On Thursday, Bitcoin network fees took a significant leap, crossing the $100 mark shortly after 8:45 a.m. EDT. However, this spike was short-lived as fees quickly dropped, settling at just $0.34 per transaction by 7 p.m. EDT. Data collected from the day’s blocks revealed that a few fortunate bitcoin miners managed to snag some blocks […]

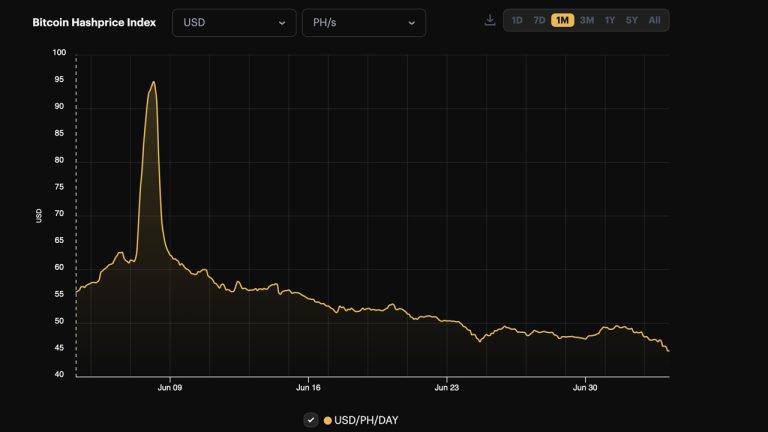

On Thursday, Bitcoin network fees took a significant leap, crossing the $100 mark shortly after 8:45 a.m. EDT. However, this spike was short-lived as fees quickly dropped, settling at just $0.34 per transaction by 7 p.m. EDT. Data collected from the day’s blocks revealed that a few fortunate bitcoin miners managed to snag some blocks […] Bitcoin’s hashprice, or the anticipated value of 1 petahash per second (PH/s) of hashing power per day, has plummeted to a historic low. According to Luxor’s hashprice index, at 6 a.m. EDT on July 4, 2024, the price per petahash dropped to $44.842 per PH/s. The dollar value of daily mining revenue per petahash of […]

Bitcoin’s hashprice, or the anticipated value of 1 petahash per second (PH/s) of hashing power per day, has plummeted to a historic low. According to Luxor’s hashprice index, at 6 a.m. EDT on July 4, 2024, the price per petahash dropped to $44.842 per PH/s. The dollar value of daily mining revenue per petahash of […]

Despite the drop in hashrate, Bitcoin miner selling isn’t correlated with the BTC price drop from $71,100 to $66,000.

Bitcoin’s hashrate has broken down from an 18-month uptrend, suggesting the start of a potential Bitcoin miner capitulation.

Following an 18-month uptrend, Bitcoin’s true hashrate fell to around 600 exahashes per second (EH/s). The hashrate is used to measure how difficult it is for miners to mine Bitcoin (BTC).

The breakdown from the uptrend could signal that some Bitcoin mining firms are selling their BTC, according to Ki Young Ju, the founder and CEO of CryptoQuant. He wrote in a June 13 X post:

It has been 29 days since the halving and the launch of the Runes protocol, and since May 1, Runes activity has been underwhelming, falling short of the expectations set months prior. Similarly, the trend of Ordinals inscriptions has significantly declined over the past month. Runes Protocol’s Initial Excitement Dwindles Amid Decreased Activity Before the […]

It has been 29 days since the halving and the launch of the Runes protocol, and since May 1, Runes activity has been underwhelming, falling short of the expectations set months prior. Similarly, the trend of Ordinals inscriptions has significantly declined over the past month. Runes Protocol’s Initial Excitement Dwindles Amid Decreased Activity Before the […] According to the seven-day simple moving average (SMA) statistics regarding Bitcoin’s hashrate, the network hashrate has stayed below the 600 exahash per second (EH/s) mark for approximately one week. The recent rise in bitcoin’s price has positively influenced the overall hashprice as the value of 1 petahash per second (PH/s) daily has climbed above the […]

According to the seven-day simple moving average (SMA) statistics regarding Bitcoin’s hashrate, the network hashrate has stayed below the 600 exahash per second (EH/s) mark for approximately one week. The recent rise in bitcoin’s price has positively influenced the overall hashprice as the value of 1 petahash per second (PH/s) daily has climbed above the […] In April, bitcoin miners amassed the second-highest monthly revenue of the past year, following the unprecedented earnings in March. In total, they collected $1.79 billion, which, although $220 million less than the previous month, still exceeded the revenues of December 2023, which totaled $1.56 billion. Bitcoin Miners Recorded Strong Revenue Last Month On May 1, […]

In April, bitcoin miners amassed the second-highest monthly revenue of the past year, following the unprecedented earnings in March. In total, they collected $1.79 billion, which, although $220 million less than the previous month, still exceeded the revenues of December 2023, which totaled $1.56 billion. Bitcoin Miners Recorded Strong Revenue Last Month On May 1, […] Bitcoin mining company Terawulf has announced the full deployment of its 50-megawatt (MW) stake in the nuclear-powered Nautilus Cryptomine facility. The behind-the-meter bitcoin mining facility is powered by 100% nuclear power and benefits from a fixed power cost of $0.02 per kilowatt-hour (kWh), according to the company. Terawulf Fires up 50 MW Zero-Carbon Bitcoin Mining; […]

Bitcoin mining company Terawulf has announced the full deployment of its 50-megawatt (MW) stake in the nuclear-powered Nautilus Cryptomine facility. The behind-the-meter bitcoin mining facility is powered by 100% nuclear power and benefits from a fixed power cost of $0.02 per kilowatt-hour (kWh), according to the company. Terawulf Fires up 50 MW Zero-Carbon Bitcoin Mining; […]

Soaring hash rate, high electricity costs and BTC price hovering under $20,000 for months is complicating matters for Bitcoin miners.

