homeowners often lack the cash to fund further improvements to their property. While traditional bank loans are not as easily available, a new partnership now offers crypto holders to use their digital assets as collateral and instantly borrow money for a kitchen remodeling or some […]

As buying a home is by itself a serious investment, homeowners often lack the cash to fund further improvements to their property. While traditional bank loans are not as easily available, a new partnership now offers crypto holders to use their digital assets as collateral and instantly borrow money for a kitchen remodeling or some […]