Canaan Inc. announced Wednesday that subsidiaries have signed agreements to expand self-mining operations at facilities in Pennsylvania and Texas, adding approximately 4.7 exahash per second (EH/s) to its computing power. Canaan Eyes U.S. Growth with Pennsylvania, Texas Mining Sites Canaan (Nasdaq: CAN) entered a three-year colocation agreement with Mawson Infrastructure Group affiliate Mawson Hosting LLC […]

Canaan Inc. announced Wednesday that subsidiaries have signed agreements to expand self-mining operations at facilities in Pennsylvania and Texas, adding approximately 4.7 exahash per second (EH/s) to its computing power. Canaan Eyes U.S. Growth with Pennsylvania, Texas Mining Sites Canaan (Nasdaq: CAN) entered a three-year colocation agreement with Mawson Infrastructure Group affiliate Mawson Hosting LLC […] Canaan Inc. reported $269.3 million in revenue for 2024, with bitcoin mining revenue surging 312% year-over-year to $44 million. The company also expanded its North American mining footprint, securing new agreements in Pennsylvania and Texas to add 4.7 EH/s of computing power. Canaan Reports $269M in Revenue Canaan Inc., a crypto mining hardware manufacturer, has […]

Canaan Inc. reported $269.3 million in revenue for 2024, with bitcoin mining revenue surging 312% year-over-year to $44 million. The company also expanded its North American mining footprint, securing new agreements in Pennsylvania and Texas to add 4.7 EH/s of computing power. Canaan Reports $269M in Revenue Canaan Inc., a crypto mining hardware manufacturer, has […] Canaan, a bitcoin application-specific integrated circuit (ASIC) mining rig manufacturer, unveiled the Avalon Mini 3 and Avalon Nano 3S, bitcoin mining devices that also function as home heaters, at CES 2025 in Las Vegas. Canaan’s Avalon Mini 3 and Nano 3S Blend Mining and Heating Blockchain hardware titan Canaan (Nasdaq: CAN) has unveiled two avant-garde […]

Canaan, a bitcoin application-specific integrated circuit (ASIC) mining rig manufacturer, unveiled the Avalon Mini 3 and Avalon Nano 3S, bitcoin mining devices that also function as home heaters, at CES 2025 in Las Vegas. Canaan’s Avalon Mini 3 and Nano 3S Blend Mining and Heating Blockchain hardware titan Canaan (Nasdaq: CAN) has unveiled two avant-garde […] Canaan Inc., a publicly listed manufacturer of bitcoin (BTC) mining hardware and blockchain infrastructure provider, has shared plans to broaden its self-mining footprint in North America. Publicly Listed Bitcoin Miner Canaan Bolsters U.S. Presence The announcement published on Wednesday says Canaan (Nasdaq: CAN) aims to reach a computing capacity of 10 exahash per second (EH/s) […]

Canaan Inc., a publicly listed manufacturer of bitcoin (BTC) mining hardware and blockchain infrastructure provider, has shared plans to broaden its self-mining footprint in North America. Publicly Listed Bitcoin Miner Canaan Bolsters U.S. Presence The announcement published on Wednesday says Canaan (Nasdaq: CAN) aims to reach a computing capacity of 10 exahash per second (EH/s) […] Canaan Inc. announced a new agreement to deliver 3,800 Avalon A1566I miners to Cleanspark Inc., a publicly listed bitcoin mining and energy technology firm. A New Deal Between Canaan and Cleanspark According to the announcement, the bitcoin miners, set to run at 249 terahash per second (TH/s) without overclocking, are configured for immersion cooling—a technique […]

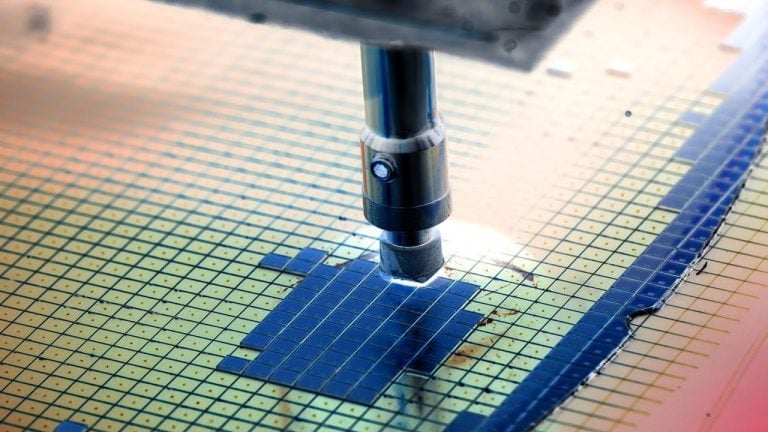

Canaan Inc. announced a new agreement to deliver 3,800 Avalon A1566I miners to Cleanspark Inc., a publicly listed bitcoin mining and energy technology firm. A New Deal Between Canaan and Cleanspark According to the announcement, the bitcoin miners, set to run at 249 terahash per second (TH/s) without overclocking, are configured for immersion cooling—a technique […] Established in 2013, Canaan Inc. (NASDAQ: CAN), is a technology company focusing on ASIC high-performance computing chip design, chip research and development, computing equipment production, and software services. Mr. Zhibing (Tony) Li is the Vice President of Canaan Inc. He recently joined the Bitcoin.com News Podcast to talk about the company’s technology R&D roadmap and […]