October witnessed a surge in Bitcoin’s (BTC) hash rate which is pushing the metric to a new high of 245 Exahashes per second. These changes led to a sharp decrease in the hash price, resulting in a drop in the profit margins for BTC miners reaching a low of $66.8 USD/PH (per one quadrillion hashes per second) on Oct. 24, 2022.

According to Luxor Technologies, “hashprice” is the revenue BTC miners earn per unit of hash rate, which is the total computational power deployed by miners processing transactions on a proof-of-work network.

Not only has volume been inconsistent, the Bitcoin hash rate increased last week to an average of 269 EH/s. This means the difficult hash rate has been rising since July 2022.

Several factors, including expansion of mining operations, which creates miner competitiveness, increased use of ASIC miners which are more efficient than their alternatives and the Ethereum Merge led to some Ethereum (ETH) mining firms to fill empty rack space from non-operating ETH GPU mining with BTC specific ASIC miners.

Consequently, the surge in the hash rate resulted in an adjustment of the Bitcoin difficulty at a time when BTC’s price was dropping. As expected, after the spike of the hash rate and the increase in the Bitcoin difficulty, the hash price plummeted to $0.0657 tera hash per day, thereby reducing the level of profit.

A contributing factor to the depressed profit level is the general rise in BTC mining costs. For example, there has been a sharp increase in the price of electricity in the U.S. From July 2021 to July 2022 alone, its price increased by 25%, from $75.20 to $94.30 per megawatt hour. Energy prices also tend to increase in winter as people need to heat their homes. The Bitcoin mining industry is already seeing a rise of mining in Kazakhstan due to affordable energy.

Bitcoin miners face other rising costs such as the hosting fee, acquisition of miners and installing or upgrading of the cooling systems. During the 2020 to 2021 crypto bull market, Bitcoin mining companies took out loans when BTC and equipment prices were also much higher. This means that the interest on existing debts themselves could hurt newer and overleveraged mining firms.

It is clear that the increase in hash rate and Bitcoin difficulty, as well as the decrease in hash price leads to a compressed profit margins. The following graph shows a decrease in profits in a landscape where hash rate, difficulty and the cost of electricity continue to rise.

If the hash rate continues to increase amid a falling hashprice, the profit margin will continue to decrease, possibly leading some mining firms to close up shop permanently.

One possible outcome is that lean (cooler balance sheets) mining firms like Marathon may be able to purchase liquidated equipment and rack space from bloated mining companies that fail.

Mining firms that are staying lean while attempting to scale may prove victorious. Mining companies such as Core Scientific, Marathon, Riot, Bitfarm and CleanSpark are preparing for expansion even as many miners are finding profitability difficult.

Related: Public Bitcoin miners' hash rate is booming — but is it actually bearish for BTC price?

In view of the difficulties discussed, BTC mining firms should adopt sustainable BTC mining models for both profitability potential and to ease regulators. This should include using renewable energy sources, increasing production capacity and installing advanced cooling systems.

Mining firms can enhance their operations by using renewable energy from wind power, solar power and hydro which concurrently reduces costs and the carbon footprint. This approach can lead to more consistency and sustainability in Bitcoin mining energy costs. Norway has managed to capture 1% of all Bitcoin mining through a 100% renewable energy approach.

The depressed Bitcoin price, high hash rate and Bitcoin difficulty as well as low hash price contribute to small profit margins which may lead to sustainable, decentralized mining practices across the industry.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph.com. Every investment and trading move involves risk, you should conduct your own research when making a decision.

On Monday, bitcoin mining rig manufacturer Canaan Inc., announced the launch of the company’s latest high-performance bitcoin miners called the A13 series. Canaan has revealed two models in the A13 series, which feature “improved power efficiency over its predecessors,” and the new models produce an estimated 110 to 130 terahash per second (TH/s). Canaan Launches […]

On Monday, bitcoin mining rig manufacturer Canaan Inc., announced the launch of the company’s latest high-performance bitcoin miners called the A13 series. Canaan has revealed two models in the A13 series, which feature “improved power efficiency over its predecessors,” and the new models produce an estimated 110 to 130 terahash per second (TH/s). Canaan Launches […] While bitcoin is down more than 72% from the crypto asset’s all-time high, bitcoin mining operations are expanding at a rapid pace during the downturn. On Tuesday, the bitcoin miner Cleanspark said its hashrate has surpassed 4 exahash per second (EH/s), and the Texas mining company Rhodium revealed it raised $11.9 million, according to a […]

While bitcoin is down more than 72% from the crypto asset’s all-time high, bitcoin mining operations are expanding at a rapid pace during the downturn. On Tuesday, the bitcoin miner Cleanspark said its hashrate has surpassed 4 exahash per second (EH/s), and the Texas mining company Rhodium revealed it raised $11.9 million, according to a […]