Established in 2013, Canaan Inc. (NASDAQ: CAN), is a technology company focusing on ASIC high-performance computing chip design, chip research and development, computing equipment production, and software services. Mr. Zhibing (Tony) Li is the Vice President of Canaan Inc. He recently joined the Bitcoin.com News Podcast to talk about the company’s technology R&D roadmap and […] On Tuesday, Jack Dorsey, the founder of Block, took to X to announce that the company is “building a mining rig.” Dorsey also shared a blog post authored by Block’s lead for mining hardware products, Naoise Irwin. The post revealed enhancements in the chip design, upgrading from the initially planned 5-nanometer (nm) process to an […]

On Tuesday, Jack Dorsey, the founder of Block, took to X to announce that the company is “building a mining rig.” Dorsey also shared a blog post authored by Block’s lead for mining hardware products, Naoise Irwin. The post revealed enhancements in the chip design, upgrading from the initially planned 5-nanometer (nm) process to an […] Following the downturn in bitcoin’s price on Friday, the hashprice of bitcoin has declined from slightly above $119 per petahash per second to marginally over $116 per PH/s on a daily basis. Should the prices remain low leading up to the forthcoming halving event scheduled for next week, certain mining devices may only be viable […]

Following the downturn in bitcoin’s price on Friday, the hashprice of bitcoin has declined from slightly above $119 per petahash per second to marginally over $116 per PH/s on a daily basis. Should the prices remain low leading up to the forthcoming halving event scheduled for next week, certain mining devices may only be viable […]

The United Arab Emirates increasingly attracts Web3 companies to its jurisdictions, becoming the center of global crypto innovation.

Behind the wave of companies moving or deploying initiatives in the UAE is regulation. The country has introduced regulatory frameworks for decentralized autonomous organizations (DAOs), virtual asset providers, metaverses and other Web3-related entities.

By offering regulatory clarity and a clear path to compliance — amid a crackdown in the United States — the UAE is moving closer to fulfilling what it wants to be: an international financial hub for digital assets.

While predictions about how it will affect the future of the UAE or the crypto space itself vary, history shows how countries have used regulatory gaps to build new industries or curb existing ones.

This week’s Crypto Biz also explores Canaan’s revenue challenges, Wormhole’s massive fundraising and Banco Santander’s crypto moves.

Open-source blockchain developer Iota announced the launch of the Iota Ecosystem DLT Foundation in Abu Dhabi, which is dedicated to expanding its distributed ledger technology (DLT) in the Middle East.

Despite a downturn in its bottom line, the company has secured a deal with an institutional investor to potentially raise $125 million in capital.

Bitcoin (BTC) miner Canaan is seeking new capital amid a slump in its revenue and bottom line.

According to its Q3 2023 earnings report released on Nov. 28, the company seeks to sell $148 million in equity through an at-the-market offering. The day before, Canaan announced that it had reached an agreement with an undisclosed institutional investor to issue up to 125,000 preferred stock at $1,000 apiece for total proceeds of $125 million.

Compared to the third quarter of 2022, the company’s revenue fell 55% to $33.3 million due to a decrease in the amount of Bitcoin (BTC) mined and a fall in the number of ASIC mining rigs sold. The firm also swung to a net loss of $110.7 million compared to a net income of $6.3 million in the same period a year ago.

“Overall, we faced increased pricing competition and a noticeable softening in purchasing power on the demand front, which has posed severe challenges to our sales,” said Nangeng Zhang, chairman and CEO of Canaan. The firm expects its Q4 revenue to be roughly unchanged from Q3 due to “challenging market conditions across the industry.”

Due to soaring electricity costs and lower BTC prices, several Bitcoin miners filed for bankruptcy in 2022, disrupting the sales of Bitcoin ASIC mining rigs. However, market conditions have improved this year due to easing inflation and a recovery in Bitcoin prices. On Nov. 13, Bitcoin miners earned $44 million in block rewards and transaction fees, the highest ever in history.

Magazine: Bitmain’s revenge, Hong Kong’s crypto rollercoaster